A 2025 Guide to Protecting Your Wealth

Your Comprehensive Guide to Gold IRAs and Retirement Planning

Effective Gold IRAs and Retirement Planning represent a crucial shift in strategy for savers navigating an era defined by global economic uncertainty and potential currency shifts like the  ‘Rio Reset’ (A concept first identified by analysts at Birch Gold). As confidence in traditional dollar-denominated assets is questioned, investors are no longer just considering alternative assets; they are actively seeking the proven stability of gold as a primary tool to protect their wealth from debasement and market volatility.

‘Rio Reset’ (A concept first identified by analysts at Birch Gold). As confidence in traditional dollar-denominated assets is questioned, investors are no longer just considering alternative assets; they are actively seeking the proven stability of gold as a primary tool to protect their wealth from debasement and market volatility.

This comprehensive guide explains what a Gold IRA is, how it functions within a modern retirement plan, and why it is considered a primary tool for hedging against the very risks highlighted by the de-dollarization trend.

Key Takeaways

- A Hedge Against Uncertainty: A Gold IRA is a self-directed retirement account that allows investors to hold physical precious metals like gold, silver, and platinum, serving as a powerful hedge against inflation and market volatility.

- Tangible Asset Ownership: Unlike traditional IRAs that hold paper assets (stocks, bonds), a Gold IRA provides ownership of a physical commodity, reducing counterparty risk associated with financial institutions.

- Strategic Allocation: Most financial experts, as highlighted in publications like Forbes, recommend a portfolio allocation of 5% to 10% in precious metals to provide diversification without sacrificing the growth potential of other assets.

- Strict IRS Rules Apply: Gold IRAs are governed by specific IRS regulations regarding contributions, storage in an approved depository, and Required Minimum Distributions (RMDs) starting at age 73.

Understanding Gold IRAs: A Tangible Addition to Your Retirement Strategy

What is a Gold IRA?

A Gold IRA, or Gold Individual Retirement Account, is a special type of self-directed IRA (SDIRA) that allows an individual to invest in physical gold, silver, platinum, and palladium. It offers the same tax advantages as a traditional IRA but holds tangible assets instead of paper ones.

Retirement Planning

In diversified Gold IRAs and Retirement Planning, a Gold IRA acts as a layer of insurance. While stocks and bonds are the primary engines for growth, gold historically serves as a safe-haven asset. Its price often moves inversely to the stock market, meaning that during periods of economic turbulence when paper assets may decline, gold investments can provide crucial stability to a portfolio.

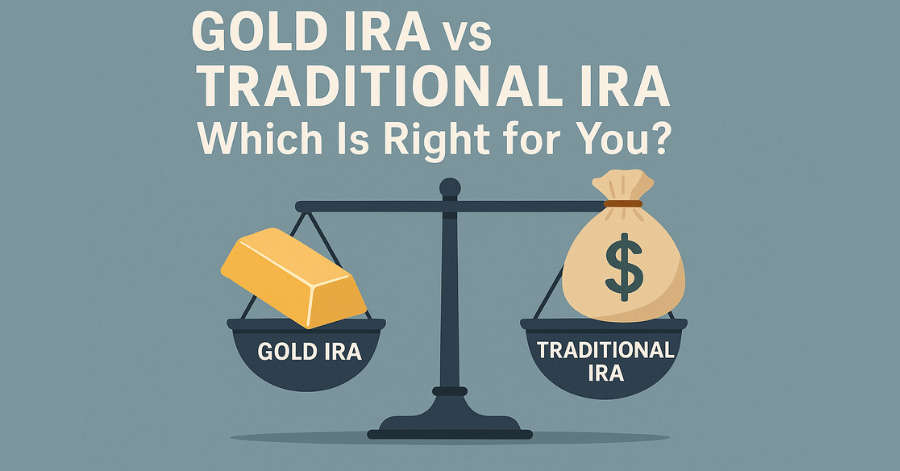

Gold IRA vs. Traditional IRA: A Direct Comparison

The choice between a  Gold IRA and a Traditional IRA comes down to the assets they hold and the purpose they serve in your Gold IRAs and Retirement Planning strategy.

Gold IRA and a Traditional IRA comes down to the assets they hold and the purpose they serve in your Gold IRAs and Retirement Planning strategy.

Gold IRA vs. Traditional IRA Comparison

Comprehensive analysis of retirement investment options

| Feature | Gold IRA | Traditional IRA |

|---|---|---|

| Primary Assets Core investment holdings | Physical Gold, Silver, Platinum, Palladium | Stocks, Bonds, Mutual Funds, ETFs |

| Key Benefit Primary advantage of this option | Tangible hedge against inflation & currency risk | Exposure to broad market growth & dividends |

| Counterparty Risk Dependence on third parties | ● Low. You own the physical asset. | ● High. Relies on the stability of financial institutions. |

| Fees Associated costs and expenses | 💰 Higher. Includes annual storage and insurance. | 💵 Generally lower. Standard management fees. |

Balancing Risk: Optimal Gold Allocation in Your Portfolio

One of the most common questions investors have is how much of their portfolio to allocate to gold. While every individual’s situation is unique, a common guideline from financial experts is to allocate between 5% and 10% of a total portfolio to precious metals. As noted by Forbes, this range is often recommended to provide meaningful diversification and a hedge against inflation without significantly limiting the growth potential of other assets in the portfolio.

Think of this as the “Goldilocks principle” for your retirement: not too much, and not too little. Too small an allocation may not provide adequate protection, while too large an allocation could overexpose you to a single, non-income-producing asset class.

Gold IRA Contribution Limits and Rules for 2025

Understanding the rules set by the IRS is crucial for maintaining a compliant Gold IRA.

2025 Contribution Limits

For individuals under age 50, the maximum annual contribution to all IRAs is $7,000.

For those age 50 and older, a “catch-up” provision allows for an additional $1,000, bringing the total to $8,000.

Required Minimum Distributions (RMDs)

Under the SECURE 2.0 Act, you must begin taking RMDs from your Traditional Gold IRA starting at age 73. It is important to plan for these distributions with your custodian, as this may involve liquidating a portion of your metals to meet the requirement. For more detailed information, please see our guide on  Gold IRA Rules and Regulations.

Gold IRA Rules and Regulations.

Please take note:

- The contribution limits apply to the total amount you can contribute across all your IRAs (Traditional, Roth, and Gold IRAs combined), not per individual account.

- Eligibility to contribute to a Roth IRA (including a Roth Gold IRA) is subject to income limits. For 2025, single filers with a modified adjusted gross income (MAGI) below $150,000 and joint filers below $236,000 can make the full contribution. If your income exceeds these thresholds, your allowable contribution may be reduced or eliminated. These income limits do not affect your ability to contribute to a Traditional or Gold IRA, only the deductibility of those contributions in some cases.

Finding the Best Gold IRA Companies

Choosing a reputable partner is the most important step in setting up a Gold IRA. While every investor must do their own research, a trustworthy company will typically meet a clear set of criteria. Use this checklist when vetting potential providers

Gold IRA Custodian Vetting Checklist

Essential criteria for selecting a trusted Gold IRA custodian

Use this comprehensive checklist to evaluate potential custodians and ensure you’re working with a reputable, experienced partner for your Gold IRA investment.

-

At least 10+ years in business High Priority

Look for a long and stable track record. Established custodians have weathered market cycles and demonstrate financial stability.

Verify business registration and regulatory compliance history -

Transparent fee structures listed online High Priority

All fees (setup, annual, storage) should be clearly disclosed on their website. Hidden fees are a major red flag.

Compare setup, annual maintenance, and storage fees across providers -

An A+ rating from the Better Business Bureau (BBB) Important

This is a strong indicator of customer satisfaction and ethical business practices. Check for complaint resolution patterns.

Review complaint history and response times to customer issues -

Positive reviews on multiple third-party sites Important

Check sources like Trustpilot, Consumer Affairs, and Google Reviews. Look for consistent positive feedback patterns.

Focus on recent reviews and how the company responds to criticism -

A dedicated specialist to guide you High Priority

The process is complex; you should have a single point of contact to help you. Avoid companies that shuffle you between representatives.

Ensure your specialist is knowledgeable about IRS regulations and precious metals

Quick Evaluation Tips

- Request references from current customers

- Ask about their depository partnerships and security measures

- Verify their registration with appropriate regulatory bodies

- Test their customer service responsiveness before committing

Top 5 Gold IRA Investment Strategies

A Precious IRA is a strategy in itself. There are several ways to approach building your position within Gold IRAs and Retirement Planning.

Top 5 Gold IRA Investment Strategies

Proven approaches for building and managing your precious metals retirement portfolio

These time-tested strategies help you maximize the benefits of precious metals in your retirement portfolio while managing risk and optimizing long-term growth potential.

-

Dollar-Cost Averaging

Beginner FriendlyRegularly invest a fixed amount of money, regardless of price fluctuations, to build your position over time.

How It Works

Set up automatic monthly contributions to your Gold IRA. This strategy reduces the impact of volatility by averaging your purchase price over time.

-

Diversification Within Metals

IntermediateDon’t just focus on gold. Allocate a portion to silver, platinum, or palladium for additional diversification.

Optimal Allocation

Consider 60-70% gold, 20-25% silver, and 10-15% platinum/palladium. Each metal has different industrial uses and market dynamics.

-

Core and Satellite Approach

IntermediateUse gold as your core, stable holding, and a smaller portion for more speculative precious metals assets.

Structure Example

80% core gold holdings for stability, 20% satellite investments in rare coins, numismatics, or emerging precious metals for growth potential.

-

Long-Term Hold

Beginner FriendlyView gold as long-term insurance for your portfolio rather than trying to time short-term market swings.

Insurance Mindset

Hold for 10+ years minimum. Focus on wealth preservation rather than quick gains. Gold’s value shines during economic uncertainty and inflation.

-

Strategic Rebalancing

AdvancedPeriodically review your portfolio. If a surge in gold prices makes it an oversized portion of your assets, consider selling some to rebalance back to your target allocation.

Rebalancing Schedule

Review quarterly, rebalance annually or when allocation drifts 5% from target. This forces you to sell high and buy low systematically.

Implementation Guidelines

Funding Your Account with a Gold IRA Rollover

For many investors, the most efficient way to fund a new Gold IRA is by using the funds already saved in an existing retirement account. This process, known as a rollover, allows you to move money from a 401(k), 403(b), TSP, or another IRA into your new, self-directed Gold IRA without incurring taxes or penalties.

There are two primary methods for this: a Direct Rollover, where funds move directly from custodian to custodian, and an Indirect Rollover, where a check is sent to you, which you then have 60 days to deposit into the new account. Each method is governed by strict IRS rules that must be followed precisely.

Executing a rollover is a critical step that requires careful planning and attention to detail. To ensure a smooth, secure, and tax-free process, please refer to our complete Guide to Gold IRA Rollovers .

.

Conclusion: A Timeless Asset: Gold IRAs and Retirement Planning

Facing new and complex economic challenges! Gold IRAs offer a time-tested strategy for preserving wealth and securing peace of mind in retirement. By providing a tangible hedge against inflation and market volatility, a well-structured Gold IRA can serve as the stabilizing anchor for a modern investment portfolio. By understanding the rules, choosing a reputable partner, and adhering to a disciplined strategy, investors can effectively use this powerful tool to ensure their golden years are truly secure.

Comprehensive FAQ Section

Q1: Can I hold the gold from my IRA myself?

A: No. IRS regulations strictly prohibit taking personal possession of the precious metals held within your Gold IRA. All assets must be held by an IRS-approved custodian in a secure, third-party depository. Attempting to store the metals at home would be considered a taxable distribution and could result in severe penalties.

Q2: Can I add gold I already own to my Gold IRA?

A: No. You cannot contribute existing gold or other precious metals that you personally own directly into a Gold IRA. All metals must be purchased through the IRA and transferred directly from the dealer to the depository to maintain the chain of custody required by the IRS.

Q3: What are the penalties if I withdraw from my Gold IRA before age 59 ½?

A: The penalties are the same as for a traditional IRA. Withdrawals made before age 59 ½ are typically subject to a 10% penalty on top of being taxed as ordinary income.

Q4: What happens to my Gold IRA when I die?

A: Your Gold IRA will be passed on to the beneficiaries you designate on your account forms. The rules for how they can take distributions vary depending on whether the beneficiary is a spouse or a non-spouse. It is crucial to keep your beneficiary designations up to date. For more details, see our [Guide to Gold IRA Beneficiary Rules].

Q5: How do I sell the gold in my IRA when I want to take a distribution?

A: You will instruct your Gold IRA custodian that you wish to sell a portion of your metals. They will coordinate the sale with a dealer (often the company you bought from, through a buy-back program). The cash from the sale is deposited into your IRA, and you can then take a cash distribution. Alternatively, you can take an “in-kind” distribution of the physical metal itself, which is also a taxable event.

Q6: Are there different fees for a Gold IRA compared to a Traditional IRA?

A: Yes. Because a Gold IRA involves the storage and insurance of a physical commodity, it has annual fees that traditional IRAs do not. These typically include an annual custodian fee and a depository storage fee. For a complete breakdown, please see our [Guide to Gold IRA Fees].

Think a Gold IRA might be right for you? Test your knowledge first!