Gold has been a store of wealth for centuries, but today, there’s a modern way to own it without touching a gold bar.

What are Gold ETFs? Gold Exchange-Trade Funds are investment funds that track the price of gold, offering investors an easy way to add gold to their portfolio without physically owning the precious metal. As more investors seek ways to diversify their investments, many wonder: why choose a Gold ETF instead of buying physical gold bars or coins? The answer lies in their convenience, liquidity, and accessibility – but let’s explore the complete picture to help you make an informed investment decision.

Understanding What Gold Exchange-Trade Funds ETFs Are: The Basics

(Exchange-Traded Funds) are securities that mirror the price of gold while trading like regular stocks on major exchanges. Think of them as a digital representation of gold that you can buy and sell with just a few clicks, making them an increasingly popular choice for modern investors.

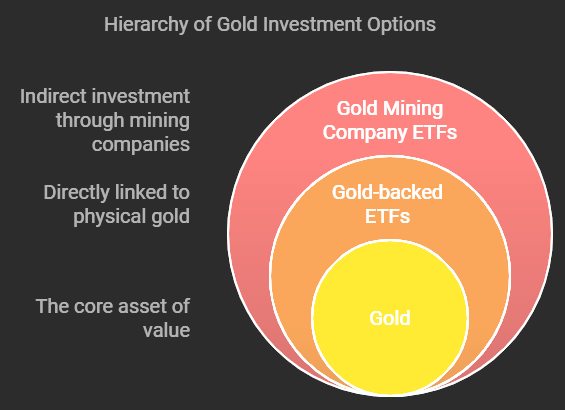

Types of Shiny yellow metal ETFs include:

- Physical gold-backed ETFs (backed by actual gold bars)

- Gold mining company ETFs (tracking companies that mine gold)

- Derivative-based gold ETFs (using financial contracts to track gold prices)

Now that we understand what Gold ETFs are, let’s explore exactly how they operate in the market.

How Do Gold ETFs Work?

When you invest in a Gold ETF, you’re buying shares in a trust that holds gold bullion. This unique investment vehicle bridges the gap between traditional stock market investing and precious metals ownership. Let’s break down the mechanics:

The Mechanics Behind Gold ETFs:

- Each share typically represents a fixed amount of gold (like 1/10th of an ounce)

- The fund stores physical gold with custodians

- Net Asset Value (NAV) updates daily based on gold prices

- Trading occurs on stock exchanges during market hours

- Professional managers handle storage and security

Key Takeaway: Gold ETFs provide the benefits of gold ownership without physical storage concerns.

With this understanding of how Gold ETFs work, let’s explore their unique advantages for investors.

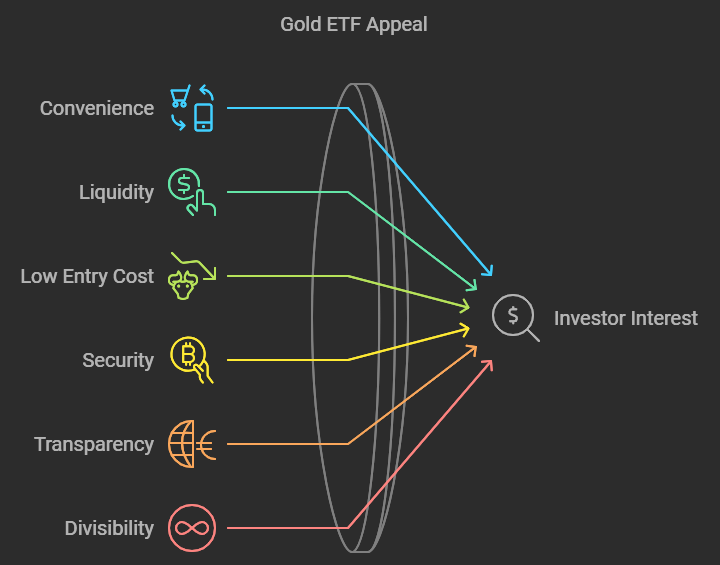

Advantages of Gold ETFs

Why Investors Choose Gold ETFs:

- Convenience: Trade instantly through your brokerage account

- Liquidity: Buy and sell easily during market hours

- Low Entry Cost: Start with as little as one share

- Security: No need for physical storage or insurance

- Transparency: Clear pricing and holdings information

- Divisibility: Purchase exact amounts you want

Now that we’ve covered the benefits of Gold ETFs, let’s compare them to other popular gold investment options to help you make the best choice for your portfolio.

Gold Exchange-Trade Funds vs. Other Gold Investments

Physical Gold

Pros:

- Direct ownership

- No counterparty risk

- Can be used as currency in extreme situations

Cons:

- Storage costs

- Insurance needed

- Less liquid

- Higher transaction costs

Gold Futures

Pros:

- High leverage potential

- Standardized contracts

- Price discovery

Cons:

- Complex

- Higher risk

- Requires significant capital

- Regular contract rollover

Silver ETFs

Pros:

- Industrial demand exposure

- Generally more volatile (potential for higher returns)

- Often cheaper per share

Cons:

- Less stable than gold

- More industrial than monetary metal

- Higher volatility risk

Understanding these comparisons helps us appreciate the different types of Gold ETFs available in the market. Let’s explore each type in detail.

Types of 24k Precious Metals ETFs Explained

Physical Gold-Backed ETFs

- Direct exposure to gold prices

- Backed by real gold bars

- Most popular among investors

- Example: SPDR Gold Shares (GLD)

Au Mining ETFs

- Exposure to gold mining companies

- Potential for leverage to gold prices

- Higher risk/reward profile

- Example: VanEck Gold Miners ETF (GDX)

Leveraged Gold ETFs

- Amplified exposure to gold prices

- Use derivatives and debt

- High risk, meant for short-term trading

- Example: ProShares Ultra Gold (UGL)

Warning: Leveraged Exchange-Traded Funds are complex instruments best suited for experienced traders.

Now that we understand the various types, let’s examine how to select the right Gold ETF for your portfolio.

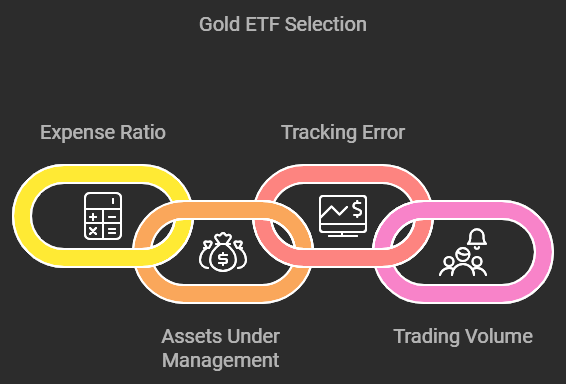

How to Choose the Right Gold ETF

Key Factors to Consider:

- Expense Ratio

- Lower is generally better

- Compare similar funds

- Consider impact on long-term returns

- Assets Under Management

- Larger funds typically offer better liquidity

- More stable operation

- Less risk of fund closure

- Tracking Error

- How closely the ETF follows gold prices

- Lower is better

- Compare historical performance

- Trading Volume

- Higher volume means easier trading

- Tighter bid-ask spreads

- Better price execution

With these factors in mind, let’s look at some of the most popular Gold ETFs in today’s market.

Top Gold ETFs to Consider

Leading Gold ETFs by Assets:

- SPDR Gold Shares (GLD)

- Largest gold ETF

- High liquidity

- 0.40% expense ratio

- iShares Gold Trust (IAU)

- Lower expense ratio (0.25%)

- Smaller share price

- Good for smaller investors

- Aberdeen Physical Gold Shares ETF (SGOL)

- Competitive expense ratio

- Gold stored in Switzerland

- Growing popularity

Before making your investment decision, it’s crucial to understand the tax implications of Gold ETFs.

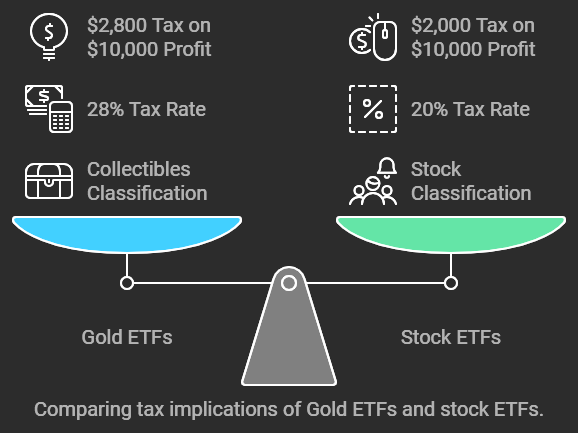

Understanding Gold ETF Tax Implications

Gold Exchange-Trade Funds and Taxation:

- Collectibles Classification: Gold ETFs are treated as collectibles by the IRS

- Tax Rate: Long-term gains taxed up to 28% (versus 20% for typical stocks)

- Holding Period: Must be held over one year for long-term treatment

- Example: A $10,000 profit from a Gold ETF held over one year could be taxed at 28% ($2,800) versus $2,000 for a typical stock ETF

Common Tax Questions:

Q: Are Gold ETFs taxed like stocks? A: No, they’re typically taxed as collectibles at a higher rate.

Q: When do I pay taxes on Gold ETFs? A: When you sell shares for a profit or receive distributions.

Before making any investment decisions, let’s review the key risks to consider.

Risks and Considerations

Key Risks to Consider:

- Market Risk: Gold prices can be volatile

- Management Risk: Fund company stability

- Counterparty Risk: Custodian reliability

- Tracking Error: Fund may not perfectly match gold prices

- Liquidity Risk: During market stress

- Currency Risk: Gold priced in USD

Market Conditions Impact:

- Interest rates affect gold prices

- Dollar strength influences returns

- Global economic conditions matter

- Market sentiment drives short-term moves

Conclusion

Understanding what Gold Exchange-Trade Funds are and how they work is crucial for modern investors. These investment vehicles offer a convenient, cost-effective way to invest in gold without the hassles of physical ownership. They provide:

- Easy access to gold markets

- Professional management

- High liquidity

- Lower entry costs than physical gold

While Gold Exchange-Trade Fundsaren’t perfect for everyone, they represent a practical option for investors seeking gold exposure in their portfolios. Remember to consider your investment goals, risk tolerance, and tax situation before investing.

Want to learn more about diversifying your portfolio? Consider exploring our related guides on precious metals investing, commodity investing, and portfolio diversification strategies. For personalized advice, consult with a qualified financial advisor who can help align your investment choices with your specific goals.

Frequently Asked Questions

Q: Can I redeem my Gold ETF for physical gold? A: Most retail investors cannot, as minimum redemption amounts are very high.

Q: How safe are Gold ETFs? A: They’re regulated investments with multiple safety measures, but all investments carry risks.

Q: What’s the minimum investment needed? A: You can start with one share, which varies in price by fund.

Q: Are Gold ETFs a good inflation hedge? A: Historically, gold has helped protect against inflation, and ETFs offer easy access to this benefit.

Disclaimer: This article is for informational purposes only. Always consult with a financial advisor before making investment decisions.

3 Comments