Ever thought about how to buy your first gold investment as a way to secure your finances Precious metals investing, especially gold, is becoming popular. Many see it as a smart move to diversify and protect against inflation. With gold prices hitting a record high in October 2024, it’s no surprise beginners are interested.

Gold bullion and coins are often seen as safe during tough times. Now, even big stores like Costco and Walmart sell gold bullion. But, it’s important to know your options before investing.

Gold investing comes in many forms, from physical gold to ETFs, stocks, and IRAs. Each has its own risks and benefits. For example, an ounce of gold now costs between $2,300 and $2,400. Experts say gold should only make up 5% to 10% of your portfolio.

Ready to buy your first gold investment? Let’s look at how to make your first gold investment wisely and safely.

Key Takeaways

- Gold prices hit record highs in 2024, sparking interest among new investors

- Diversification is key – experts suggest limiting gold to 5-10% of your portfolio

- Options range from physical gold to ETFs, stocks, and gold IRAs

- Big retailers now offer gold bullion, making it more accessible

- Understanding different gold purities and forms is crucial for informed investing

- Gold IRAs provide a tax-deferred option for retirement portfolio diversification

- Beginners should be cautious with high-risk options like gold futures

Understanding Gold as an Investment Asset

Gold has been valuable for centuries, used as money and a safe place to keep wealth. Its appeal as an investment comes from its special qualities and long history.

Historical Significance of Gold

Gold’s value goes back thousands of years. In the early 1970s, one ounce was worth $35. Now, its value has soared, showing it can keep wealth safe over time. It has always been valuable when the economy is down or uncertain.

Gold’s Role in Modern Portfolios

Today, gold acts as a shield against inflation and a safe place to invest. It’s wise to keep gold to 3-6% of your portfolio, based on how much risk you can handle. Gold’s value often goes up when there’s political or economic trouble, making it a smart choice to diversify.

Current Market Trends and Valuations

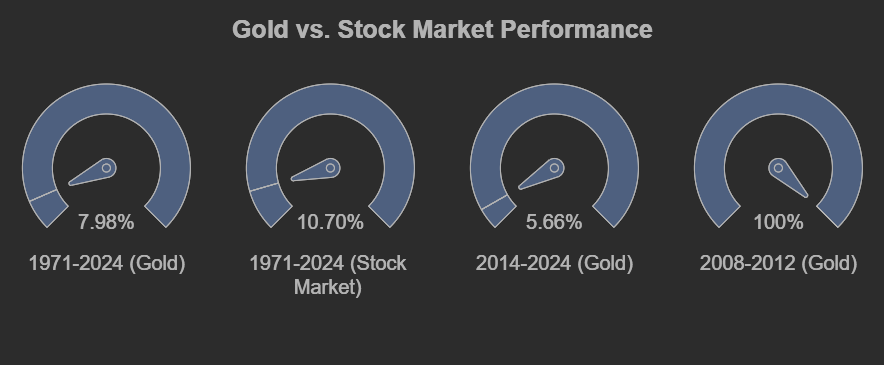

Gold’s market has seen big growth lately. It has risen by about 84% from June 2014 to May 2024. Its growth rate over the last decade was 5.66%, and since 1971, it’s been 7.81%. These changes show gold’s potential as a solid investment.

| Period | Gold Performance | Stock Market Performance |

|---|---|---|

| 1971-2024 | 7.98% average annual return | 10.70% average annual return |

| 2014-2024 | 84% appreciation | Data not provided |

| 2008-2012 (Financial Crisis) | Over 100% price increase | Data not provided |

Knowing these trends can guide investors in adding gold to their plans.

Types of Gold Investments Available

Gold investments come in many forms, each with its own benefits and things to consider. Investors can choose from tangible assets to financial instruments. This gives them many ways to add gold to their portfolios.

Physical Gold Options

Gold bars and coins are favorites for those who want something they can hold. These items are bought at a 1% to 5% premium over the gold’s value. Big gold bars, like those in Fort Knox, can weigh up to 400 troy ounces. They are less liquid and more expensive to trade.

Gold ETFs and Mutual Funds

Gold ETFs, like SPDR Gold Shares ETF (GLD), hold real gold and follow its price. They are easy to trade and have an average annual expense ratio of 0.61%. The VanEck Vectors Gold Miners ETF (GDX) focuses on gold mining stocks. This gives investors a chance to see the industry’s performance.

Gold Mining Stocks

Investing in gold mining companies, such as Newmont Corp. (NEM) or Barrick Gold Corp. (GOLD), can be profitable even when gold prices are flat. These companies work all over the world. This helps spread out their risks across different markets.

Gold IRA Accounts

Gold IRA accounts let investors add precious metals to their retirement savings. These accounts offer tax benefits but need special storage and custodian arrangements. They are a long-term way to invest in gold.

| Investment Type | Key Feature | Consideration |

|---|---|---|

| Gold Bars and Coins | Tangible asset | 1-5% premium over gold value |

| Gold ETFs | Easy to trade | 0.61% average expense ratio |

| Gold Mining Stocks | Global diversification | Company-specific risks |

| Gold IRA Accounts | Tax advantages | Specific storage requirements |

Financial advisors usually recommend not to have more than 10% of your portfolio in gold. This helps keep a balance between potential gains and the risk of your overall portfolio.

Buy Your First Gold Investment

It can be very fulfilling when you buy your first gold investment. Like a sense of accomplishment. Gold prices are near all-time highs as of late March 2024. It’s a great choice for beginners looking to diversify their portfolios.

Determining Your Investment Goals

First, think about what you want to achieve. Are you aiming for long-term growth or quick profits? It’s important to know your risk tolerance. Gold can protect against economic risks, but it may not always beat other investments.

Setting Your Investment Budget

You can start with a small budget for when you buy four first gold investment. You can buy parts of gold ETFs or smaller coins. Costco’s recent gold bar sellout shows the high demand for physical gold.

Choosing the Right Investment Vehicle

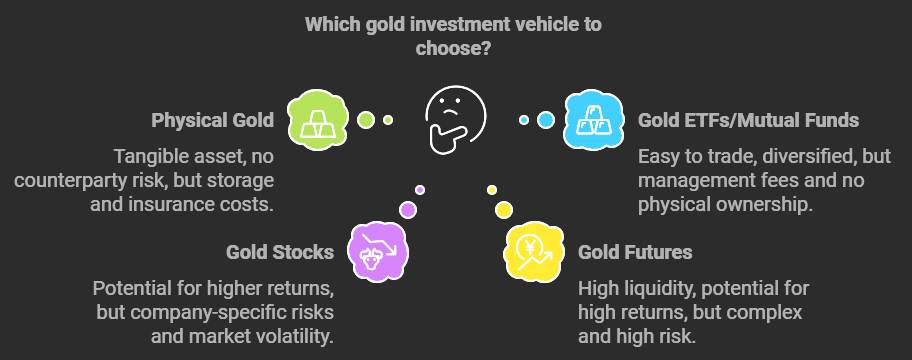

There are many ways to invest in gold:

- Physical gold (bars, coins, jewelry)

- Gold ETFs and mutual funds

- Gold stocks

- Gold futures

Each option has its own advantages and disadvantages. For instance, physical gold requires secure storage, while gold ETFs are easier to buy and sell.

| Investment Type | Pros | Cons |

|---|---|---|

| Physical Gold | Tangible asset | Storage costs |

| Gold ETFs | Easy to trade | Management fees |

| Gold Stocks | Potential dividends | Company-specific risks |

| Gold Futures | High liquidity | High risk |

Pick the option that matches your goals and risk level. Gold investments can diversify your portfolio, reducing risk.

Physical Gold Investment Essentials

Investing in physical gold is a solid way to diversify your portfolio. Gold bars, coins, and bullion are top picks for those looking for stability. They keep their value when other investments drop, making them great for keeping wealth safe over time.

Gold bars range from 1 gram to 400-troy-ounce London Good Delivery Bars. Smaller bars are easier for beginners, while bigger ones are for big investors. Gold coins, like the British Gold Sovereign, offer flexibility in smaller amounts.

When looking at physical gold, purity is very important. Most gold bars are 0.9999 fine, or 24 karats. This high purity means they hold their value well and are easy to sell. Coins usually come in standard sizes: 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz, with some bigger sizes available.

“Gold is a refuge for investors during market volatility and economic uncertainties.”

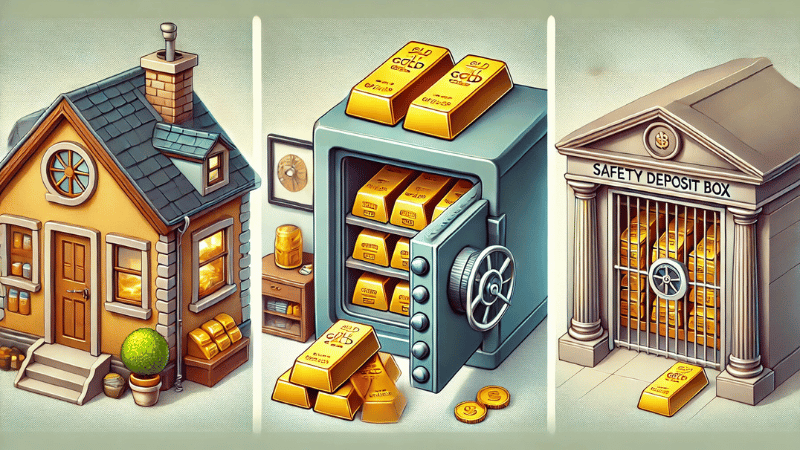

Thinking about where to store and insure your gold is key. You can use home safes, bank boxes, or professional storage. Each option has its own benefits and drawbacks, like security, cost, and how easy it is to get to.

| Investment Type | Pros | Cons |

|---|---|---|

| Gold Bars | Lower premiums, purity assurance | Storage challenges, less divisible |

| Gold Coins | Easy to trade, divisible | Higher premiums, potential counterfeits |

| Gold Bullion | Direct ownership, tangible asset | Storage costs, insurance needs |

Buying investment-grade gold bullion is often tax-free in many places, like the UK and EU. This tax break makes gold even more appealing for long-term investments.

Understanding Gold ETFs and Mutual Funds

Gold exchange-traded funds and gold mutual funds make it easy to buy your first gold investment without physical metal. They are great for both new and seasoned investors. These options are affordable and accessible.

Benefits of Gold ETFs

Gold ETFs mirror gold’s price, making them liquid and easy to trade. In 2024, gold prices hit over $2,700 per ounce, showing their potential. For example, SPDR Gold Shares (GLD) holds physical gold and manages $56.4 billion in assets.

How to Purchase Gold ETFs

Buying gold ETFs is straightforward through brokerage accounts. iShares Gold Trust (IAU) is a top choice with a 0.25% expense ratio and $27.1 billion in assets. VanEck Vectors Gold Miners ETF (GDX) focuses on gold mining, giving you a look into the industry.

Comparing ETFs and Mutual Funds

ETFs generally have lower fees than mutual funds. The average annual fee for gold ETFs is 0.65% per $10,000. Mutual funds might have higher costs but offer active management. Think about these differences when picking between ETFs and mutual funds for your gold investment.

| ETF | Expense Ratio | 2024 YTD Performance | Assets Under Management |

|---|---|---|---|

| SPDR Gold Shares (GLD) | 0.40% | 23.6% | $56.4 billion |

| iShares Gold Trust (IAU) | 0.25% | 23.8% | $27.1 billion |

| VanEck Gold Miners ETF (GDX) | 0.51% | 26.4% | $12.66 billion |

| GraniteShares Gold Trust (BAR) | 0.175% | 23.9% | Not Available |

Buy Your First Gold Investment for Precious Metal IRA Strategies

Gold individual retirement accounts are a smart way to diversify your retirement savings. They let you hold IRA-approved precious metals. Plus, you get tax benefits similar to traditional IRAs.

Traditional vs Roth Gold IRAs

You have two main choices for a gold IRA. Traditional gold IRAs let you deduct contributions from your taxes. Roth gold IRAs offer tax-free withdrawals in retirement. For 2024, you can contribute up to $7,000, with an extra $1,000 if you’re 50 or older.

Setting Up Your Gold IRA

To begin tax-advantaged gold investing, pick a reputable gold IRA company. They’ll guide you in choosing an IRS-approved custodian and picking eligible precious metals. Remember, physical gold in IRAs must meet purity standards and be stored in an approved depository. For more information about setting up your gold-backed IRA click here.

Storage and Custodian Requirements

Gold IRAs have special storage needs. Your precious metals must be kept in an IRS-approved facility, not at home. This adds to costs, as custodial fees are higher due to storage and insurance.

| Gold IRA Feature | Details |

|---|---|

| 2024 Contribution Limit | $7,000 ($8,000 if 50+) |

| Recommended Portfolio Allocation | 5% to 10% |

| Penalty-Free Withdrawals | Age 59½ |

| Required Minimum Distributions | Age 73 |

Gold IRAs have unique benefits but also higher fees and less liquidity than traditional retirement accounts. It’s important to think carefully about your financial goals before investing in a gold IRA.

Risk Management and Portfolio Diversification

Managing gold investments is key to a balanced portfolio. Experts recommend 5-10% of your portfolio for gold. This helps balance risk and returns, especially when markets drop.

Studies show gold can boost returns when stocks are weak. Over 40 years, it has helped protect investments and increase returns in tough times.

| Portfolio Composition | Compound Annual Growth | Risk Reduction |

|---|---|---|

| 60% Stocks, 40% Bonds | 9.8% | Baseline |

| 54% Stocks, 36% Bonds, 10% Gold | 9.7% | Significant |

Gold is great for managing risk. It doesn’t move with stocks and bonds much. Its price tends to go up more than down. This makes it a solid choice for diversifying your portfolio.

In the 2008 crisis, a 10% gold investment in a US portfolio could have saved over $17,000. It also could have raised annual returns by almost 0.7 percentage points.

“Gold acts as investment insurance, smoothing risk and return, and reducing overall losses during market downturns.” GPHub

Choosing the right gold investment is crucial. Gold ETFs are good for beginners because they’re cheap and easy to use. Physical gold is like insurance for big crises. But, stay away from risky investments like mining stocks to keep your portfolio balanced.

Storage and Security Considerations

Keeping your gold safe is very important. With gold prices at record highs in September 2024, finding a secure place to store it is more crucial than ever. Let’s look at your options for protecting your precious metals.

Home Storage Options

Storing gold at home might seem easy, but it’s risky. If you decide to do this, get a high-quality safe. But, storing a lot of gold at home isn’t safe because of security issues. It’s also wise to keep your gold private to lower the chance of theft.

Bank Safety Deposit Boxes

Bank vaults are safer than home storage. They’re a favorite choice for investors. But, you might only be able to get to your gold during bank hours. Also, check if your gold insurance covers items in safety deposit boxes.

Professional Storage Facilities

Third-party vaults offer the best security for your gold. These places often include insurance in their fees. They have advanced security systems and protect your gold 24/7.

| Storage Option | Security Level | Accessibility | Insurance |

|---|---|---|---|

| Home Safe | Low | High | Varies |

| Bank Safety Deposit Box | Medium | Limited | Limited |

| Professional Storage Facility | High | Moderate | Included |

Whichever option you pick, keep detailed records of your gold purchases. It’s smart to regularly check your gold to make sure it’s real. Remember, the right storage is essential to keep your gold’s value over time.

Conclusion: How to Buy your First Gold Investment for Beginners

Investing in gold is great for keeping wealth safe over time and spreading out your investments. Gold’s value has grown a lot, hitting $2,160 per ounce in March 2024. This is an 8% jump from the last record. It shows gold can protect against economic ups and downs.

Gold is key in a diversification strategy. It doesn’t move much with stocks and bonds, which helps lower risk. In the 1970s, gold prices jumped from $35 to $850 per share as interest rates went up.

When looking at gold investment benefits, keep an eye on market trends. Gold prices tend to go up in early January, March, and mid-June to early July. With predictions of gold hitting $3,000 per ounce soon, it might be a good time to look into gold investments. Always talk to a financial advisor to find the best fit for your needs and goals.

FAQ

What are the main types of gold investments available for beginners?

Beginners can invest in physical gold, like bars and coins. They can also choose gold ETFs, gold mining stocks, or gold IRAs. Each option has its own benefits and considerations. It’s important to research and choose the one that best fits your investment goals and risk tolerance.

How much should I invest in gold as a beginner?

Beginners should start small and gradually increase their investment. Many financial advisors suggest allocating 5-10% of your portfolio to gold. You can start with smaller denominations of physical gold or fractional shares of gold ETFs.

What are the advantages of investing in gold ETFs over physical gold?

Gold ETFs offer greater liquidity and lower storage and insurance costs. They are easier to buy and sell. However, ETFs don’t provide the tangible asset that physical gold does, which some investors prefer.

How do I store and insure physical gold investments?

When your ready to buy your first gold investment you can store physical gold in home safes, bank safety deposit boxes, or professional storage facilities. Each option has its pros and cons. For insurance, you can add riders to your homeowner’s policy or opt for specialized precious metals insurance. Professional storage facilities often include insurance in their fees.

What is a Gold IRA, and how does it work?

A Gold IRA is a self-directed Individual Retirement Account that allows you to invest in physical gold and other precious metals with tax advantages. You can choose between traditional and Roth Gold IRAs, each with different tax implications. To set up a Gold IRA, you’ll need to work with a reputable custodian who specializes in precious metals IRAs and arrange for secure storage of your gold assets.

How do gold prices fluctuate, and what factors influence them?

Gold prices can be volatile and are influenced by various factors. Economic conditions, geopolitical events, currency fluctuations, and supply and demand play a role. Factors like interest rates, inflation, and political instability can significantly impact gold prices. It’s important to stay informed about these factors and understand that gold prices can experience both short-term volatility and long-term trends.

Can I invest in gold through my regular brokerage account?

Yes, you can invest in gold through most regular brokerage accounts. You can purchase gold ETFs, mutual funds, or stocks of gold mining companies. These options provide exposure to gold without the need for physical storage and can be easily bought and sold like other securities in your portfolio.

What are the tax implications of investing in gold?

The tax implications of gold investments vary depending on the type of investment and how long you hold it. Physical gold is typically taxed as a collectible, with a maximum long-term capital gains rate of 28%. Gold ETFs and mining stocks are generally taxed like other securities, with rates depending on your holding period and income level. Gold IRAs offer tax advantages, but specific rules apply to distributions and required minimum distributions (RMDs).

How does gold perform during economic crises or high inflation periods?

Gold is often considered a safe-haven asset during economic uncertainties and periods of high inflation. Historically, gold has tended to maintain its value or even increase in price during economic downturns and when inflation erodes the purchasing power of fiat currencies. This is one reason why investors use gold as a hedge against economic instability and inflation.

What’s the difference between investing in gold bullion and gold coins?

Gold bullion typically refers to gold bars or ingots and is valued primarily for its gold content. Gold coins, on the other hand, can have both bullion value (based on gold content) and numismatic value (based on rarity, condition, and collector demand). Bullion is usually a more straightforward investment focused on gold’s intrinsic value, while coins can potentially offer additional value for collectors but may come with higher premiums.