As a gold enthusiast, I’ve always been fascinated by the allure of this precious metal. While panning for nuggets might not be practical in today’s world, I’ve discovered an exciting alternative: investing in gold mining stocks. Join me as we dig into the world of gold mining investments and uncover the potential treasures and pitfalls that await us in this modern-day gold rush.

Unearthing the Basics: What Are Gold Mining Stocks?

When we talk about gold mining stocks, we’re not just referring to shiny metal bars. These stocks represent shares in companies that extract gold from the earth. It’s like owning a piece of the entire mining operation, from the first survey to the final gold pour.

More than Just Gold: The Big Picture

Investing in gold mining stocks is about more than just betting on the price of gold. We’re putting our faith in:

- The company’s management skills

- Their ability to discover new gold deposits

- The efficiency of their mining operations

- And yes, the price of gold itself

Think of it as gold investing on steroids – more exciting, but also riskier. It’s a rollercoaster ride that’s not for the faint of heart, but for those of us who love the thrill, it can be incredibly rewarding.

The Glittering Appeal: Why We Love Gold Mining Stocks

The Power of Leverage: Amplifying Our Gains

One of the most exciting aspects of gold mining stocks is their potential for leverage. When gold prices climb, mining stocks often soar even higher. Imagine this: a 1% increase in gold prices might make mining stocks jump 2-3%. It’s like having a golden megaphone for our investments.

Show Me the Money: The Promise of Dividends

Unlike a gold bar sitting silently in a vault, some gold mining stocks pay dividends. That means extra cash in our pockets just for being shareholders. It’s like the gold mine is sending us a thank-you note in the form of regular payments.

Growth Potential: Striking the Mother Lode

Picture this: a mining company we’ve invested in suddenly discovers a massive new gold deposit. Their stock price could skyrocket overnight, turning our modest investment into a fortune. It’s like being part of a real-life treasure hunt, where X marks the spot on the stock market.

Mergers and Buyouts: The Golden Handshake

In the world of gold mining, bigger fish often swallow smaller ones. If we own shares in a company that gets bought out, we might wake up to a very pleasant surprise in our investment account. It’s like finding an unexpected nugget in our pan.

The Dark Side of the Mine: Risks and Challenges

Buckle Up for a Wild Ride: Volatility Ahead

I’ll be honest with you – gold mining stocks can be as jumpy as a kangaroo on coffee. Their prices swing up and down much more than the price of gold itself. If we get nervous easily, these might not be the right investment for us.

When Things Go Wrong: The Perils of Mining

Mining is tough work, and a lot can go wrong. Mines can flood, workers might go on strike, or expensive equipment can break down. Any of these problems can hurt a company’s profits and send its stock price tumbling. It’s a reminder that we’re not just investing in gold, but in the complex business of extracting it.

The Heartbreak of Empty Mines: When Exploration Fails

Here’s a scenario that keeps gold mining executives up at night: What if a company spends millions looking for gold… and finds nothing? Their stock price could drop faster than we can say “fool’s gold.” It’s a stark reminder that in mining, there are no guarantees.

Political Problems: Navigating Troubled Waters

Many gold mines are located in countries with unstable governments. A new law or change in leadership could spell trouble for mining companies working there. As investors, we need to be aware of these geopolitical risks and how they might impact our investments.

Not-So-Green Reputation: The Environmental Challenge

Let’s face it – digging huge holes in the ground isn’t great for the environment. Bad publicity about a mine’s environmental impact can hurt a company’s stock price. As responsible investors, we need to consider the environmental practices of the companies we invest in.

Types of Gold Mining Stocks: Choosing Our Adventure

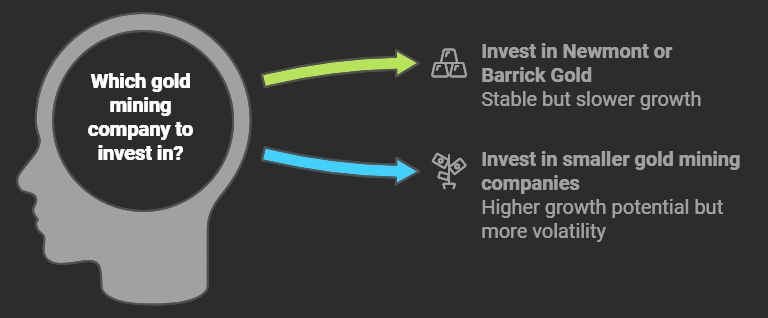

The Big Players: Giants of the Industry

Companies like Newmont and Barrick Gold are the behemoths of the gold mining world. They’re more stable but might not grow as fast as smaller companies. Investing in these giants is like boarding a large ship – the ride might be smoother, but don’t expect any sudden changes in direction.

Mid-Size Miners: The Golden Middle

Firms like Yamana Gold and Kinross Gold occupy the middle ground. They offer a mix of stability and growth potential. It’s like finding a balance between the safety of the big players and the excitement of the smaller ones.

The Little Guys: High Risk, High Reward

Junior mining companies are the small fry of the industry, often focusing on finding new gold deposits. They’re super risky, but if they strike gold, their stocks could soar. Investing in these companies is like buying a lottery ticket – the odds are long, but the payoff could be massive.

The Smart Money: Streaming and Royalty Companies

Here’s an interesting twist: companies like Franco-Nevada don’t mine gold. Instead, they finance mining projects in exchange for a share of the gold or profits. It’s a clever way to invest in gold mining with potentially less risk. Think of it as being the bank in a gold rush rather than the prospector.

How to Invest in Gold Mining Stocks: Your Path to Potential Profits

- Open a brokerage account (if you haven’t already)

- Do your homework – read about the companies and their mines

- Decide how much risk you’re comfortable with

- Spread your investments around – don’t put all your eggs in one basket

- Keep an eye on gold prices and stay informed about the mining industry

Remember, knowledge is power in the world of gold mining stocks. The more we learn, the better equipped we’ll be to make informed decisions.

Gold Mining Stocks vs. Physical Gold: Which Glitters More?

Let’s break it down:

Gold Mining Stocks:

- Pros: More potential for big gains, possible dividends

- Cons: Riskier, affected by company-specific problems

Physical Gold:

- Pros: You actually own the gold, no company risk

- Cons: No dividends, storage can be a hassle

The best choice depends on what we want from our investment and how much risk we can handle. Some investors like to have a mix of both for diversification.

The Golden Checklist: Important Factors to Consider

Want to sound like a pro when discussing gold mining investments? Pay attention to these key factors:

- Reserves and Resources: How much gold does the company have in the ground?

- Production Costs: Lower costs mean higher profits when gold prices rise

- Production Growth: Are they mining more gold each year?

- Debt Levels: Too much debt can be dangerous in the volatile mining industry

- Exploration Budget: Are they actively looking for new gold deposits?

- Political Risk: Where are their mines located, and how stable are those regions?

By keeping these factors in mind, we can make more informed decisions about which gold mining stocks might be worth our investment.

Gold Mining ETFs: The Easy Way to Strike Gold

If picking individual stocks seems too daunting, we can invest in a bunch of gold mining companies at once with an ETF (Exchange-Traded Fund). Some popular options include:

- VanEck Vectors Gold Miners ETF (GDX)

- VanEck Vectors Junior Gold Miners ETF (GDXJ)

- Sprott Gold Miners ETF (SGDM)

These ETFs offer instant diversification within the gold mining sector, making them an attractive option for those of us who want exposure to the industry without the hassle of researching individual companies.

Going Green: The Future of Gold Mining

The mining industry has long had a reputation for environmental damage, but things are changing. As responsible investors, we should be aware of these shifts:

- Some companies are focusing on sustainable mining practices

- Investors are increasingly demanding better environmental performance

- New technologies are helping to reduce the environmental impact of mining

Looking for mining companies that prioritize environmental responsibility isn’t just good for the planet – it might be a smart investment move as regulations tighten and consumers become more environmentally conscious.

How Much Should We Invest in Gold Mining Stocks?

There’s no one-size-fits-all answer, but some experts suggest allocating 5-10% of our investment portfolio to gold-related investments. Gold mining stocks might be a part of that allocation. Remember, it’s crucial to maintain a diversified portfolio and not put too much of our nest egg in one basket, no matter how shiny it might be.

The Future of Gold Mining: What’s Next on the Horizon?

The gold mining industry is constantly evolving. Here are some trends to watch:

- Increased use of automation and robotics in mines

- Exploration in more challenging and remote locations

- Growing focus on “ethical gold” that’s mined responsibly

- Potential consolidation as larger companies acquire smaller ones

- Development of new extraction technologies

Keeping an eye on these trends could help us make more informed investment decisions as the industry continues to evolve.

Should We Invest in Gold Mining Stocks?

Before we rush to stake our claim in the world of gold mining stocks, let’s ask ourselves:

- Can we handle significant swings in stock prices?

- Do we believe in the long-term value of gold?

- Are we willing to learn about and stay informed on the mining industry?

- Can we avoid panic selling when prices inevitably drop?

If we answered yes to these questions, gold mining stocks might be a good fit for our investment strategy. But let’s always remember:

- It’s a bumpy ride, so buckle up

- Research is crucial – don’t skimp on due diligence

- Never invest more than we can afford to lose

- Stay informed about gold prices and mining operations

The Final Nugget: Wrapping Up Our Golden Adventure

Investing in gold mining stocks can be an exhilarating journey. It’s like being part of a modern-day gold rush, but from the comfort of our homes. However, it’s not for everyone. These stocks can be as unpredictable as a prospector’s luck, swinging from dizzying highs to gut-wrenching lows.

If we decide to take the plunge into the world of gold mining stocks, let’s remember to:

- Diversify our investments

- Learn about the companies we’re investing in

- Keep a close eye on gold prices and mining news

- Be patient – success in mining often takes time

With careful research, a bit of luck, and a healthy dose of patience, gold mining stocks could add some serious sparkle to our investment portfolio. Just don’t forget your metaphorical hard hat – this investment journey can get bumpy!

Remember, while we’re enthusiastic about gold mining stocks, we’re not financial advisors. Always do your own research and consider seeking professional advice before making any investment decisions. Happy prospecting, fellow gold enthusiasts!

7 Comments