Disclaimer: Remember to consult with a financial advisor to determine if gold investing aligns with your specific financial goals and circumstances.

Invest in Gold: Your Comprehensive Guide to Golden Opportunities in 2024

As we march into 2025, the allure of gold continues to captivate financial markets and individual investors alike. The age-old question “Should you invest in gold?” remains as relevant as ever. This timeless asset has long been a beacon of stability in turbulent economic times, prompting many to consider adding it to their portfolios. But before you decide to invest in gold, it’s crucial to understand the nuances of this unique market and how it fits into your overall financial strategy.

In this comprehensive guide, we’ll explore everything from the basics of gold investment to advanced strategies, helping you navigate the precious metal markets with confidence. So, buckle up as we embark on this golden journey together!

Why Invest in Gold: Benefits and Considerations

Let’s kick things off with the million-dollar question: Why should you consider investing in gold? Well, there are several compelling reasons that make gold an attractive option for many investors:

1. Hedge against inflation: Gold has historically maintained its value over long periods, making it an excellent hedge against the eroding effects of inflation.

2. Portfolio diversification: Adding gold to your investment mix can help spread risk and potentially improve overall portfolio performance.

3. Safe-haven asset: During times of economic or political uncertainty, gold often serves as a safe haven for investors seeking stability.

4. Tangible asset: Unlike stocks or bonds, physical gold is a tangible asset you can hold in your hand, providing a sense of security for some investors.

But hold on—before you rush to buy gold bars, it’s essential to consider some potential drawbacks:

- Gold doesn’t produce income like dividend-paying stocks or interest-bearing bonds.

- The price of gold can be volatile in the short term.

- Storage and insurance costs for physical gold can eat into your returns.

So, how do you decide if gold is right for your investment strategy? Let’s dig deeper into the various forms of gold investments to help you make an informed decision.

Understanding Different Forms of Gold Investments

How should you invest in gold? Don’t fret, you’ve got options—and I mean lots of options! Let’s break down the most common types of gold investments:

Physical Gold

- Gold bullion: Bars or ingots of pure gold

- Gold coins: Government-minted coins like American Gold Eagles or Canadian Gold Maple Leafs

- Gold jewelry: A dual-purpose investment that you can wear and enjoy

Paper Gold

- Gold ETFs (Exchange-Traded Funds): Funds that track the price of gold

- Gold mining stocks: Shares in companies that mine and produce gold

- Gold futures and options: Contracts for buying or selling gold at a future date

Gold-Backed Accounts

- Gold certificates: Documents that represent ownership of gold stored by a bank

- Digital gold: Online platforms allowing you to buy and sell gold electronically

Each of these investment types has its own set of pros and cons. For example, physical gold offers the security of tangible ownership but comes with storage concerns, while gold ETFs provide ease of trading but don’t give you actual possession of the metal.

Gold Mutual Funds: Additional Gold Paper Options

Characteristics of Gold Mutual Funds

Gold mutual funds are financial instruments that track the price of gold without investors actually owning physical gold. They are categorized as “paper gold” for the following reasons:

- Lack of physical possession: Investors in gold mutual funds do not hold any tangible gold. Instead, they own shares in a fund that represents gold’s value.

- Indirect ownership: These funds typically invest in gold ETFs or other gold-related assets, providing indirect exposure to gold prices.

- Documentation-based: The ownership of gold is represented solely through documentation or digital records, rather than physical metal.

Comparison to Physical Gold

Gold mutual funds differ from physical gold investments in several key aspects:

- Liquidity: They offer higher liquidity compared to physical gold, as they can be easily bought and sold.

- Storage: Unlike physical gold, there’s no need for secure storage or insurance.

- Accessibility: Investors can participate in the gold market with smaller amounts, making it more accessible.

Benefits of Gold Mutual Funds as Paper Gold

- Market participation: Allows investors to benefit from gold price movements without the complexities of physical ownership.

- Cost-effective: Generally involves lower costs compared to buying and storing physical gold.

- Transparency: Offers clear pricing and easier valuation compared to physical gold.

- Systematic investment: Enables regular investments through options like Systematic Investment Plans (SIPs).

While gold mutual funds provide these advantages, it’s important to note that they also carry certain risks, such as counterparty risk and market volatility, which are inherent to paper gold investments.

Gold in Your Portfolio: Strategies for Diversification

Now that we’ve covered the basics, you might be wondering, “How much gold should I add to my portfolio?” Great question! The answer depends on your individual financial goals, risk tolerance, and overall investment strategy.

Many financial advisors recommend allocating between 5% and 10% of your portfolio to gold. This allocation can help provide a buffer against market volatility while still allowing for growth from other investments.

Here are some strategies to consider when diversifying with gold:

- Core and satellite approach: Use gold as a “satellite” investment around your core holdings of stocks and bonds.

- Rebalancing: Regularly adjust your gold allocation to maintain your desired portfolio balance.

- Dollar-cost averaging: Invest in gold gradually over time to potentially reduce the impact of price fluctuations.

Remember, the key to invest in gold successfully is diversifying and finding the right balance that aligns with your financial objectives and risk tolerance.

Gold Allocation Strategies: A Quick Guide

Important: Always consult a financial professional before you decide to invest in gold. This information is for general guidance only.

Here are some quick tips to get started with. Always remember to do your due diligence when researching strategies.

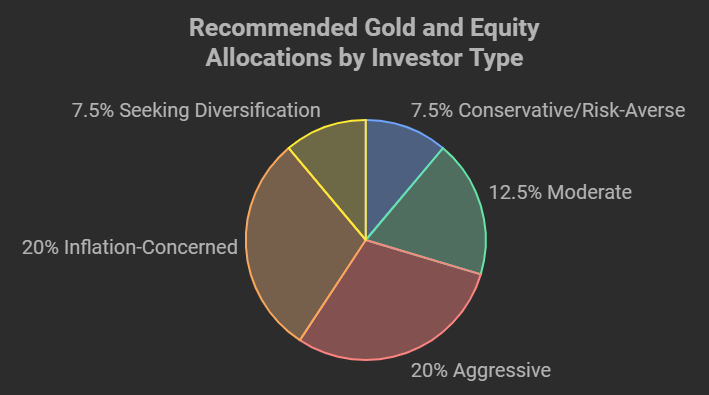

Investor Types and Recommended Allocations

- Conservative/Risk-Averse: 5-10%, focus on physical gold/ETFs

- Moderate: 10-15%, mix of physical gold and equities

- Aggressive: Up to 20%, higher allocation to mining stocks/ETFs

- Inflation-Concerned: 15-25%, focus on physical gold/ETFs

- Seeking Diversification: 5-10%, mix of physical gold/ETFs

Key Considerations

- Risk tolerance

- Investment goals

- Economic environment

- Age and time horizon

- Existing portfolio composition

- Regular rebalancing

Remember: These are general guidelines. Your specific situation may require a different approach. Always seek professional advice for personalized investment strategies.

Historical Performance of Gold as an Investment

You might be thinking, “That’s all well and good, but how has gold actually performed as an investment?” Let’s take a trip down memory lane and examine gold’s track record.

Gold has had its ups and downs over the years, but its long-term performance has been impressive.

- In the 1970s, gold prices soared from $35 per ounce to over $800.

- The 2000s saw another significant bull run, with gold reaching a record high of $1,895 in 2011.

- As of 2024, gold continues to trade at historically high levels, reflecting ongoing economic uncertainties and inflationary pressures.

However, it’s important to note that gold’s performance can vary greatly depending on the time frame you’re looking at. Unlike stocks, gold doesn’t generate earnings or pay dividends, so its price is driven primarily by supply and demand factors.

Gold vs Other Precious Metals: Which Should You Choose?

Gold isn’t the only precious metal in town. You might be wondering, “How does gold stack up against silver, platinum, or palladium?” Let’s compare:

1. Silver: Often more volatile than gold, but potentially offers higher returns

2. Platinum: Rarer than gold, with prices influenced heavily by industrial demand

3. Palladium: A critical component in catalytic converters, with prices driven by the automotive industry

Each metal has its own unique characteristics and market dynamics. While gold is often considered the “king” of precious metals due to its historical significance and widespread recognition, diversifying across multiple metals can potentially reduce risk and capture different market opportunities.

The Role of Gold in Hedging Against Inflation

One of gold’s most touted benefits is its ability to act as an inflation hedge. But how effective is gold at protecting your wealth from the ravages of inflation?

Historically, gold has maintained its purchasing power over long periods, often outpacing inflation. Here’s why:

- Limited supply: Unlike fiat currencies, the supply of gold is finite, which can help preserve its value.

- Global demand: Gold is valued worldwide, which can help stabilize its price during localized economic downturns.

- Negative correlation with currency: When the value of currencies declines due to inflation, gold often becomes more attractive to investors.

However, it’s important to note that gold’s effectiveness as an inflation hedge can vary in the short term. Its price is influenced by many factors beyond just inflation, including geopolitical events, interest rates, and overall market sentiment.

How to Start Investing in Gold: A Beginner’s Guide

Ready to dip your toes into the world of gold investing? Here’s a step-by-step starter kit: on how to invest in gold for beginners. This should get you started in the right direction:

1. Educate yourself: Continue learning about gold markets, investment options, and risks.

2. Determine your goals: Decide why you want to invest in gold and how it fits into your overall financial plan.

3. Choose your investment method: Decide between physical gold, ETFs, stocks, or other gold-related investments.

4. Start small: Begin with a modest investment to get comfortable with the market.

5. Monitor your investment: Keep an eye on gold prices and related news to make informed decisions.

6. Consult a professional: Consider talking to a financial advisor for personalized guidance.

Remember, investing in gold, like any investment, carries risks. Never invest more than you can afford to lose, and always do your due diligence before making any financial decisions.

Physical Gold vs Paper Gold: Pros and Cons

Still unsure whether to go for physical gold or paper gold? Let’s break down the pros and cons of each:

Physical Gold

Pros:

- Tangible asset you can hold and store yourself

- No counterparty risk

- Can be used as currency in extreme economic situations

Cons:

- Storage and insurance costs

- Potential for theft

- Less liquid than paper gold

Paper Gold (e.g., ETFs, stocks)

Pros:

- Highly liquid and easy to trade

- No storage or insurance concerns

- Often lower transaction costs

Cons:

- Counterparty risk (dependent on the issuer’s financial stability)

- No physical possession of gold

- May not perfectly track the price of physical gold

Not all gold investments are the same. Paper gold—such as ETFs, futures, and certificates—offers easy access and liquidity, but comes with counterparty risk and may not always be backed by enough physical gold. Physical gold provides real security but requires storage and insurance. For a deeper dive into the differences and risks, read our supporting article: [Physical Gold vs. Paper Gold: The Ultimate Guide for Enthusiasts]. This is where you’ll find Key Differences You Should Know.

Quick Comparison

| Feature | Paper Gold | Physical Gold |

|---|---|---|

| Ownership | Certificate/contract | Actual gold in hand |

| Liquidity | High | Lower |

| Storage | None | Required |

| Counterparty Risk | Yes | No |

| Price Manipulation | Possible | Less likely |

Did You Know?

There may be as much as 100 times more paper gold than physical gold in some markets. In a crisis, this can make it hard to convert paper claims into real metal

Your choice between physical and paper gold will depend on your investment goals, risk tolerance, and personal preferences.

Try our Gold Investment Cost Calculator

Gold ETFs: A Comprehensive Overview for Investors

Gold ETFs have become increasingly popular among investors looking for gold exposure without the hassles of physical ownership. But how do gold ETFs work, and are they right for you?

Gold ETFs are investment funds that track the price of gold. When you buy shares in a gold ETF, you’re essentially buying a claim on a portion of the fund’s gold holdings. Here are some key points to consider:

- Ease of trading: Gold ETFs can be bought and sold like stocks through your brokerage account.

- Lower costs: Generally, gold ETFs have lower fees compared to buying and storing physical gold.

- Liquidity: ETFs are highly liquid, making it easy to enter and exit positions.

- Transparency: Most gold ETFs publish their holdings daily, allowing you to see exactly what you own.

However, it’s important to note that not all gold ETFs are created equal. Some use derivatives or other financial instruments to track gold prices, which can introduce additional risks. Always read the prospectus carefully before investing in any ETF.

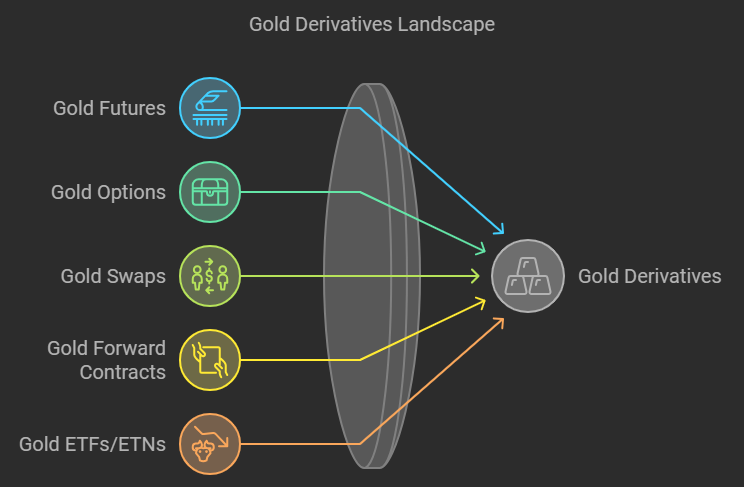

Gold Derivatives: Key Types and Considerations

Important: Derivatives can be complex and risky. Always seek professional financial advice before investing.

Main Types:

- Gold Futures

- Standardized contracts, exchange-traded

- High liquidity, leverage potential

- Gold Options

- Right to buy/sell at set price and time

- Limited risk for buyers, complex pricing

- Gold Swaps

- OTC agreements, customizable terms

- Used by institutions, less liquid

- Gold Forward Contracts

- Similar to futures, but OTC

- Customizable, counterparty risk

- Gold ETFs/ETNs

- Exchange-traded, track gold prices

- Easy to trade, may use derivatives

Key Considerations:

- Leverage potential

- Product complexity

- Counterparty risk

- Regulatory environment

- Associated costs

Remember: These products have varying risk-reward profiles. Carefully assess your investment goals and risk tolerance before investing.

Risks and Drawbacks of Gold Investment

When investing in gold, it’s crucial to understand the potential risks:

- Price Fluctuations: Gold’s value can swing dramatically due to global events, economic shifts, and currency movements.

- No Income: Unlike stocks or bonds, gold doesn’t generate dividends or interest. Its worth depends solely on price increases, which aren’t guaranteed.

- Storage Costs: Physical gold requires secure storage, which adds expenses for insurance and protection.

- Liquidity Challenges: Selling gold, particularly in bulk, can be difficult during market downturns or financial stress.

- Counterparty Risk: Investing in gold through ETFs or mining stocks exposes you to the financial health of the issuing company.

- Market Timing: Predicting when to buy or sell gold can be tricky, potentially leading to losses.

- Opportunity Cost: Money tied up in gold could miss out on higher returns from other investments.

- Currency Risk: For international investors, exchange rate shifts can affect the value of gold in local currencies.

- Regulatory Issues: Government policies regarding gold ownership and taxation can change unexpectedly.

- Environmental and Ethical Concerns: Gold mining has significant environmental impacts, which may be important to socially conscious investors.

While gold can provide portfolio diversification and protection during economic uncertainty, understanding these risks is essential to making informed decisions. Always align your gold investment with your overall financial goals and risk tolerance.

Gold in a Digital Age

In the digital age, gold investing is evolving with the rise of cryptocurrencies and digital gold products:

- Cryptocurrencies vs. Gold: Bitcoin is often called “digital gold” due to its limited supply and store-of-value role, similar to gold. However, cryptocurrencies are highly volatile compared to gold’s stability. Younger investors are increasingly viewing both gold and crypto as safe-haven assets during economic uncertainty.

- Digital Gold Products:

- Gold-Backed Cryptos: Digital tokens like PAX Gold and Tether Gold combine blockchain’s benefits with gold’s stability.

- Digital Gold Accounts: These platforms offer gold investing without physical storage, increasing liquidity and lowering costs.

- Tokenization: Blockchain allows fractional ownership of gold assets, making them more accessible.

- Impact on Traditional Gold:

- Accessibility: Digital platforms widen gold investing opportunities.

- Lower Costs & Greater Liquidity: Digital gold often has reduced storage and transaction costs while enhancing liquidity.

- Changing Demographics: Younger investors may favor digital options over physical gold.

- Portfolio Diversification: Digital assets offer more choices for diversification.

Though digital gold products and cryptocurrencies are gaining traction, traditional gold still offers timeless advantages like physical ownership, no reliance on technology, and global recognition. Both forms are likely to coexist, catering to diverse investor needs.

Regulatory Environment for Gold Ownership and Trading

Gold ownership and trading regulations differ widely across the globe. Here’s a snapshot of key regulations by region:

- United States: Gold ownership is legal with no federal reporting for most purchases. Cash transactions over $10,000 must be reported to the IRS. Gold in IRAs must meet specific purity standards, and some states have removed sales tax on bullion.

- European Union: Investment-grade gold is generally VAT-exempt, though regulations vary by country. For instance, in Germany, profits from gold held over a year are tax-free.

- India: Import duties fluctuate to manage gold inflows. Government schemes like the Gold Monetization Scheme encourage citizens to mobilize their gold holdings. Restrictions exist on how much gold travelers can bring in.

- China: Gold imports are controlled through select banks. Private gold ownership is allowed, and the Shanghai Gold Exchange is central to gold trading.

- Switzerland: No VAT on gold bullion, with strong privacy laws protecting owners’ identities.

- Japan: Gold can be freely owned and traded, though consumption tax may apply.

- South Africa: As a gold producer, the country has mining-specific regulations. Private ownership is allowed, but export restrictions exist.

General Regulatory Considerations:

- Anti-Money Laundering (AML) rules affect gold trading, requiring customer identity verification.

- Conflict Gold: Regulations like the U.S. Dodd-Frank Act require disclosure of gold from conflict regions.

- Central Bank Policies: Gold trading by central banks may be restricted.

- Cross-Border Movement: Many countries regulate the movement of large quantities of gold across borders.

Regulations can change frequently, so staying updated on local rules is crucial. Consulting reputable dealers or legal experts can help ensure compliance with gold regulations.

Finding Your Gold Investment Authority

Navigating the complex world of gold investment requires insights from various authoritative sources. This guide highlights key aspects to consider when you invest in gold, from market outlooks to historical perspectives, drawing on expertise from leading financial institutions and industry analysts. Whether you’re a novice investor or a seasoned trader, understanding these diverse facets can help inform your gold investment strategy in today’s dynamic economic landscape.

- Market Outlook: J.P. Morgan upgraded gold price targets for 2024-2025.

- Portfolio Allocation: Morgan Stanley suggests 1-5% gold allocation in diversified portfolios.

- Economic Analysis: Forbes offers a comprehensive analysis of gold’s performance in various economic conditions.

- Technical Analysis: Investopedia provides detailed coverage of gold market trends.

- Industry Trends: The World Gold Council’s Gold Demand Trends report is authoritative for supply and demand outlook.

- Central Bank Policies: APMEX offers insights on how central bank actions influence gold prices.

- Technological Developments: Tavex Bullion provides up-to-date information on gold mining technology.

- Regulatory Environment: The World Gold Council is a key source for gold trading regulations.

- Alternative Investments: Reuters, Gainesville Coins, Physical Gold, and Royal Mint offer comparisons between gold and other assets.

- Historical Perspective: Investopedia provides comprehensive historical data on gold performance during past crises.

Seek professional guidance: Consult with a financial advisor to tailor your gold investment strategy to your circumstances.

- Remember, while gold can be a valuable component of a diversified portfolio, it’s important to invest in gold with careful consideration and alignment with your overall financial strategy.

Tax Implications of Investing in Gold

When it comes to investing, we can’t forget about Uncle Sam’s share. So, how is gold taxed, and what should you know before investing?

The tax treatment to consider before you invest in gold can be complex and varies depending on the type of investment and how long you hold it. Here are some general guidelines:

1. Physical gold: Typically taxed as a collectible, with a maximum long-term capital gains rate of 28%.

2. Gold ETFs: Most are taxed as collectibles, similar to physical gold.

3. Gold mining stocks: Taxed like regular stocks, with lower long-term capital gains rates available.

4. Gold futures and options: Subject to complex tax rules, often involving a blend of short-term and long-term capital gains rates.

Remember, tax laws can change, and individual circumstances vary. It’s always a good idea to consult with a tax professional for personalized advice on how your investments will be taxed before you invest in gold.

Invest in Gold Mining Stocks: Opportunities and Risks

If you’re looking for potentially higher returns and are willing to take on more risk, gold mining stocks might be worth considering. But what should you know before you invest in gold mining companies?

Gold mining stocks offer exposure to gold prices while also providing the potential for company growth and dividends. However, they come with their own set of risks:

1. Operational risks: Mining is a complex and sometimes dangerous business.

2. Geopolitical risks: Many gold mines are located in politically unstable regions.

3. Environmental concerns: Mining can have significant environmental impacts, potentially leading to regulatory issues or public backlash.

4. Leverage to gold prices: Mining stocks often amplify gold price movements, for better or worse.

When evaluating gold mining stocks, consider factors such as the company’s production costs, reserves, management quality, and financial health. It’s often a good idea to diversify across multiple mining companies to spread risk.

The Impact of Global Events on Gold Investments

One of the fascinating aspects of gold is how it responds to world events. But how exactly do global happenings influence gold prices?

Gold is often seen as a safe-haven asset, meaning its price tends to rise during times of uncertainty. Here are some global events that can impact gold investments:

1. Economic crises: During financial downturns, investors often flock to gold for safety.

2. Geopolitical tensions: Wars, trade disputes, and political instability can drive up gold prices.

3. Currency fluctuations: A weakening U.S. dollar often correlates with rising gold prices.

4. Central bank policies: Interest rate decisions and monetary policies can influence gold’s attractiveness as an investment.

5. Technological advancements: New uses for gold in technology could impact demand and prices.

Keeping an eye on global news and understanding how different events might affect gold prices can help you make more informed investment decisions.

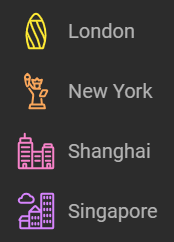

Global Gold Markets: Key Players and Price Drivers

Major Trading Hubs

- London: LBMA – premier OTC market

- New York: COMEX – highest volume futures trading

- Shanghai: SGE & SHFE – leading Asian exchanges

- Singapore: Emerging Asian hub

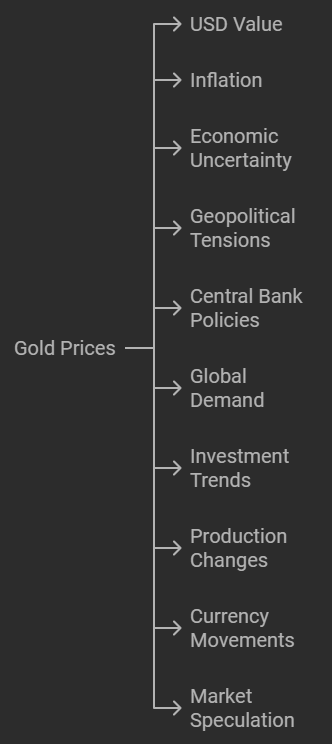

Price Influencers

- USD Value: Inverse relationship

- Inflation: Hedge against rising prices

- Economic Uncertainty: Safe-haven appeal

- Geopolitical Tensions: Conflicts drive prices up

- Central Bank Policies: Interest rates impact

- Global Demand: Jewelry and industrial needs

- Investment Trends: ETFs and other vehicles

- Production Changes: Supply fluctuations

- Currency Movements: USD-priced, global impact

- Market Speculation: Short-term volatility

Gold’s Rising Appeal in Turbulent Times

Geopolitical tensions in the Middle East and Eastern Europe have heightened global uncertainty, driving investors towards gold as a safe-haven asset. Simultaneously, major central banks are expected to implement rate cuts, with the Fed, ECB, and BoE all projected to ease monetary policy by early 2025. These factors have propelled gold to unprecedented highs, surpassing $2,500 per ounce.

The combination of political instability and anticipated monetary easing creates a potent environment for gold appreciation. As fears of supply disruptions persist and interest rates potentially decrease, gold’s non-yielding nature becomes increasingly attractive. This perfect storm of geopolitical and economic factors underscores gold’s enduring role as a hedge against uncertainty, positioning it as a compelling investment in these volatile times.

However, it’s crucial to remember that past trends don’t guarantee future outcomes. The gold market remains dynamic, responding to a complex interplay of global economic, political, and social factors. Investors should always consider the ever-changing nature of the market when making decisions.

Technical Analysis Essentials for Gold Trading

Chart Reading

- Analyze multiple timeframes

- Use candlestick charts for detailed price info

- Consider volume alongside price

- Identify trends and patterns

Key Indicators

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Support and Resistance Levels

Advanced Techniques

- Triangle Apex Reversal

- Multiple Timeframe Analysis

- Correlation Analysis

Best Practices

- Combine multiple indicators

- Consider market context and fundamentals

- Backtest strategies

- Stay informed on global events

- Remember: Technical analysis isn’t infallible

Mastering these techniques can improve trading decisions, but should be part of a comprehensive strategy including fundamental and sentiment analysis.

Gold Price Influencers: A Comprehensive Overview

Supply Factors

- Mining Production: Stable, ~3,000 metric tons/year

- Mining Costs: Can set price floor

- Recycling: Increases with high prices

Demand Factors

- Jewelry: 50-60% of annual demand

- Investment: Bars, coins, ETFs

- Central Bank Purchases: Significant recent impact

- Technology/Industrial Uses: ~7.5% of demand

Economic and Market Factors

- Currency Value: Inverse USD relationship

- Interest Rates: Lower rates increase appeal

- Inflation: Hedge against rising prices

- Economic Uncertainty: Safe-haven appeal

- Geopolitical Tensions: Conflicts drive demand

Market Dynamics

- Global Market Trading: 24/7 price changes

- Speculation: Futures and derivatives impact

- ETF Demand: Affects physical and mining stocks

- Investor Sentiment: Portfolio adjustments influence prices

Other Factors

- Technological Advancements: New uses impact the demand for gold

- Sustainability Concerns: Affect production and sentiment

- Cultural Factors: Significant in countries like India and China

This complex interplay of factors creates a dynamic market with both long-term trends and short-term fluctuations. Investors and analysts must consider these elements when predicting gold price movements.

Gold IRA: Securing Your Retirement with Precious Metals

As we think about long-term financial security, you might be wondering, “Can I include gold in my retirement plan?” The answer is yes, through a Gold IRA.

A Gold IRA is a self-directed Individual Retirement Account that allows you to hold physical gold and other precious metals. Here’s what you need to know:

1. Diversification: Adding gold to your retirement portfolio can help spread risk.

2. Tax advantages: Gold IRAs offer similar tax benefits to traditional IRAs.

3. Storage requirements: The gold must be held by an IRS-approved custodian.

4. Contribution limits: Gold IRAs are subject to the same contribution limits as traditional IRAs.

Before opening a Gold IRA, consider factors such as storage fees, the types of gold allowed, and how it fits into your overall retirement strategy.

Timing Your Gold Investment: Market Trends and Indicators

Timing the market is notoriously difficult, but are there any indicators or trends that can help you make smarter gold investment decisions?

While no one can predict the future with certainty, here are some factors to watch:

- Interest rates: Lower rates often correlate with higher gold prices.

- Inflation expectations: Rising inflation fears can drive gold prices up.

- Stock market performance: Gold often moves inversely to stock markets.

- Technical analysis: Chart patterns and momentum indicators can provide insights for short-term traders.

- Seasonal trends: Gold prices sometimes exhibit seasonal patterns, though these are not guaranteed.

Remember, trying to time the market perfectly is often a fool’s errand. Many successful investors advocate for a long-term, buy-and-hold strategy when it comes to gold.

Storing and Insuring Your Gold Investments

If you’ve decided to invest in physical gold, how do you keep it safe and protected?

Here are some options to consider:

Home storage:

Pros:

Immediate access

Cons:

Security risks, potential insurance issues

Bank safe deposit boxes:

Pros:

bank-level security

Cons:

limited access, may not be insured

Private vaults:

Pros:

High security, often insured

Cons:

Fees, less convenient access

Allocated storage with dealers:

Pros:

Professional management

Cons:

Fees, reliance on third party

When it comes to insurance, standard homeowners policies often have limits on gold coverage. Consider specialized precious metals insurance for comprehensive protection.

Sustainable Gold: The Future of Responsible Investing

As we wrap up our golden journey, let’s explore an emerging trend: How is the gold industry addressing sustainability concerns, and what does this mean for investors?

The gold industry is increasingly focusing on sustainability and ethical practices.

- Responsible sourcing: Efforts to ensure gold is conflict-free and ethically mined

- Environmental initiatives: Reducing the carbon footprint of gold mining and processing

- Recycled gold: Growing market for recycled gold jewelry and investment products

- Blockchain technology: Improving traceability in the gold supply chain

For eco-conscious investors, these developments offer new opportunities to invest in gold with environmental and social values.

Conclusion: Is Gold Right for Your Investment Strategy?

We’ve covered a lot of ground in our exploration of gold investments. From understanding the basics to diving into advanced topics like Gold IRAs and market timing, you’re now equipped with the knowledge to make informed decisions about including gold in your investment strategy.

Remember, there’s no one-size-fits-all approach to investing. Gold can play a valuable role in a diversified portfolio, but it’s important to consider your individual financial goals, risk tolerance, and overall investment strategy.

Whether you’re drawn to the glitter of physical gold coins, the convenience of ETFs, or the potential growth of mining stocks, the world of gold investing offers something for every type of investor. So, are you ready to add some golden opportunities to your financial future?

As always, it’s wise to do your own research and consult with a financial advisor before making any significant investment decisions. Happy investing, and may your financial future be as bright as gold!

Remember to consult with a financial advisor to determine if gold investing aligns with your specific financial goals and circumstances.

PLEASE LEAVE A COMMENT IF YOU FEEL THIS GUIDE IS VALUABLE!