Key Takeaway

Corrections Are Normal, Strategy is Key: After a strong run, a short-term gold market correction (a dip of 10% or more) in 2025 is possible, likely triggered by unexpected interest rate hikes or easing geopolitical tensions. However, historical data and ongoing central bank buying reinforce gold’s long-term role as a vital hedge against inflation and uncertainty, making any potential dip a strategic consideration rather than a reason for panic.

Introduction To Gold Market Corrections

Gold. It’s that shiny metal everyone talks about, especially when things get a little shaky in the world. We saw gold prices climb close to record highs in early 2025, which is exciting, but it also makes you wonder: is there an Gold Market Corrections 2025 coming? Let’s dive into what that means for your investments.

Gold had a pretty impressive run in 2024, gaining about 13-15%, based on year-end reports from primary financial data sources, the World Gold Council. It’s often seen as a safe-haven asset, a place to park your money when there’s uncertainty swirling around the global economy or political landscape. This article will break down potential corrections in the gold market for 2025, what could trigger them, and how you can navigate these ups and downs.

To Get More Information about Gold’s Gains Reported by the WGC: Gold’s 2024 performance best in 14 years – World Gold Council

Key Drivers of Gold Prices in 2025

Several factors can push gold prices up or down. Think of them as the behind-the-scenes players influencing the gold market.

Geopolitical Tensions

Remember all the talk about trade disputes between the US and China, the ongoing Russia-Ukraine conflict, and instability in the Middle East? These kinds of geopolitical risks continue to fuel demand for gold. When things get tense globally, people often flock to gold as a safe haven. We’re even seeing central banks in places like Asia and Eastern Europe increasing their gold reserves to help stabilize their economies.

Federal Reserve Policies and Interest Rates

The Federal Reserve, the central bank of the United States, plays a big role. Their monetary policy, especially interest rates, has a significant impact on gold prices. Currently, the Fed’s stance is somewhat supportive of gold demand. However, any unexpected interest rate hikes could trigger a correction. So, keep a close eye on what the Fed is saying and doing. It’s crucial to understand the interest rate impact on gold.

Global Economic Conditions

The strength of the US dollar, inflation trends, and how China’s economy is doing are all important. A stronger dollar can actually make gold less attractive, while inflationary pressures tend to support gold demand. For example, if China’s stimulus measures boost their industrial activity, that could also increase demand for precious metals like gold.

Understanding Gold Market Corrections

Let’s talk about what a market correction actually is.

What is a Market Correction?

A correction is basically a temporary dip in price, usually a decline of 10% or more from recent highs. Gold has seen corrections before, especially during past geopolitical crises or when central banks tighten monetary policy.

Factors That Could Trigger a Gold Market Corrections 2025

Several things could trigger a correction in the gold market. Rising interest rates can make gold less appealing because it doesn’t generate interest income like some other investments. If things calm down on the geopolitical front, the demand for safe-haven assets like gold might decrease. Also, if gold prices have been really high for a while, some investors might decide to take their profits, which can also lead to a price drop.

Historical Performance of Gold During Corrections

Looking at the past can give us some clues about the future.

Lessons from Past Corrections

Remember the gold price drop in 2013? It fell by a hefty 28% due to rising interest rates and reduced quantitative easing (basically, when the Fed was pumping less money into the economy). Looking at that event can help us understand what might happen in 2025, but it’s important to remember that every situation is unique.

Current Trends and Technical Analysis

Technical indicators, which are tools that analysts use to predict price movements, suggest we might see a short-term pullback in gold prices before they potentially resume an upward trend. Some analysts are even projecting gold prices could reach $3,000-$3,300 by the end of 2025, despite any short-term volatility.

Read Our Comprehensive Article About Gold Markets & Prices.

Global Events Shaping Gold’s Trajectory

Two more important factors are at play.

Central Bank Buying

Central banks, particularly in Asia and Eastern Europe, continue to purchase gold. This ongoing trend helps support long-term price stability.

Central banks, particularly in Asia and Eastern Europe, continue to purchase gold. This ongoing trend helps support long-term price stability.

Supply Chain Disruptions

The lingering effects of US-China trade tensions and the Russia-Ukraine conflict continue to impact global supply chains. These disruptions can affect both industrial demand and investor sentiment.

Solution-Based Outlook for Investors

So, what can you do as an investor?

Strategies to Navigate Gold Market Corrections 2025

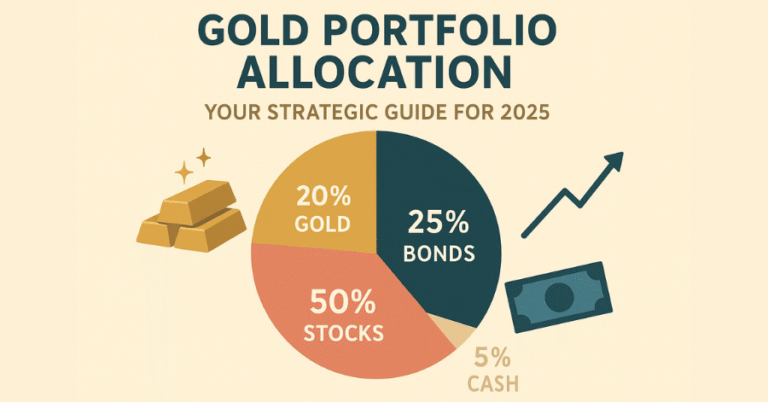

One smart move is to  diversify your portfolio. Don’t put all your eggs in one basket. Consider other safe-haven assets like bonds or real estate. Another strategy is dollar-cost averaging, which means if you plan to invest $1,200 in gold over a year, you would invest $100 each month, buying more when the price is low and less when it’s high. This can help smooth out the impact of price fluctuations. And, of course, stay informed! Keep up with geopolitical developments and what central banks are doing.

diversify your portfolio. Don’t put all your eggs in one basket. Consider other safe-haven assets like bonds or real estate. Another strategy is dollar-cost averaging, which means if you plan to invest $1,200 in gold over a year, you would invest $100 each month, buying more when the price is low and less when it’s high. This can help smooth out the impact of price fluctuations. And, of course, stay informed! Keep up with geopolitical developments and what central banks are doing.

Long-Term Perspective on Gold Investments

Even with potential corrections, gold has consistently proven to be a reliable hedge against inflation and currency devaluation. Historically, it has delivered attractive long-term returns, appreciating approximately 8% annually over the past two decades, according to J.P. Morgan Private Bank.

Shaokai Fan, Global Head of Central Banks at the World Gold Council, has emphasized gold’s enduring appeal during times of geopolitical and economic uncertainty. In 2024, he noted that “global gold demand has set new quarterly highs and annual total records,” driven by strong central bank purchases amidst rising geopolitical risks.

Gold’s role as a safe-haven asset continues to make it an essential component of a diversified investment portfolio, particularly during periods of market stress or inflationary spikes. While short-term volatility is possible, its long-term performance underscores its value as a strategic asset.

FAQ Navigating the Gold Market: Your Questions Answered

This FAQ section is designed to answer the immediate questions a reader might have after finishing the article, filling in crucial gaps.

Q1: What is the difference between a market correction and a bear market for gold?

A market correction is generally defined as a short-term price decline of 10-20% from a recent high. It’s often seen as a healthy, temporary event within a larger long-term uptrend. A bear market is a more severe and sustained downturn, typically defined as a price drop of 20% or more over a prolonged period. The article discusses the potential for a correction, not a full-blown bear market.

Q2: The article mentions interest rates. Why do they affect gold so much?

Gold does not pay interest or dividends. When interest rates rise, interest-bearing assets like government bonds and high-yield savings accounts become more attractive to investors seeking income. This can cause some money to flow out of non-yielding assets like gold, putting downward pressure on its price. Conversely, when interest rates are low or falling, gold becomes more appealing.

Q3: Is it a bad sign if some investors are “taking profits”?

Profit-taking is a normal and healthy part of any market cycle. After an asset like gold has experienced a strong price increase, some short-term investors will sell to lock in their gains. This can trigger a small correction, which in turn can create a more attractive entry point for long-term investors who believe in gold’s fundamental value.

Q4: How does a strong U.S. Dollar affect the price of gold?

Gold is priced in U.S. dollars globally. When the dollar strengthens against other currencies, it takes fewer dollars to buy an ounce of gold, which can cause the dollar price of gold to fall. Additionally, a stronger dollar makes gold more expensive for investors holding other currencies, which can reduce international demand.

Q5: Given the risk of a correction, is gold still a good long-term investment?

Most financial strategists agree that gold’s primary role in a portfolio is not for short-term gains but as a long-term strategic hedge. As the article notes, it has historically proven to be a reliable store of value that protects against inflation and currency devaluation. The potential for short-term corrections does not change its fundamental, long-term purpose as a diversification tool and a form of financial insurance.

Conclusion: Staying Informed and Prepared

Let’s recap. We talked about the key drivers of gold prices in 2025, including geopolitical tensions, Fed policies, and global economic conditions. We’ve explored what a market correction is and the factors that could trigger one. We also looked at past corrections and current trends. Finally, we discussed strategies for navigating these market fluctuations and the long-term perspective on gold investments.

The most important thing is to stay informed and prepared. Keep up with global events and economic policies so you can make smart investment decisions. The gold market can be volatile, but by understanding the key factors at play, you can better position yourself for success. Remember, this isn’t financial advice, so it’s always a good idea to talk to a financial advisor before making any investment decisions.