Key Market Gold Price Drivers in 2024-2025

Introduction to The Forces That Influence Gold Prices

Unlocking the secrets of gold price drivers are ideal for your investment journey, as an investor. Gold is more than just a shiny metal – it’s a complex financial asset that responds to a variety of market forces. Whether you’re new to the world of precious metals or a seasoned gold bug, unpacking the key factors that shape gold’s value can help you time your purchases and sales more effectively.

In this comprehensive guide, we’ll dive deep into the primary drivers behind gold prices in 2024-2025. From the impact of inflation and interest rates to the role of currency fluctuations and geopolitical events, we’ll equip you with the knowledge you need to navigate the dynamic gold market. By the end, you’ll have a clearer picture of where gold prices are headed and how to potentially profit from the trends.

Key Takeaway: Monitor inflation data closely, as persistent high inflation is likely to benefit gold.

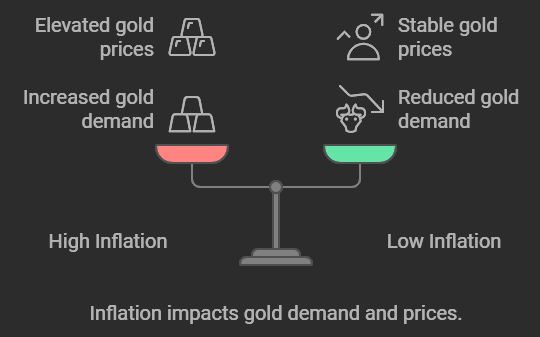

The Influence of Inflation on Gold Prices

Gold has historically been viewed as a reliable hedge against rising prices

Gold as an Inflation Hedge

- When inflation erodes the purchasing power of fiat currencies, investors turn to gold

Global Inflation Trends:

- Current inflation rates in major economies impact gold demand

- High inflation typically increases the appeal of gold as an inflation hedge

- Low inflation can reduce gold’s attractiveness as an inflation-resistant asset

Supply Chain Issues and Inflation:

- Supply chain disruptions have contributed to higher inflation

- Constraining supply challenges can be consided a part of the gold price drivers

- The combination of elevated inflation and limited supply has supported gold prices

Key Takeaway: Monitor inflation data closely, as persistent high inflation is likely to benefit gold.

Interest Rates and Their Impact on Gold

Interest rates are pivotal, but the strength of the dollar also directly influences gold’s global demand and valuation

Inverse Relationship with Interest Rates:

- Gold and interest rates generally have an inverse relationship

- Rising interest rates increase the opportunity cost of holding non-yielding assets like gold

- Falling interest rates make gold more appealing compared to other investments

Central Bank Policies:

- Central bank actions, such as rate hikes by the Federal Reserve, directly affect gold valuations

- Hawkish policies tend to put downward pressure on gold prices

- Dovish policies can boost the appeal of gold

Real vs. Nominal Rates:

- Real interest rates (adjusted for inflation) more accurately reflect gold’s appeal

- When real rates are low or negative, gold becomes a more attractive investment

Key Takeaway: Monitor central bank policies and the trajectory of real interest rates to assess gold’s potential performance.

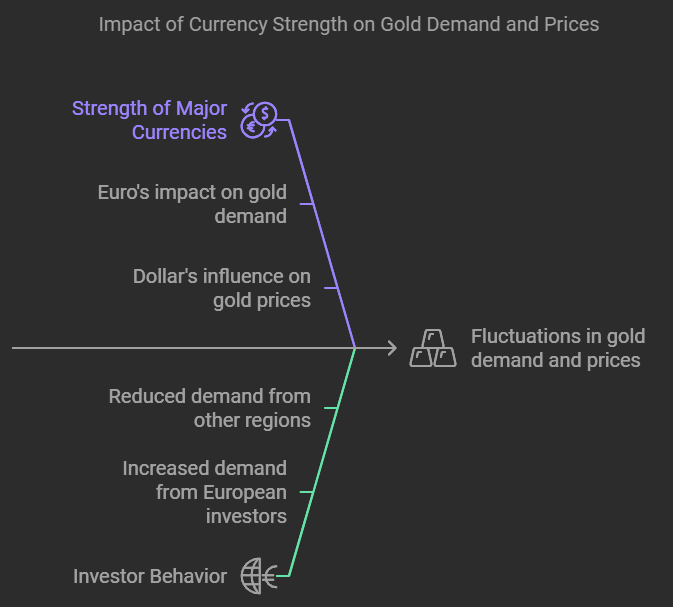

Currency Fluctuations and Gold Price

While economic factors like interest rates and currency shifts are major players, geopolitics also plays a powerful role in driving gold prices.

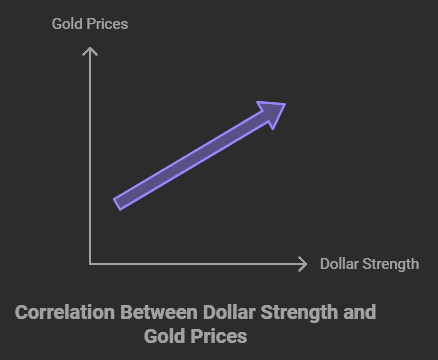

Dynamics Gold and the U.S. Dollar:

- The strength or weakness of the U.S. dollar has a direct correlation with gold prices

- A strong dollar makes gold more expensive for investors using other currencies, reducing demand

- A weaker dollar makes gold more affordable, boosting demand and driving prices higher

Global Currency Shifts:

- Shifts in the strength of other major currencies can also impact gold demand and prices

- For example, a stronger Euro may increase European investors’ appetite for gold

Inflationary Pressures on Currencies:

- When fiat currencies lose value due to inflation, investors often turn to gold as a more stable store of value

Key Takeaway: Keep a close eye on currency markets and how exchange rate fluctuations might affect gold’s relative affordability.

Geopolitical Events and Their Effect on Gold

Political events are powerful, yet the fundamentals of supply and demand in the gold market hold substantial weight in determining its value.

Political Uncertainty as a Driver:

- Gold is viewed as a safe-haven asset, attracting investors during periods of heightened geopolitical tensions

- Increased political uncertainty typically drives up gold prices

Historical Examples:

- Events like the 2016 Brexit referendum and the U.S.-China trade war have contributed to gold price spikes

Current Geopolitical Tensions:

- Ongoing conflicts and tensions, such as the Ukraine war, have the potential to further drive up gold prices

Key Takeaway: Monitor the global political landscape and assess the potential impact of geopolitical events on gold prices.

Supply and Demand Dynamics in the Gold

The balance of gold’s supply and demand is fundamental to its pricing.

Gold mining output, industrial usage, and investment demand all directly impact its market value. When mining production decreases, limited supply can drive prices up, while higher demand from industries and investors, such as for electronics or ETFs, adds additional upward pressure on prices. Understanding these dynamics is essential for anticipating potential price shifts in the gold market.

Market Mining Production Trends:

- Global gold mining output is a critical factor in determining the available supply of the precious metal

- Changes in mining production can affect gold’s price

- A major player in the saga of gold price drivers for the mining industry is: (AISC) All-In Sustaining Costs. Along with other metrics, AISC contains the comprehensive expenses involved in producing gold; e.g. Per ounce.

Industrial Demand for Gold:

- Demand from sectors like electronics, dentistry, and jewelry also plays a role in gold’s valuation

- Shifts in industrial production and consumption patterns can impact gold prices

Investment Demand:

- Demand from ETFs, central banks, and individual investors is a substantial price influencer

- Increased investment demand typically drives gold prices higher

Key Takeaway: Understand the dynamics of gold supply and demand to anticipate how the precious metal’s price might evolve.

Speculation and Market Sentiment’s Role

Gold prices aren’t just influenced by fundamental factors—they’re also highly sensitive to investor sentiment and speculation. Emotional drivers like fear and greed can cause sharp price swings, especially during economic uncertainty when gold is seen as a safe haven. Speculators in the gold futures market add to this volatility by leveraging trades and betting on short-term price movements.

Meanwhile, traders track economic indicators closely, using data on employment, inflation, and growth to predict gold’s performance. Staying attuned to these psychological and speculative forces can provide valuable insights into gold’s potential price trends in the short to medium term.

Market Psychology:

- The psychology of investors, including fear, greed, and risk aversion, can impact gold prices in the short term

- Periods of heightened market volatility or uncertainty often trigger a surge in gold demand as a safe haven

Role of Speculators:

- Speculative trading in the gold futures market can contribute to price volatility

- Leveraged bets and short-term trading can amplify price swings

Global Economic Indicators:

- Investors and traders closely monitor economic data to gauge the health of the global economy and make predictions about gold’s performance

Key Takeaway: Stay attuned to market sentiment and economic indicators to anticipate how gold prices might react in the short to medium term.

Conclusion

The yellow metal’s value is shaped by a complex interplay of factors that effectsthe gold price drivers, from inflation and interest rates to currency fluctuations and geopolitical events. By understanding these key drivers, you can make more informed decisions about when to buy, sell, or hold gold in your investment portfolio.

As we look ahead to 2024-2025, closely monitoring the trends in these areas will be crucial for gold investors. From watching inflation data and central bank policies to tracking currency markets and geopolitical developments, staying informed will help you anticipate how gold prices might evolve and position yourself accordingly.

Remember, gold is a unique asset that can provide stability, diversification, and protection against various economic and financial risks. By incorporating gold into your investment strategy and understanding the forces that influence its value, you’ll be better equipped to navigate the complexities of the precious metals market and potentially capitalize on gold’s long-term performance.

FAQs

Q: What makes gold prices go up or down?

A: Gold price drivers typically fluxuate gold’s pricees due to:

- High inflation rates

- Lower interest rates

- Weaker U.S. dollar

- Geopolitical tensions

- Strong investment demand

- Supply constraints

Prices typically fall when:

- Interest rates increase

- The U.S. dollar strengthens

- Market stability increases

- Investment demand weakens

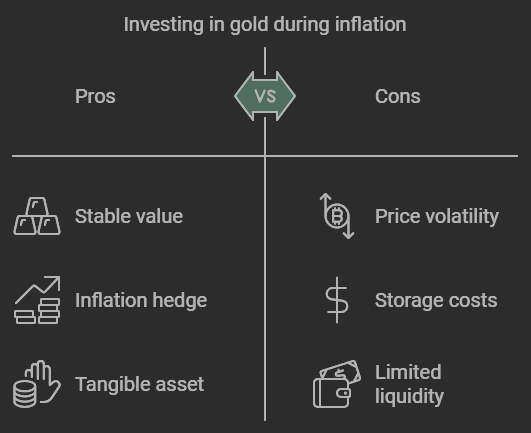

Q: Is gold a good investment during high inflation?

A: Gold has historically performed well during periods of high inflation because:

- It maintains purchasing power when currencies lose value

- It’s a tangible asset that can’t be printed like money

- It often rises in value as inflation increases However, individual investment decisions should be based on your personal financial goals and risk tolerance.

Q: How does interest rates affect gold prices?

A: Interest rates impact gold prices in several ways:

- Higher rates typically pressure gold prices down

- Lower rates tend to support gold prices

- Real interest rates (adjusted for inflation) have the strongest influence

- Negative real rates often boost gold’s appeal

Q: What role does the U.S. dollar play in gold prices?

A: The U.S. dollar and gold typically have an inverse relationship:

- When the dollar strengthens, gold often becomes more expensive for foreign buyers

- When the dollar weakens, gold usually becomes more affordable globally

- Most international gold trades are conducted in U.S. dollars

Q: How much gold should I have in my portfolio?

A: While we can’t provide specific investment advice:

Many financial advisors suggest 5-10% allocation to gold

- The exact percentage depends on your:

- Risk tolerance

- Investment timeline

- Overall financial goals

- Current market conditions

Q: When is the best time to buy gold?

A: Consider buying gold when:

- Inflation is rising

- Real interest rates are low or negative

- Geopolitical tensions are high

- The U.S. dollar is weakening

- You want to diversify your portfolio

Q: How can I track factors affecting gold prices?

A: Monitor these key indicators:

- Inflation rates in major economies

- Federal Reserve interest rate decisions

- U.S. Dollar Index (DXY)

- Major geopolitical events

- Gold ETF flows

- Central bank gold purchases

Q: Does gold always go up when stocks go down?

A: Not always, but gold often acts as a portfolio stabilizer because:

- It typically has low correlation with stocks

- It can perform well during market stress

- It acts as a safe haven during uncertainty However, there’s no guaranteed inverse relationship