What Is a Gold IRA Rollover?

Your Comprehensive Guide to Securing Your Retirement

Have you ever wondered how to protect your retirement savings from economic uncertainties? I’ve been there, and I’ve found that diversifying with precious metals can be a game-changer. That’s where a Gold IRA rollover comes into play. In this guide, I’ll walk you through everything you need to know about Gold IRA rollovers, from the basics to advanced strategies.

Understanding the Basics of a Gold IRA Rollover

First things first, let’s break down what a Gold IRA rollover is. Simply put, it’s a process where you transfer funds from your existing retirement account, like a 401(k) or traditional IRA, into a new Individual Retirement Account that allows you to hold physical gold and other precious metals.

Why would you want to do this? Well, gold has been a stable store of value for thousands of years. In times of economic uncertainty, inflation, or market volatility, gold often maintains or increases its value. By adding gold to your retirement portfolio, you’re essentially creating a hedge against these financial risks.

The History of Gold IRAs: From Traditional Investments to Precious Metals

Before we dive deeper into the specifics of Gold IRA rollovers, let’s take a quick journey through time to understand how Gold IRAs came to be. This context will help you appreciate why they’ve become such a popular option for retirement planning.

The concept of Individual Retirement Accounts (IRAs) was first introduced in 1974 with the Employee Retirement Income Security Act (ERISA). However, at that time, IRAs were limited to stocks, bonds, and other traditional paper assets. Gold and other precious metals weren’t part of the picture yet.

Let us fast forward to 1997 when the Taxpayer Relief Act changed the game.

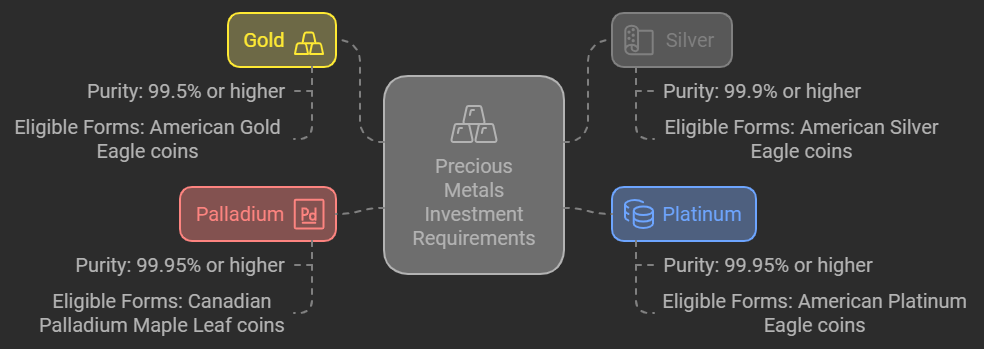

The Taxpayer Relief Act of 1997 expanded the types of assets that could be held in IRAs to include certain precious metals. However, not all precious metals are eligible. The IRS has specific requirements for the types and purity of precious metals allowed in IRAs:

Precious Metals

- Gold:

- Must be 99.5% pure or higher

- Eligible forms include: American Gold Eagle coins (including proofs)

- Silver:

- Must be 99.9% pure or higher

- Eligible forms include: American Silver Eagle coins (including proofs)

- Platinum:

- Must be 99.95% pure or higher

- Eligible forms include: American Platinum Eagle coins

- Palladium:

- Must be 99.95% pure or higher

- Eligible forms include: Canadian Palladium Maple Leaf coins

It’s important to note that collectible coins and rare or collectible bullion are not allowed in IRAs. The focus is on investment-grade bullion whose value is derived from its precious metal content rather than its rarity or condition.

The Rise of Gold IRAs in the Early 2000s

In the early 2000s, interest in Gold IRAs began to surge, particularly following the dot-com bubble burst and the financial crisis of 2008. These significant economic events underscored the inherent volatility of traditional markets, prompting investors to seek stability in gold, which is often regarded as a “haven” asset. As a result, many turned to Gold IRAs as a means to safeguard their retirement savings against economic uncertainty.

Key Economic Events Influencing Gold IRA Popularity

The dot-com bubble burst occurred between 1999-2001, with the NASDAQ composite index peaking on March 10, 2000, before beginning its steep decline. The 2008 financial crisis is generally considered to have begun in September 2008 with the collapse of Lehman Brothers, though its roots can be traced back to the subprime mortgage crisis that started in 2007.

Recommended Sources for Further Research

For more precise information and an in-depth look at these topics, especially in relation to Gold IRAs, I would recommend consulting the following source:

The World Gold Council (www.gold.org) provides comprehensive research and data on gold investments, including historical context and market trends. Their “Gold Demand Trends” reports, which are published quarterly, often include information on investment patterns and how they relate to economic events.

Utilizing World Gold Council Resources

Specifically, you might find their research section valuable for historical data on gold investment trends following major economic events. They often provide detailed analyses of how events like the dot-com bubble burst and the 2008 financial crisis impacted gold demand and investment patterns.

The Importance of Multiple Sources

For the most accurate and detailed information, it would be best to cross-reference multiple reputable sources and possibly consult academic papers or financial industry reports that focus on the history of alternative investments like Gold IRAs.

How to Roll Over Your 401(k) to a Gold IRA: A Step-by-Step Guide

Now that you understand the concept, let’s dive into the process. Rolling over your 401(k) to a Gold IRA isn’t as complicated as it might sound. Here’s a step-by-step guide to help you navigate the process:

1. Choose a Gold IRA custodian: This is a financial institution that will manage your Gold IRA. Look for reputable companies with a track record of excellent customer service.

2. Open your new Gold IRA account: Your chosen custodian will guide you through this process.

3. Initiate the rollover: Contact your current 401(k) administrator and inform them of your decision to roll over to a Gold IRA.

4. Fund your new account: Your 401(k) funds will be transferred to your new Gold IRA.

5. Choose your precious metals: Work with your custodian to select and purchase IRS-approved gold coins or bars.

6. Store your gold: Your custodian will arrange for secure storage of your precious metals in an IRS-approved depository.

Remember, this is a 401k to gold IRA rollover, and it’s crucial to follow IRS guidelines to avoid any penalties or tax implications.

10 Common Mistakes to Avoid During Your Gold IRA Rollover

As with any financial decision, there are potential pitfalls to be aware of. Here are some gold IRA rollovers mistakes you’ll want to steer clear of:

1. Choosing an unreliable custodian

2. Failing to understand the fees involved

3. Not diversifying within your Gold IRA

4. Overlooking storage fees

5. Violating IRS rules on prohibited transactions

6. Failing to meet minimum distribution requirements

7. Choosing the wrong type of precious metals

8. Not considering your long-term investment goals

9. Rushing the rollover process

10. Neglecting to seek professional advice

By being aware of these common errors, you can ensure a smoother rollover process and maximize the benefits of your Gold IRA.

The Ultimate Checklist for a Smooth Gold IRA Rollover Process

To help you stay organized and ensure you don’t miss any crucial steps, I’ve created this gold IRA rollover checklist:

[ ] Research and choose a reputable Gold IRA custodian

[ ] Gather all necessary documentation from your current retirement account

[ ] Open your new Gold IRA account

[ ] Initiate the rollover process with your current account administrator

[ ] Confirm the transfer of funds to your new Gold IRA

[ ] Select IRS-approved precious metals for your account

[ ] Arrange for secure storage of your gold

[ ] Review all fees and ensure you understand the cost structure

[ ] Set up a system to track your Gold IRA performance

[ ] Plan for required minimum distributions (if applicable)

By following this checklist, you’ll be well on your way to a successful Gold IRA rollover.

Understanding the Tax Implications of a Gold IRA Rollover

One of the most common questions I hear is about gold IRA rollover taxes. It’s a crucial aspect to understand because doing it wrong can lead to unexpected tax bills. Here’s what you need to know:

1. Direct rollovers: If done correctly, a direct rollover from a 401(k) or traditional IRA to a Gold IRA is typically tax-free.

2. Indirect rollovers: These can be tricky. You have 60 days to complete the rollover, or you might face taxes and penalties.

3. Roth conversions: If you’re converting a traditional IRA to a Roth Gold IRA, you’ll owe taxes on the amount converted.

4. Required Minimum Distributions (RMDs): Once you reach 72, you’ll need to take RMDs from your Gold IRA, which are taxable.

Remember, tax laws can be complex, so it’s always a good idea to consult with a tax professional before making any significant financial decisions.

Gold IRA Rollover Eligibility: Are You Qualified?

Before you get too excited about rolling over to a Gold IRA, it’s important to understand the gold IRA rollover eligibility requirements. Here’s a quick rundown:

- You must have an eligible retirement account (e.g., 401(k), 403(b), 457(b), traditional IRA)

- If you’re still employed, you may need to be over 59½ to rollover a 401(k)

- Roth IRAs are generally not eligible for rollover to a traditional Gold IRA

- Your current plan must allow for rollovers (most do, but it’s worth checking)

If you meet these criteria, you’re likely eligible for a Gold IRA rollover. However, it’s always best to confirm with your current plan administrator and a Gold IRA specialist.

Pros and Cons of Rolling Over Your Traditional IRA to a Gold IRA

As with any financial decision, there are advantages and disadvantages to consider when converting a traditional IRA to gold IRA. Let’s break them down:

Pros:

1. Diversification of your retirement portfolio

2. Protection against inflation and economic instability

3. Potential for growth as gold prices increase

4. Tangible asset that you can physically own

Cons:

1. Gold doesn’t produce income like stocks or bonds

2. Storage and insurance costs can be higher than traditional IRAs

3. Gold prices can be volatile in the short term

4. Potential for higher fees compared to traditional IRAs

Weighing these factors against your personal financial goals and risk tolerance is crucial in making the right decision for your retirement.

How Long Does a Gold IRA Rollover Take? Timeline and Expectations

If you’re considering a Gold IRA rollover, you might be wondering about the gold IRA rollover timeline. The good news is that the process is typically quicker than you might expect:

1.Account setup: 1-2 business days

2. Fund transfer: 5-10 business days for direct rollovers

3. Precious metals purchase: 1-3 business days once funds are available

4. Delivery to depository: 1-5 business days

So, from start to finish, you’re looking at about 2-3 weeks for the entire process. However, keep in mind that indirect rollovers must be completed within 60 days to avoid penalties.

Direct vs Indirect Gold IRA Rollovers: Which Method Is Right for You?

When it comes to rolling over your retirement funds, you have two options: direct and indirect rollovers. Let’s compare these direct vs indirect gold IRA rollover methods:

Direct Rollover:

- Funds are transferred directly from your old account to your new Gold IRA

- No taxes are withheld

- Lower risk of missing the 60-day deadline

- Generally simpler and less stressful

Indirect Rollover:

- Funds are distributed to you, and you’re responsible for depositing them into your new Gold IRA

- 20% of the distribution is typically withheld for taxes

- You must complete the rollover within 60 days

- Offers more flexibility but comes with higher risks

For most people, a direct rollover is the safer and more straightforward option. However, your specific circumstances might make an indirect rollover more appealing.

Gold IRA Rollover Rules: Staying Compliant with IRS Regulations

Navigating the gold IRA rollover rules set by the IRS is crucial to avoid penalties and ensure your retirement funds remain tax-advantaged. Here are some key regulations to keep in mind:

1. One-rollover-per-year rule: You can only perform one indirect IRA-to-IRA rollover in a 12-month period.

2. 60-day rule: For indirect rollovers, you must complete the process within 60 days of receiving the distribution.

3. Same property rule: The same property you take out of your old IRA must go into the new one (with some exceptions for cash distributions used to purchase gold).

4. Prohibited transactions: You can’t use your IRA funds to purchase collectibles or certain precious metals that don’t meet purity standards.

5. No self-dealing: You can’t use your Gold IRA to benefit yourself or certain family members before retirement.

Staying compliant with these rules is essential for a successful Gold IRA rollover.

Maximizing Your Retirement: Strategic Timing for Gold IRA Rollovers

Timing can be everything when it comes to financial decisions, and knowing when to rollover to gold IRA can make a significant difference in your retirement savings. Here are some factors to consider:

1. Market conditions: Consider rolling over when traditional markets are overvalued or unstable.

2. Gold prices: While timing the market is challenging, you might want to initiate a rollover when gold prices are relatively low.

3. Age and retirement timeline: The closer you are to retirement, the more conservative your portfolio should typically become.

4. Economic indicators: Keep an eye on inflation rates and geopolitical events that might impact gold prices.

5. Personal financial situation: Consider a rollover when you change jobs or retire, as these are often opportune times to reassess your retirement strategy.

Remember, the best time to diversify is often before you think you need to. Don’t wait for a crisis to start thinking about protecting your retirement savings.

The Role of Gold IRA Custodians in the Rollover Process

A gold IRA custodian rollover plays a crucial role in the entire process. These financial institutions are specially authorized to hold and manage your precious metals on your behalf. Here’s what you need to know about their role:

1. Account setup: They help you establish your Gold IRA account.

2. Funds transfer: They coordinate the transfer of funds from your old retirement account.

3. Precious metals acquisition: They facilitate the purchase of IRS-approved gold and other precious metals.

4. Storage: They arrange for the secure storage of your gold in an IRS-approved depository.

5. Reporting: They handle all necessary IRS reporting and provide you with regular account statements.

6. Compliance: They ensure that all transactions comply with IRS regulations.

Choosing the right custodian is crucial for a smooth Gold IRA rollover experience.

How to Transfer Multiple Retirement Accounts into a Single Gold IRA

If you’re looking to consolidate retirement accounts gold IRA style, you’re in luck. It’s possible to transfer multiple retirement accounts into a single Gold IRA. Here’s how:

1. Choose a custodian: Select a Gold IRA custodian that can handle multiple account transfers.

2. Open your Gold IRA: Set up your new account with the chosen custodian.

3. Initiate transfers: Contact each of your current retirement account administrators to initiate rollovers.

4. Coordinate timing: Try to time the transfers so they arrive in your new Gold IRA around the same time.

5. Purchase precious metals: Once all funds are in your Gold IRA, work with your custodian to purchase gold and other precious metals.

Consolidating multiple accounts can simplify your retirement planning and potentially reduce fees.

Gold IRA Rollover Fees: What to Expect and How to Minimize Costs

Understanding gold IRA rollover fees is crucial for making an informed decision. Here are some common fees you might encounter:

1. Setup fee: One-time fee for opening your Gold IRA account

2. Annual custodian fee: Yearly fee for managing your account

3. Storage fee: Annual cost for storing your gold in a secure depository

4. Transaction fees: Costs associated with buying or selling precious metals

5. Wire transfer fees: Charges for transferring funds electronically

6. Cash-out fees: Costs associated with taking distributions from your Gold IRA

To minimize these costs:

- Compare fees among different custodians

- Look for custodians that offer fee waivers or promotions

- Consider custodians that use flat fees rather than percentage-based fees

- Minimize transactions to reduce associated fees

Remember, the lowest fees don’t always mean the best service. Balance cost with reputation and quality of service.

Partial Gold IRA Rollovers: Diversifying Your Retirement Portfolio

If you’re intrigued by the idea of a Gold IRA but don’t want to put all your eggs in one basket, a partial gold IRA rollover might be the perfect solution. This strategy allows you to diversify your retirement portfolio while maintaining some of your traditional investments.

Here’s how it works:

1. Decide what percentage of your existing retirement account you want to rollover into gold.

2. Follow the same process as a full rollover, but only transfer the chosen percentage.

3. Your remaining funds stay in your original retirement account.

This approach allows you to enjoy the potential benefits of gold ownership while still maintaining a diversified retirement strategy.

Required Minimum Distributions (RMDs) and Gold IRA Rollovers: What You Need to Know

Understanding how Required Minimum Distributions (RMDs) work with a gold IRA RMD rollover is crucial for anyone over 72 or nearing that age. Here are the key points:

1. Gold IRAs are subject to the same RMD rules as traditional IRAs.

2. You must start taking RMDs by April 1 of the year following the year you turn 72.

3. RMDs are calculated based on the total value of all your traditional IRAs, including your Gold IRA.

4. You can take your RMD in cash or in-kind (physical gold), but in-kind distributions can be complex.

5. Failing to take your RMD can result in a 50% penalty on the amount not distributed.

Planning for RMDs is an important part of your overall retirement strategy, especially when dealing with physical assets like gold.

Conclusion: Is a Gold IRA Rollover Right for You?

We’ve covered a lot of ground in this comprehensive guide to Gold IRA rollovers. From understanding the basics to navigating complex topics like taxes and RMDs, you now have a solid foundation to make an informed decision.

Remember, a Gold IRA rollover can be an excellent way to diversify your retirement portfolio and protect your savings against economic uncertainties. However, it’s not the right choice for everyone. Consider your personal financial situation, risk tolerance, and retirement goals before making a decision.

If you’re still unsure, don’t hesitate to seek advice from a financial advisor who specializes in retirement planning and precious metals IRAs. They can provide personalized guidance based on your unique circumstances.

Ultimately, whether you choose to roll over to a Gold IRA or stick with more traditional investment vehicles, the most important thing is that you’re taking an active role in planning for your financial future. Here’s to a golden retirement!