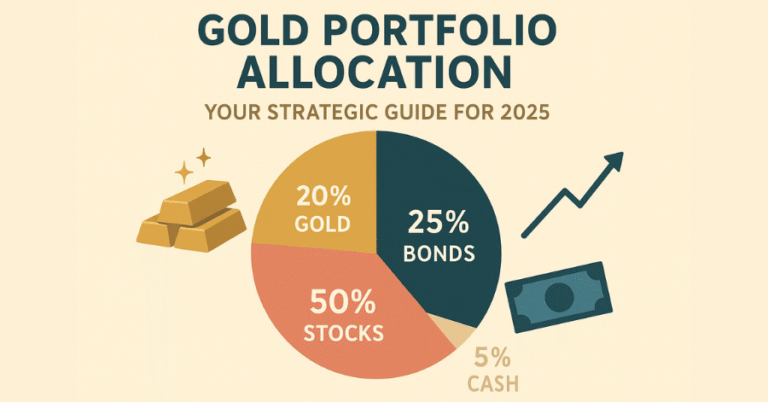

Gold Portfolio Allocation: Your Strategic Guide for 2025

Key Takaways: Gold Allocation Percentage Why Gold Allocation Matters in 2025: The ‘Rio Reset’ and Your Retirement The global economic order…

Economic crisis investment refers to strategies that focus on protecting wealth during periods of financial instability, such as recessions or market crashes. Investors typically turn to assets like gold, bonds, and other safe-haven investments that tend to perform well when stock markets decline. Diversifying a portfolio with these assets can provide stability and preserve wealth in uncertain times. Additionally, investing in sectors that remain resilient during crises, such as utilities or consumer staples, can help minimize risk and ensure long-term financial security.

Key Takaways: Gold Allocation Percentage Why Gold Allocation Matters in 2025: The ‘Rio Reset’ and Your Retirement The global economic order…