Introduction: Gold’s Enduring Legacy in Modern Times

Here’s a fascinating fact that never fails to amaze me: Central banks added a record-breaking 1,136 tonnes of gold to their reserves in 2023! As a gold enthusiast, I find it incredible how this ancient store of value continues to shape our modern financial world. Whether you’re a history buff who loves the tangible connection to past civilizations or an investor seeking to protect your wealth, understanding the nuances between physical gold vs. paper gold has never been more crucial.

The Current Gold Landscape (2024)

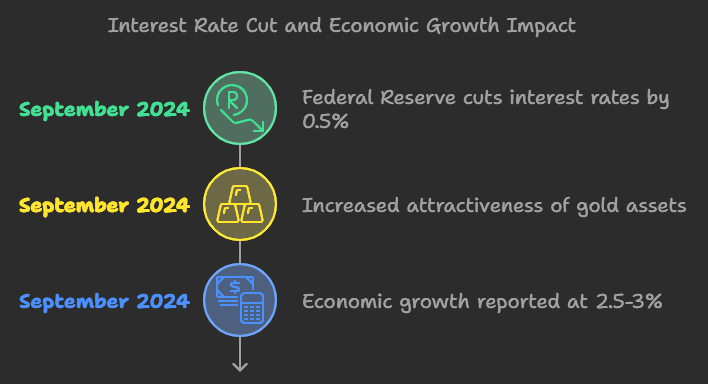

Economic Outlook for October 2024

The Federal Reserve cut interest rates by 0.5% in September 2024, which was larger than the typical 0.25% cut. This rate cut is generally seen as positive for financial assets, including gold. Lower interest rates tend to increase the attractiveness of non-yielding assets like gold.Economic growth is reported to be between 2.5-3% without a recession or significant labor market weakness. This economic backdrop is considered favorable for both equity and fixed income returns.

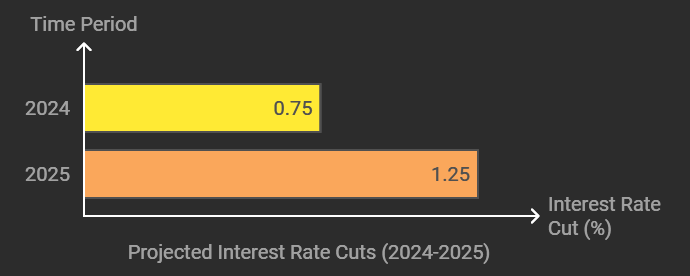

Market Expectations

Market participants expect further interest rate cuts, with projections of another 0.75% in cuts before the end of 2024 and an additional 1.25% by the end of 2025. These anticipated rate cuts could potentially support gold prices, as lower interest rates often boost gold’s appeal as an investment.

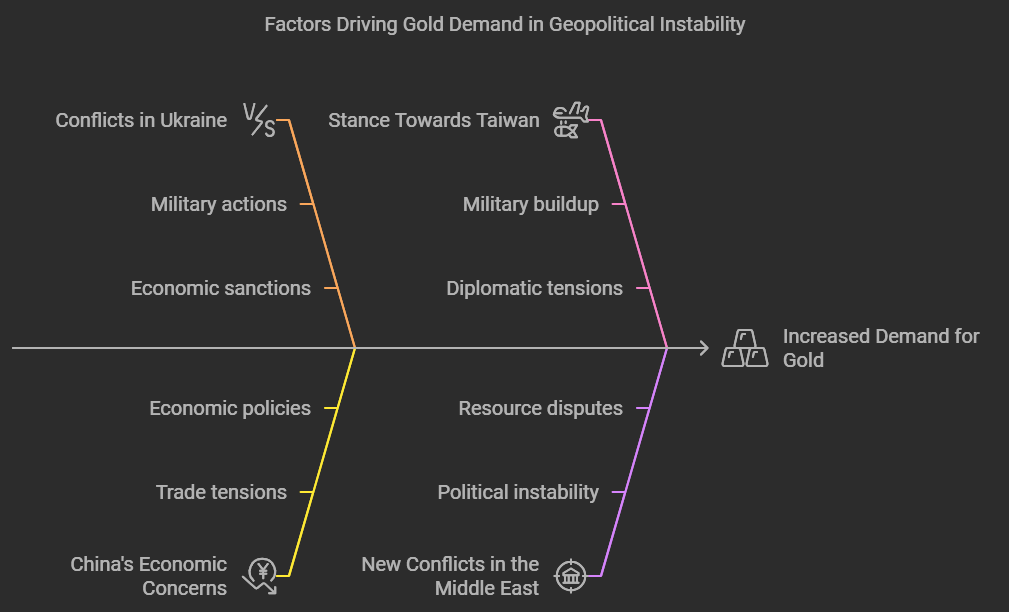

Geopolitical Factors

Our research results show ongoing geopolitical tensions, including conflicts in Ukraine, concerns about China’s economy and its stance towards Taiwan, and new conflicts in the Middle East. Geopolitical instability typically increases demand for safe-haven assets like gold.

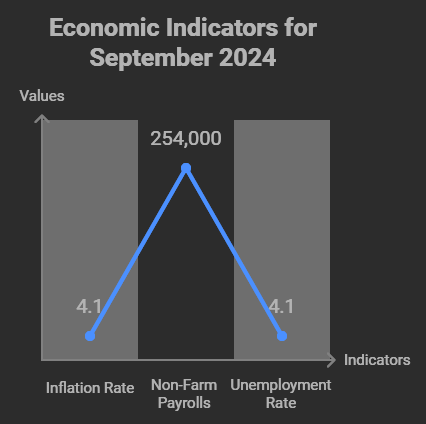

Inflation and Employment

Recent data shows mixed signals on inflation and employment. There was a warmer-than-expected inflation reading, especially in core inflation (excluding food and energy). The job market remains strong, with non-farm payrolls for September 2024 surging to 254,000 jobs created and unemployment falling to 4.1%.

Please Take Note:

While these insights don’t provide specific gold price predictions for October 2024, they offer context on the economic and market conditions that could influence gold prices. For the most current and accurate information on gold prices and trends, it would be best to consult real-time financial data sources or speak with a financial advisor.

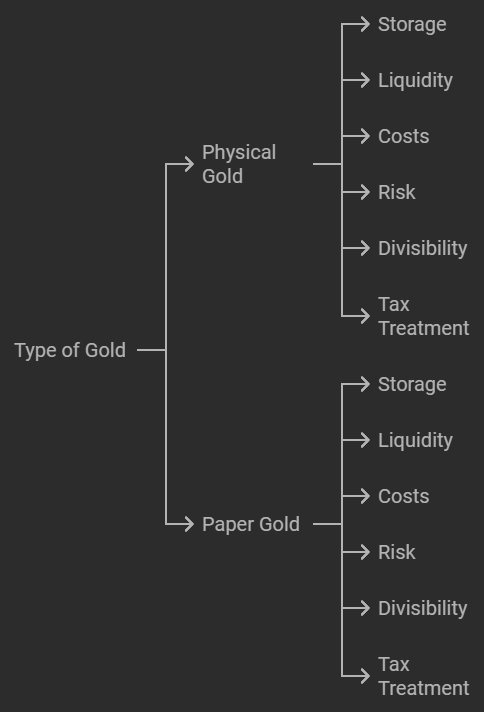

Comprehensive Comparison: Physical vs. Paper Gold

Investment Strategies for Paper Gold

1. Strategic ETF Positioning

- Dollar-cost averaging approach

- Monthly purchases of $500-1000 in gold ETFs

- Focus on major funds like GLD or IAU

- Current expense ratios: 0.25% – 0.40%

2. Momentum Trading Strategies

- Using technical analysis for short-term trades

- Popular indicators for gold futures:

- 50/200 day moving averages

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

3. Mining Stock Tactics

- Portfolio allocation suggestions:

- 40% major miners (Newmont, Barrick)

- 40% mid-tier producers

- 20% junior miners for growth potential

Investment Strategies for Physical Gold

1. Stack and Hold Strategy

- Monthly acquisition plan:

- 70% bullion coins/bars

- 20% premium coins (Eagles, Maples)

- 10% numismatic pieces

2. Physical Diversification

- Strategic allocation:

- 1 oz coins for liquidity

- 10 oz bars for cost efficiency

- Numismatic coins for collector value

- Consider platinum/silver for broader exposure

3. Leveraging Physical Holdings

- Using gold as loan collateral

- Participating in dealer buyback programs

- Building relationships with local dealers

This comparison between physical gold vs. paper gold highlights the unique benefits of each. Physical gold, like coins or bars, provides tangible ownership and is ideal for those seeking a long-term, secure asset. In contrast, paper gold (such as ETFs) offers convenience, liquidity, and easier access to gold’s price movements without handling physical assets.

Practical Implementation Guide

Paper Gold Investment Steps

- Brokerage Account Setup

- Recommended platforms: Fidelity, Charles Schwab, Vanguard

- Account minimums: Usually $0-500

- Required documentation: ID, SSN, bank details

- Top Gold ETFs (2024):

Physical Gold Acquisition Guide

- Reputable Dealers:

- Online: APMEX, JM Bullion, Kitco

- Local: Remember to do research on your local dealers

- Authentication tools: Sigma Metalytics verifier

- Storage Solutions:

Expert Insights

“Gold’s role in portfolio diversification becomes even more critical during periods of economic uncertainty. Consider a 5-15% allocation depending on your risk tolerance.” – World Gold Council

“For collectors, the numismatic market offers unique opportunities. Focus on quality over quantity, and always buy the book before the coin.” – Jeff Garrett, Professional Numismatist

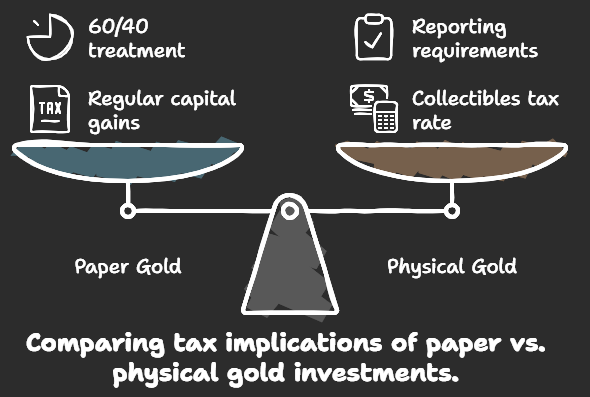

Tax Considerations

Paper Gold Taxation

- ETF sales: Regular capital gains rates

- Futures contracts: 60/40 long-term/short-term treatment

- Mining stocks: Standard equity taxation

Physical Gold Taxation

- Collectibles tax rate: 28% maximum

- Reporting requirements:

- Form 1099-B for sales over $1,000

- Form 8300 for cash transactions over $10,000

Conclusion: Physical Gold vs. Paper Gold

As both a history enthusiast and gold investor, I’ve found that the choice between physical and paper gold isn’t just about returns – it’s about what resonates with your personal philosophy and goals. The tangible connection to history that comes with holding a gold coin can be just as valuable as the potential financial benefits.

Remember, the best strategy often combines both forms: paper gold for liquidity and ease of trading, and physical gold for that irreplaceable sense of true ownership and historical connection. Whether you’re stacking coins or trading ETFs, stay informed, stay passionate, and keep learning about this fascinating asset that has captivated humanity for millennia.

What’s your preferred way of owning gold? I’d love to hear about your experiences and what draws you to this timeless metal!

Frequently Asked Questions About Gold Investment

General Gold Investment Questions

Q: What’s the minimum amount needed to start investing in gold? A: You can start with paper gold (ETFs) for as little as $50! For physical gold, while a 1oz coin costs around $2,400 (as of 2024), you can begin with 1/10 oz coins or even smaller denominations. I started my collection with a 1/4 oz American Gold Eagle – it’s about finding what works for your budget.

Q: Is gold really a good hedge against inflation? A: Historically, yes! Gold has maintained its purchasing power over centuries. Fun fact: in Ancient Rome, an ounce of gold could buy a fine toga and sandals – today, that same ounce could buy a quality suit and shoes. While short-term prices fluctuate, gold has proven to be an excellent long-term inflation hedge.

Physical Gold Questions

Q: How can I be sure my physical gold is authentic? A: Great question! There are several methods:

- Purchase from reputable dealers who use Sigma Metalytics verifiers

- Learn basic testing methods (dimensions, weight, sound)

- Consider graded coins from NGC or PCGS

- For larger purchases, get an independent assay

Q: What’s the safest way to store physical gold at home? A: From my experience:

- Invest in a TL-15 rated safe (minimum)

- Bolt it to your foundation

- Use silica gel packets to control humidity

- Consider multiple storage locations

- Never discuss your holdings publicly

- Maintain proper insurance coverage

Paper Gold Questions

Q: Which gold ETF is best for long-term holding? A: For long-term holders, consider:

- GLDM (lowest expense ratio at 0.18%)

- IAU (great liquidity, 0.25% expense ratio)

- AAAU (offers optional physical delivery) Choose based on your trading frequency, expense tolerance, and whether physical conversion options matter to you.

Q: How do gold ETFs actually work? Do they own real gold? A: Most major gold ETFs like GLD and IAU are backed by physical gold stored in secured vaults. Each share typically represents a fraction of an ounce of gold. However, only authorized participants can convert shares to physical gold, and minimum quantities are substantial (usually 100,000 shares or more).

Market and Trading Questions

Q: When is the best time to buy gold? A: While timing the market is challenging, consider:

- Buying during periods of price consolidation

- Dollar-cost averaging to reduce timing risk

- Watching for seasonal patterns (traditionally stronger in January and August)

- Following central bank buying trends

Q: How liquid is physical gold compared to paper gold? A: Paper gold (ETFs) offers nearly instant liquidity during market hours. Physical gold typically takes 1-3 days to convert to cash through a dealer. However, during financial crises, physical gold can actually become MORE liquid than paper gold – something we saw glimpses of during the 2020 market turbulence.

Tax and Regulatory Questions

Q: Do I need to report my gold purchases to the government? A: In the US:

- Cash purchases over $10,000 require Form 8300

- Sales of specific quantities require 1099-B reporting

- Regular credit/debit purchases don’t require reporting

- International transport over $10,000 requires declaration

Q: Can I hold gold in my IRA? A: Yes! You can hold certain gold investments in a Self-Directed IRA:

- Specific coins (American Eagles, Canadian Maple Leafs, etc.)

- Gold bars meeting purity requirements (minimum .995 fine)

- Gold ETFs

- Must be held by an approved custodian

Collector-Specific Questions

Q: Are numismatic coins a good investment? A: From a collector’s perspective:

- Focus on quality over quantity

- Buy slabbed coins from reputable grading services

- Study the market before investing

- Consider them a separate category from bullion

- Understand that premiums can be subjective

Remember: collecting history-rich numismatic pieces can be incredibly rewarding, but requires more expertise than bullion investing.