Here is a history lesson – few assets have captured imagination and preserved wealth quite like gold. From the glittering treasures of ancient Egyptian pharaohs to modern investment portfolios, gold investment continues to hold a unique position in our financial world. As fellow gold enthusiasts, we’re excited to explore why this precious metal remains relevant in 2024-25 and how it might fit into your financial journey.

The Historical Journey of Gold: From Ancient Currency to Modern Investment

Gold’s story begins in the earliest civilizations, where its natural beauty and rarity made it an ideal symbol of wealth and power. Ancient Egyptians considered gold the flesh of the gods, while the first known gold coins were minted by King Croesus of Lydia around 550 BCE. This marked the beginning of gold’s role as a standardized currency.

The metal’s monetary significance reached new heights during the age of empire-building. Spanish conquistadors’ quest for gold in the Americas changed the global economy forever, while the California Gold Rush of 1849 helped shape modern America. The discovery of gold at Witwatersrand in 1886 transformed South Africa into an economic powerhouse.

Perhaps the most significant chapter in gold’s modern history was the Bretton Woods system (1944-1971), which pegged international currencies to the U.S. dollar, which was in turn backed by gold at $35 per ounce. When President Nixon ended this system in 1971, it ushered in our current era of floating exchange rates – yet gold’s importance didn’t diminish.

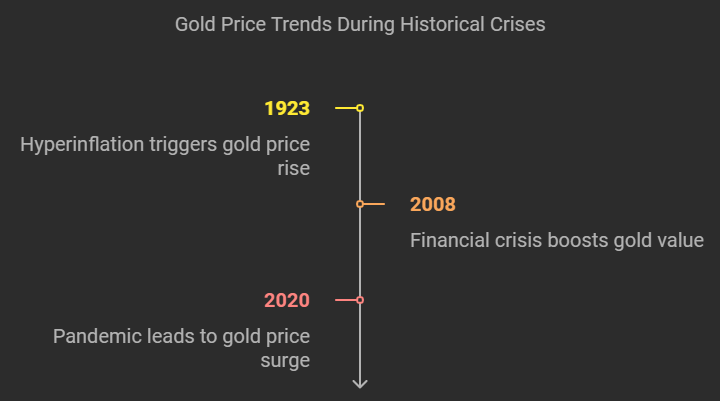

Throughout crisis after crisis, gold has demonstrated its ability to preserve wealth:

- During the 1923 German hyperinflation, those who held gold maintained their purchasing power while paper currency became worthless

- In the 2008 financial crisis, gold provided a safe haven, rising from $800 to over $1,900 per ounce by 2011

- During the 2020 pandemic uncertainty, gold reached new historic highs above $2,000 per ounce

What Makes Gold Unique Among Investment Assets?

Gold investment possesses several extraordinary characteristics that set it apart from other investments:

Physical Properties

- Indestructible: Gold doesn’t corrode or degrade over time

- Malleable: One ounce can be stretched into a wire 50 miles long

- Rare: All gold ever mined would fit in a cube roughly 22 meters on each side

- Easily divisible and portable: High value-to-weight ratio

- Impossible to counterfeit: Specific gravity and other properties make it hard to fake

Economic Properties

- Limited supply: Annual mining adds only about 1.5% to existing stock

- No counterparty risk: Physical gold isn’t someone else’s liability

- Universal acceptance: Recognized and valued globally

- Independent of government control: Can’t be “printed” like fiat currency

Most uniquely, gold tends to have low or negative correlation with other major asset classes. When stocks and bonds struggle, gold often shines brightest. This makes it an excellent portfolio diversifier – it’s like insurance for your investment portfolio.

Understanding Gold’s Investment Performance

Looking at gold’s performance requires historical context. Since 1971 (end of gold standard), gold has provided an average annual return of about 7.7%. However, this doesn’t tell the whole story:

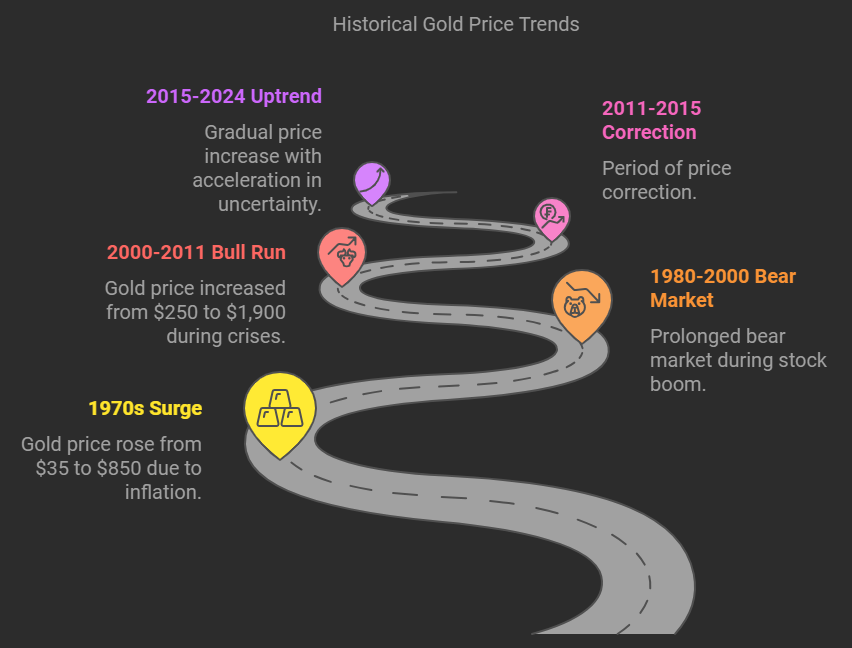

Notable Performance Periods:

- 1970s: Gold rose from $35 to $850 as inflation soared

- 1980-2000: Prolonged bear market during the great stock boom

- 2000-2011: Bull run from $250 to $1,900 during dot-com crash and financial crisis

- 2011-2015: Correction period

- 2015-2024: Gradual uptrend with acceleration during global uncertainty

What’s particularly interesting is gold’s behavior during market stress:

- October 1987 stock market crash: Gold up 4.6% while S&P 500 fell 21.5%

- 2008 financial crisis: Gold up 5.5% while S&P 500 lost 37%

- March 2020 COVID crash: Gold held steady while stocks plummeted

Modern Investment Thesis: Why Gold Matters Today

The case for your gold investment in 2024-25 is perhaps stronger than ever, driven by several key factors:

Global Economic Uncertainty

- Record government debt levels worldwide

- Unprecedented monetary expansion by central banks

- Geopolitical tensions affecting trade and currency stability

- Growing concerns about traditional banking system stability

Inflation Protection

While no investment is perfect, gold has historically maintained purchasing power over long periods. An ounce of gold bought a fine men’s suit in 1900 – and still does today.

Central Bank Buying

Central banks have turned from net sellers to net buyers of gold since 2010. In recent years, countries like China, Russia, and India have significantly increased their gold reserves, suggesting a global shift in monetary confidence.

The Digital Age Paradox

Despite cryptocurrency emergence, physical gold’s appeal has grown stronger. Many see it as the ultimate “analog” backup in an increasingly digital world vulnerable to cyber threats and technological disruption.

Different Ways to Invest in Gold

Physical Gold

- Bullion bars: Best value for larger investments

- Coins: More liquid and easier to trade

- Jewelry: Combines utility with investment (though with higher markups)

Pros:

- Direct ownership

- No counterparty risk

- Highly liquid globally

Cons:

- Storage and security costs

- Insurance needs

- Potential premium over spot price

Paper Gold

- ETFs (like GLD, IAU)

- Easily traded

- Low storage costs

- Highly liquid

- But: No physical possession

- Mining Stocks

- Potential leverage to gold price

- Dividend possibility

- But: Company-specific risks

- Futures and Options

- High leverage potential

- Sophisticated hedging tools

- But: Complex and risky

Common Gold Investment Mistakes to Avoid

Overpaying for Collectible

- Rare coins can be valuable, but require expert knowledge

- Premiums on commemorative items often don’t recover

Poor Storage Decision

- Home storage risks

- Uninsured storage

- Not documenting purchases

Timing Mistakes

- Buying only when prices are rising

- Panic selling during temporary dips

- Not averaging in over time

Authentication Errors

- Not using reputable dealers

- Skipping proper testing

- Falling for counterfeit products

Creating Your Gold Investment Strategy

4 Helpful steps to set the foundation for your gold investment stategy

1: Define Your Gold Investment Goals

- Portfolio diversification

- Inflation hedge

- Crisis protection

- Speculation

2: Determine Allocation

- Conservative: 5-10% of portfolio

- Moderate: 10-15%

- Aggressive: 15-25%

3: Choose Investment Vehicle

Match your goals with appropriate forms:

- Long-term holding: Physical bullion

- Trading: ETFs or futures

- Growth potential: Mining stocks

4: Implementation Plan

- Dollar-cost averaging approach

- Regular rebalancing schedule

- Clear exit criteria

- Secure storage solution

Conclusion

Gold’s enduring value proposition isn’t about getting rich quick – it’s about preserving wealth and maintaining purchasing power through uncertain times. As fellow enthusiasts, we believe understanding gold’s unique properties, historical performance, and proper investment approach is crucial for anyone considering this precious metal.

Whether you’re just starting to explore gold investment or looking to optimize your existing strategy, remember that gold is just one component of a well-rounded portfolio. Its real value lies in its ability to provide stability and insurance against the unknown.

In an era of unprecedented monetary experiments and growing global uncertainties, gold’s ancient role as a store of value remains as relevant as ever. By approaching gold investment with knowledge, patience, and a clear strategy, you can harness its unique properties to help secure your financial future.

Remember: The key to successful gold investment isn’t in timing the market perfectly, but in understanding its role in your broader financial picture and staying committed to your strategy through market cycles. After all, gold’s story isn’t just about the past – it’s about preserving wealth for generations to come.