Introduction: The Science Behind a Resilient Portfolio

To build a truly resilient portfolio for 2025, you must understand a fundamental concept: Gold vs. Stocks vs. Bonds correlation. This statistical measure is the bedrock of modern diversification. In a world shaped by the ‘Rio Reset’—where traditional relationships between assets are under strain—a deep dive into correlation is no longer just for professional analysts; it’s essential for every serious investor.

This guide explains in simple terms what correlation is, why gold’s low correlation to stocks and bonds is its most powerful feature, and how this data provides the scientific foundation for a strategic allocation to precious metals.

Gold vs. Stocks vs. Bonds: Understanding Correlation Coefficients

First, let’s demystify the term. A correlation coefficient is simply a number between -1 and +1 that shows how two assets move in relation to each other.

- +1 (Perfect Positive Correlation): The two assets move in perfect lockstep. When one goes up, the other goes up.

- 0 (No Correlation): The movements of the two assets are completely random and unrelated.

- -1 (Perfect Negative Correlation): The two assets move in exact opposition. When one goes up, the other goes down.

For true diversification, the goal is to combine assets with the lowest possible correlation. Holding two assets with a correlation of +1 is not diversification; it’s duplication. The “magic” of risk reduction happens when you combine assets that do not move in the same direction at the same time.

Gold’s Correlation Data: An Interactive Analysis

The data clearly illustrates gold’s unique position in the investment universe. Based on decades of market analysis from institutions like the World Gold Council, the long-term correlation of gold to other major asset classes reveals why it is such a powerful diversifier.

Analysis: Why Gold Zigs When Other Assets Zag

The data is clear, but why does gold behave this way? The reasons are fundamental to its nature as an asset.

- Gold vs. Stocks: Stock prices are fundamentally tied to economic growth and corporate profits. When the economy is strong, companies earn more, and stock prices rise. Gold, conversely, is a monetary asset. Its value is driven by factors like interest rates, currency strength, and investor fear. Because their core drivers are different, they often move independently.

- Gold vs. the U.S. Dollar: This is the most reliable inverse relationship. Gold is priced in U.S. dollars globally. Therefore, when the value of the dollar falls, it takes more dollars to buy one ounce of gold, causing its price to rise. This makes gold a direct hedge against the debasement of the world’s primary reserve currency—a critical feature in the era of the ‘Rio Reset.’

The “Crisis Alpha” Effect

The true power of gold’s low correlation becomes most apparent during a financial crisis. In a market panic, the correlations of most financial assets (like U.S. stocks, international stocks, corporate bonds, and real estate) tend to converge toward +1. In simple terms: everything falls together.

This is when gold often provides “crisis alpha.” Its correlation to stocks can turn sharply negative. As investors sell everything else, they flee to the perceived safety of gold, causing its price to rise while other assets are in freefall. This is not just a theory; it is a pattern observed in 1987, 2008, and 2020. This unique property makes gold less of an investment and more of a form of portfolio insurance.

Frequently Asked Questions (FAQ)

1. Is gold still relevant in 2025 with the rise of Bitcoin and digital assets?

Answer: Yes, gold remains highly relevant as a portfolio diversifier in 2025. While Bitcoin has gained institutional acceptance, gold’s 5,000-year track record provides unmatched stability. Gold’s correlation to traditional assets remains near zero, while Bitcoin often moves with tech stocks during market stress. Many sophisticated investors now hold both: gold for crisis protection and Bitcoin for growth potential. The key difference is gold’s negative correlation during financial panics, while Bitcoin’s correlation to risk assets often increases during crises.

2. How does rising interest rates in 2025 affect gold’s performance in my portfolio?

Answer: Rising interest rates traditionally create headwinds for gold since it doesn’t pay yield. However, gold’s portfolio value isn’t solely about absolute returns—it’s about correlation and risk reduction. Even during rate hike cycles, gold often maintains its diversification benefits. The correlation data shows gold can still provide “crisis alpha” regardless of rate environment. Focus on gold’s role as portfolio insurance rather than a growth investment. A 5-10% allocation can still improve risk-adjusted returns even when rates are rising.

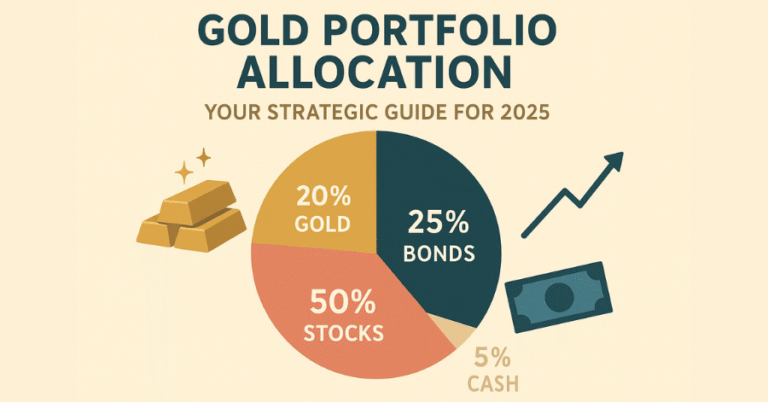

3. What’s the optimal gold allocation percentage for 2025 market conditions?

Answer: Based on Modern Portfolio Theory and current market dynamics, most institutional research suggests 5-10% gold allocation for balanced portfolios. Conservative investors near retirement might consider up to 15%, while aggressive growth investors might limit to 5%. The key is maintaining this allocation through systematic rebalancing. With current geopolitical tensions and currency debasement risks in 2025, even traditionally stock-heavy portfolios benefit from the 5% minimum allocation for tail risk protection.

4. Should I buy physical gold, gold ETFs, or gold mining stocks in 2025?

Answer: Each serves different purposes in portfolio construction:

- Physical Gold: Best correlation benefits, ultimate crisis protection, but storage costs

- Gold ETFs (GLD, IAU): Convenient, liquid, maintains correlation benefits without storage hassles

- Gold Mining Stocks: Higher volatility, correlation closer to general stock market, less effective as diversifier

For pure diversification benefits discussed in the correlation analysis, physical gold or gold ETFs provide the clearest correlation advantages. Mining stocks behave more like cyclical stocks than monetary gold.

5. How does the current inflation environment affect gold’s role in my 2025 portfolio?

Answer: Gold’s relationship with inflation is often misunderstood. While gold can provide some inflation protection over very long periods, its real value lies in currency debasement protection and portfolio diversification. In 2025’s complex inflation environment, gold’s low correlation to stocks and bonds becomes more valuable than its inflation-hedging properties. Think of gold as portfolio insurance against financial system stress rather than a direct inflation hedge. TIPS (Treasury Inflation-Protected Securities) may be better pure inflation hedges.

6. Does ESG investing conflict with holding gold in 2025?

Answer: ESG considerations around gold mining are legitimate concerns for 2025 investors. However, you can address this through:

- Recycled Gold Products: Many dealers offer recycled gold with lower environmental impact

- ESG-Screened Gold ETFs: Some funds focus on responsible mining practices

- Allocation Context: A 5-10% gold allocation for portfolio stability may align with long-term sustainable investing goals

The diversification benefits and financial stability that gold provides can support your overall ESG portfolio by reducing risk and volatility, potentially allowing for more concentrated sustainable investments in other asset classes.

7. How do I implement gold allocation in my existing 401(k) or retirement accounts in 2025?

Answer: Most 401(k) plans don’t offer direct gold investments, but you have several options:

- Gold ETFs: If your plan offers them (GLD, IAU, or gold mining funds)

- Precious Metals Mutual Funds: Broader exposure including silver and platinum

- Self-Directed IRA: Roll over a portion to a self-directed IRA that allows physical gold

- Taxable Account: Hold gold outside retirement accounts for easier access and rebalancing

The correlation benefits work regardless of account type. Start with whatever gold exposure your current plan offers, then consider additional allocation in taxable accounts to reach your target 5-10% allocation across your total portfolio.

Conclusion: The Statistical Case for a Gold Allocation

The data on correlation provides the scientific proof behind a strategic allocation to gold. Its unique ability to move independently of stocks, bonds, and real estate makes it an unparalleled tool for diversification. This isn’t a matter of opinion; it is a statistical reality proven over decades.

This low correlation is the fundamental reason why a 5-10% allocation can improve a portfolio’s risk-adjusted returns. By understanding this data, you can move forward with the confidence that adding gold to your portfolio is a decision grounded in the sound principles of modern portfolio theory.

One Comment