Key Takeaways

- Leverage Effect: Gold mining stocks can amplify gold price movements 2-3x, offering higher returns but greater volatility

- Risk vs. Reward: Mining stocks provide dividends and growth potential but carry operational, political, and geological risks physical gold doesn’t

- Company Types Matter: Major producers offer stability, mid-tier balanced growth, juniors high speculation, royalty companies lower risk

- Due Diligence Essential: Research AISC costs, reserves, management quality, and geographic risks before investing

- Diversification Strategy: Consider ETFs for instant diversification or combine physical gold with mining stocks for balanced exposure

- Not for Everyone: Requires higher risk tolerance and active monitoring compared to passive gold ownership

Read Our Comprehensive Article About How to Buy Your First Gold Investment

Read Our Comprehensive Article About How to Buy Your First Gold Investment

A Complete Investment Guide

For investors seeking to capitalize on the enduring value of gold, an exciting alternative to physical bullion exists: Gold Mining Stocks. While holding bullion offers direct ownership, investing in the companies that extract gold from the earth provides a dynamic, leveraged approach to the precious metals market. This guide explores the world of gold mining investments, detailing the significant opportunities and inherent risks that define this modern-day gold rush.

Unearthing the Basics: What Are Gold Mining Stocks?

Gold mining stocks represent ownership shares in publicly traded companies engaged in the exploration, development, and operation of gold mines. An investment in these stocks is not a direct investment in the commodity itself, but rather in the operational success and profitability of the mining enterprise.

More than Just Gold: A Multi-faceted Investment

The performance of gold mining stocks is influenced by a confluence of factors beyond the spot price of gold. Investors are placing capital behind:

- The company’s management expertise and strategic decisions.

- The geological success of its exploration programs in discovering new, economically viable gold deposits.

- The efficiency and cost-effectiveness of its mining and processing operations.

- The underlying price of gold, which dictates the company’s revenue.

This creates a leveraged play on the gold market that introduces both higher potential rewards and increased risks compared to holding bullion. It is a volatile sector that demands careful due diligence from investors.

The Allure of Gold Mining Stocks: Key Advantages

The Power of Leverage: Amplifying Gains

One of the primary attractions of gold mining stocks is the potential for operational leverage. Because mining companies have fixed operating costs, a rise in the price of gold can lead to a disproportionately larger increase in their profits and, consequently, their stock price. For example, a 10% increase in the gold price can often result in a 20-30% or greater increase in the share price of a well-run mining company during a bull market.

Leverage in Action: Gold vs. Miners (Illustrative Example, Q4 2024 – Q1 2025)

⚡ Leverage in Action: Gold vs. Miners

(Illustrative Example, Q4 2024 – Q1 2025)

LEVERAGE

Potential for Dividends and Growth

Unlike physical bullion, which generates no income, many established gold mining stocks offer dividends to shareholders. These regular payments can provide a consistent return stream, even during periods of flat gold prices. Furthermore, mining stocks offer growth potential independent of the gold price. A major new discovery or a successful mine expansion can lead to significant stock appreciation, offering returns that physical gold cannot match. Mergers and acquisitions are also common in the sector, which can result in buyouts at a premium for shareholders.

Risks and Challenges Inherent to Gold Mining Stocks

Navigating Market Volatility

Investors must understand that gold mining stocks exhibit significant volatility. Their prices often experience much larger swings, both up and down, than the price of gold itself. This heightened volatility requires a strong risk tolerance from investors.

Operational and Geopolitical Risks

Mining is an operationally intensive business fraught with potential challenges. Mine floods, labor strikes, equipment failures, and unexpected geological issues can all negatively impact a company’s production and profitability, leading to a decline in its stock price. Furthermore, many of the world’s most significant gold deposits are in politically unstable regions. A sudden change in mining laws, tax regimes, or government leadership can pose a severe risk to a company’s assets and operations.

Exploration and Environmental Factors

Exploration is a high-risk endeavor. Mining companies can spend hundreds of millions of dollars searching for new deposits with no guarantee of success. A failed exploration program can lead to significant financial losses and a collapse in stock value. Additionally, the mining industry faces increasing scrutiny over its environmental and social governance (ESG) practices. Negative publicity or regulatory action related to environmental damage can harm a company’s reputation and stock performance.

Types of Gold Mining Stocks: A Tiered Approach

Major Producers: The Industry Giants

Companies like Newmont (NEM) and Barrick Gold (GOLD) are the largest players in the industry. They operate multiple mines across diverse geographic locations, offering greater stability and lower risk compared to smaller miners. While their growth potential may be more moderate, they often provide reliable dividends and are more resilient to operational setbacks at a single mine.

Mid-Tier Producers: A Balance of Growth and Stability

Firms like Kinross Gold (KGC) and B2Gold Corp (BTG) represent the middle ground. These companies typically operate one or several mines and have established production records but are still focused on growth. They can offer a compelling balance of the stability found in major producers and the higher growth potential of smaller companies.

Junior Miners: High-Risk Exploration Plays

Junior mining companies are typically non-producing firms focused on exploration. They are highly speculative investments. While the vast majority fail to discover an economically viable deposit, a successful discovery can result in life-changing returns for early investors. These stocks are akin to venture capital and are only suitable for investors with a very high tolerance for risk.

Read Our Article A1 Guide to Junior Gold Mining Investments

Read Our Article A1 Guide to Junior Gold Mining Investments

Streaming and Royalty Companies: A Smarter Way to Invest

An alternative business model is offered by streaming and royalty companies, such as Franco-Nevada (FNV). These firms do not operate mines. Instead, they provide upfront financing to mining companies in exchange for the right to purchase a percentage of the future gold production at a deeply discounted price (a “stream”) or receive a percentage of the mine’s revenue (a “royalty”). This model provides exposure to gold production with significantly less exposure to the operational and capital risks of mining, making it a popular choice for risk-averse investors.

How to Invest in Gold Mining Stocks

Investing in gold mining stocks can be done through a standard brokerage account. The process involves:

- Opening a Brokerage Account: Choose a reputable online broker that provides access to the stock exchanges where mining companies are listed (e.g., NYSE, NASDAQ, TSX).

- Conducting Due Diligence: Thoroughly research any company before investing. Read their annual reports, investor presentations, and financial statements. Analyze their mine portfolio, production costs, debt levels, and management team.

- Diversifying Your Holdings: Avoid concentrating your capital in a single stock. Consider a mix of major, mid-tier, and potentially royalty companies to spread risk. Alternatively, invest in a Gold Miners ETF.

- Monitoring Your Investments: Stay informed about the gold price, industry news, and company-specific announcements to manage your portfolio effectively.

Gold Mining Stocks vs. Physical Gold: Which Is Right for You?

- Gold Mining Stocks: Offer higher potential returns through leverage and dividends but come with significant company-specific and operational risks.

- Physical Gold: Provides direct ownership and a hedge against systemic financial risk with zero counterparty risk but offers no income and requires secure storage.

The optimal choice depends on an investor’s goals and risk tolerance. Many sophisticated investors choose a combination of both, using physical gold as a core, long-term safety holding and mining stocks as a satellite allocation for growth potential.

Gold Mining ETFs: Instant Diversification

For investors who find picking individual stocks too complex, ETFs (Exchange-Traded Funds) offer a simple solution. These funds hold a basket of gold mining stocks, providing instant diversification across the sector. Popular options include:

- VanEck Gold Miners ETF (GDX): Invests in major gold mining companies.

- VanEck Junior Gold Miners ETF (GDXJ): Focuses on smaller, mid-tier and junior mining companies.

- Sprott Gold Miners ETF (SGDM): Uses a factor-based strategy to select its holdings.

❓ Frequently Asked Questions

Q: Are gold mining stocks better than physical gold?

A: Neither is inherently “better” – it depends on your goals. Mining stocks offer leverage and dividends but carry more risk. Physical gold provides direct ownership and crisis protection but no income. Many investors use both.

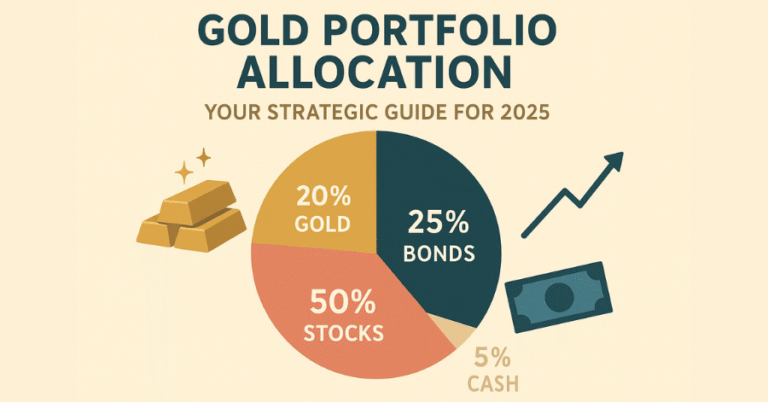

Q: How much should I allocate to gold mining stocks?

A: Most financial advisors suggest 5-10% of a portfolio for precious metals exposure total, with mining stocks being a subset of that allocation based on your risk tolerance.

Q: What’s the most important metric to evaluate mining companies?

A: All-In Sustaining Costs (AISC) per ounce is critical – it shows the true cost of production. Companies with AISC below current gold prices are profitable.

Q: Should beginners invest in individual mining stocks or ETFs?

A: ETFs like GDX are generally better for beginners as they provide instant diversification and professional management, reducing single-company risk.

Q: Do mining stocks always move with gold prices?

A: Not always. While there’s typically correlation, mining stocks can be affected by company-specific issues, operational problems, or broader stock market sentiment independent of gold prices.

Q: What’s the difference between reserves and resources?

A: Reserves are proven, economically extractable gold deposits. Resources are estimated deposits that may become reserves with further development. Reserves are more valuable and reliable.

Q: Are junior mining stocks worth the risk?

A: Only for experienced, high-risk-tolerance investors. Most juniors fail, but successful discoveries can generate enormous returns. Never invest more than you can afford to lose completely.

Q: How do I research a mining company’s political risk?

A: Check the Fraser Institute’s mining jurisdiction rankings, review the company’s geographic diversification, and research the political stability and mining laws of countries where they operate.

Conclusion: Should You Invest in Gold Mining Stocks?

Investing in gold mining stocks can be a highly rewarding venture, but it is not without significant risk. These equities offer a leveraged play on the price of gold that can lead to substantial gains, yet they are also subject to a host of operational, geological, and political risks that do not affect physical bullion.

Investors who possess a higher risk tolerance, are willing to conduct thorough due diligence, and believe in the long-term value of gold may find that mining stocks are a suitable component of a diversified precious metals allocation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investments carry risk. Always conduct your own research and consider consulting with a qualified financial advisor before making any investment decisions.

9 Comments