Are you confident your retirement savings can weather the storm? With market uncertainty and inflation on the rise, choosing between a Gold IRA vs. Traditional IRA could be the most crucial financial decision you’ll make.

Traditional IRAs offer familiar tax advantages and investment flexibility, but Gold IRAs provide a unique safeguard against economic instability. In this guide, we’ll break down the pros, cons, and key differences to help you decide which path secures your future.

Key Takeaways

- Gold IRAs let you add physical precious metals to your retirement savings, which might protect against market ups and downs.

- Traditional IRAs give you tax breaks, helping your savings grow over time.

- Gold IRAs and Traditional IRAs have different rules for how much you can put in, when you can take it out, and where it’s stored. It’s important to know these details.

- Thinking about how much risk you can handle, how long you can wait for your money, and what you want for your future is key in picking the right retirement account.

- Talking to a financial advisor who knows what they’re doing can help you understand the complex stuff and make a choice that fits your retirement dreams.

Understanding the Fundamentals of Retirement Accounts

Retirement investing is key to financial planning. Knowing about different retirement accounts is the first step to a secure future. The traditional IRA and gold IRA are two popular choices, each with its own benefits and considerations.

Basic Structure of IRAs

Individual Retirement Accounts (IRAs) are special accounts for saving and investing in retirement. They let your investments grow without taxes, making them great for retirement investing.

Key Features of Retirement Accounts

Retirement accounts, like traditional IRAs and gold IRAs, have important features. These features make them good for tax-advantaged savings:

- Tax-deferred growth of investments

- Potential for tax-deductible contributions

- Flexibility in investment options, including stocks, bonds, and precious metals

- Penalties for early withdrawals to encourage long-term savings

IRA Contribution Limits and Guidelines

The IRS sets limits on how much you can contribute to traditional IRAs and other retirement accounts. Knowing the traditional ira pros and cons is key for planning your retirement savings.

- Traditional IRA contribution limits for 2023: $6,000 ($7,000 if you’re age 50 or older)

- Income limits for deductible contributions may apply based on your filing status and income level

- Contributions can be made until the tax filing deadline (typically April 15)

Learning about retirement accounts helps you choose the right one. Whether it’s a traditional IRA or a gold IRA, it should fit your retirement investing goals and financial situation.

Gold vs Traditional IRA: Core Differences Explained

Choosing between a gold IRA and a traditional IRA can greatly affect your retirement. These options have different benefits and things to consider. It’s important to understand these differences.

A traditional IRA lets you invest in many things like stocks and bonds. But, a gold IRA focuses on physical metals like gold and silver. This makes a gold IRA a good way to diversify your investments and protect against market ups and downs.

The risk level is another big difference. Traditional IRAs can be risky because of the stock market. On the other hand, gold IRAs offer a stable asset that can keep its value over time. This can help protect your savings during tough economic times.

Both traditional IRAs and gold IRAs have tax benefits. But, the details can vary. It’s key to know the specifics of each to choose wisely based on your financial goals and how much risk you’re willing to take.

In the end, picking between a gold IRA and a traditional IRA depends on your investment style and retirement plans. By understanding the main differences, you can make a choice that helps secure a good retirement for yourself.

Benefits and Features of Traditional IRAs

Traditional IRAs are a great choice for retirement planning. They offer tax benefits and a wide range of investment options. These accounts can be a key part of your financial plan.

Tax Advantages of Traditional IRAs

One big plus of Traditional IRAs is tax-deferred growth. You can deduct contributions from your taxable income. This can save you a lot of money, especially if you’re in a high tax bracket.

Also, the money in your IRA grows without being taxed. This means your savings can grow faster over time.

Investment Options Available

Traditional IRAs let you invest in many things. You can choose from stocks, bonds, mutual funds, ETFs, and even REITs. This lets you create a portfolio that fits your risk level and goals.

Whether you like to manage your investments yourself or work with a financial advisor, a Traditional IRA can work for you.

Distribution Rules and Requirements

There are rules for taking money out of a Traditional IRA. You can start taking distributions at 59 1/2 without penalty. But, taking money out early can cost you 10% in penalties, with some exceptions.

It’s key to know the traditional ira withdrawal rules to avoid big tax bills.

Choosing between a traditional ira vs roth ira depends on your financial situation and goals. Understanding the tax implications of gold ira vs traditional ira helps you make the best choice for your retirement.

Exploring Gold IRA Investment Options

Investing in physical gold for retirement is exciting. A gold-backed retirement account, or gold and silver IRA, is a great choice. It lets you diversify your portfolio with precious metals. This can protect your investments from market ups and downs and inflation.

A gold IRA lets you hold gold, silver, platinum, and palladium in your retirement account. This adds stability and security to your investment plan. Precious metals often keep their value when the economy is down.

Eligible Gold IRA Assets

In a gold-backed retirement account, you can pick from many assets. These include:

- Gold, silver, platinum, and palladium bullion and coins

- Certain IRS-approved gold, silver, platinum, and palladium bars and rounds

- Precious metal ETFs and mutual funds

Working with a qualified custodian is key. They help make sure your physical gold investment is managed right in your gold and silver IRA.

“At Gold Prosperity Hub, we believe that investing in a Gold IRA can be a powerful way to diversify your retirement portfolio and potentially mitigate the impact of market volatility.” GPHub

Adding physical gold investment to your retirement plan can be smart. It uses the special qualities of precious metals. These can help protect against inflation and economic uncertainty.

Risk Assessment and Portfolio Diversification Strategies

Securing your retirement means understanding risks and diversifying your savings. Whether you choose a traditional IRA or a gold IRA, knowing about market risks and how to plan for the long term is key. This knowledge helps you make smart choices.

Market Volatility Considerations

The financial markets can change quickly, affecting your retirement savings. By diversifying your retirement portfolio, you can hedge against inflation and protect your assets. This strategy adds stability and security to your investments for the future.

Asset Allocation Techniques

Effective asset allocation is vital for asset protection strategies. By spreading your investments across different types, like stocks, bonds, and gold, you create a balanced portfolio. This balance makes your investments less vulnerable to market swings.

- Diversify your investments to minimize risk exposure.

- Allocate a portion of your portfolio to alternative assets, like gold, to provide a hedge against inflation.

- Regularly review and adjust your asset allocation to align with your financial goals and risk tolerance.

Long-term Investment Planning

Retirement planning is a long-term journey. Your investment strategy should reflect this. A patient and disciplined approach to managing your portfolio helps you navigate market ups and downs. This keeps you focused on your long-term financial goals.

“Successful investing is about managing risk, not avoiding it.”

A diversified portfolio, including traditional and alternative assets like gold, can help you deal with market uncertainties. It ensures your retirement savings are safe for the long term.

Tax Implications and Regulatory Requirements

Understanding the tax implications and rules of your retirement savings is key. Choosing between a traditional IRA and a gold IRA can affect your taxes a lot. You should think about these tax effects carefully.

A big difference between traditional IRAs and gold IRAs is their tax treatment. You can deduct contributions to a traditional IRA, which lowers your taxable income. But, you’ll have to pay taxes on withdrawals. Gold IRA contributions aren’t deductible, but withdrawals might be tax-free.

A gold IRA is also self-directed Individual Retirement Account, which means you can diversify your portfolio with physical gold and silver. This flexibility requires you to follow extra regulatory requirements. You’ll need to work with a custodian and make sure your investments meet IRS rules.

The tax implications and rules of your retirement account are very important for your financial future. Knowing the details of each option helps you choose wisely. This choice should match your investment goals and how much risk you’re willing to take.

Storage, Custodian, and Management Considerations

Setting up a gold IRA involves important details like storage, custodian selection, and management. These aspects greatly affect your gold IRA investment experience and success.

Custodian Selection Process

Choosing the right custodian is key for a gold IRA. Unlike a traditional IRA, a gold IRA custodian does more. They ensure your metals are stored safely and follow all rules.

When looking at gold IRA companies, check their custodian services, storage, and fees. A good custodian offers valuable help and support for your gold IRA.

Storage Facility Requirements

Where your precious metals are stored is crucial for a gold IRA. IRS rules say they must be in an approved depository. This means a secure, insured, and audited place.

- Choose depositories with segregated storage to keep your metals apart from others.

- Make sure the storage meets high security standards, like 24/7 watch, strong access, and fire protection.

- Think about the storage’s location, as it can affect how easy it is to get to and its safety.

Annual Maintenance Fees

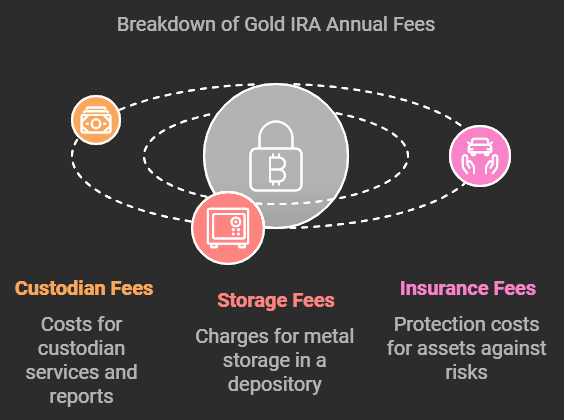

Having a gold IRA means paying annual fees for custodian services and metal storage. These fees differ based on the gold IRA company, custodian, and storage needs.

When comparing gold IRA companies, know what the annual fees cover. This includes:

- Custodian Fees: The costs for the custodian’s work and reports.

- Storage Fees: The price for keeping your metals safe in a depository.

- Insurance Fees: The cost to protect your gold IRA assets from theft, loss, or damage.

By looking at these details, you can choose wisely and manage your gold IRA well.

Making Your Decision: Factors to Consider

Choosing between a Gold IRA and a Traditional IRA requires careful thought. It’s important to consider how each option fits into your retirement plan. Whether a gold IRA is better than a traditional IRA or how a gold IRA compares to a traditional IRA, several key factors can guide your choice.

Your risk tolerance is a key factor. Gold IRAs are seen as a safer choice, protecting against market ups and downs. On the other hand, Traditional IRAs offer a broader range of investments, fitting a riskier portfolio better.

Think about your investment goals and time horizon. A Gold IRA is great for long-term stability and wealth preservation. But, if you’re looking for growth, a Traditional IRA might be more suitable.

Your personal finances and tax situation also matter. The tax benefits of a Traditional IRA are attractive if you’ll be in a lower tax bracket in retirement. Meanwhile, a Gold IRA offers special tax-deferral perks.

“Ultimately, the decision between investing in a gold IRA or sticking with a traditional IRA comes down to your individual circumstances, risk tolerance, and long-term financial goals.”

By weighing these factors, you can make a choice that matches your retirement dreams. This will help secure your financial future.

Conclusion

This guide has shown you the key differences between a Gold IRA vs Traditional IRA. A Traditional IRA gives you tax benefits and many investment choices. On the other hand, a Gold IRA is great for keeping wealth safe over time with gold investments.

Choosing between these IRAs depends on your financial goals, how much risk you can take, and what you like in investments. Knowing about long-term wealth preservation, retirement savings in gold, and gold IRA investment strategies helps you make a smart choice. This choice should match your financial goals for the future.

Whether you choose a Gold IRA for stability or a Traditional IRA for tax benefits, it’s important to manage your retirement savings well. By carefully considering your options and getting advice from experts, you can make sure your retirement savings are ready for whatever the future brings.

Ready to Take the Next Step?

Choosing between a Gold IRA and a Traditional IRA is a crucial decision for your retirement future. Consult a trusted financial advisor to tailor the right strategy for your goals.

Looking to dive deeper? Explore our related content on retirement planning and gold investments for expert insights and actionable tips. [Read More Here]

FAQ

What is the difference between a Gold IRA vs Traditional IRA?

A Gold IRA lets you invest in real precious metals like gold and silver. A Traditional IRA, on the other hand, focuses on stocks, bonds, and mutual funds.

What are the benefits of a Gold IRA?

A Gold IRA can protect your money from inflation. It also helps diversify your retirement savings. Plus, it keeps your wealth safe with physical metals.

What are the benefits of a Traditional IRA?

Traditional IRAs grow your money without taxes until you withdraw it. They offer many investment choices and often have lower fees than Gold IRAs.

Which IRA is better for my retirement planning?

Choosing the right IRA depends on your goals and risk level. Mixing traditional and alternative assets, like metals, is often wise.

What are the tax implications of a Gold IRA vs. a Traditional IRA?

Traditional IRAs might let you deduct contributions upfront. They grow tax-free until you take the money out. Gold IRAs don’t offer this deduction but can grow tax-free too.

How do I set up a Gold IRA?

To start a Gold IRA, pick a custodian and open an account. Then, move money from another retirement account. Finally, buy eligible metals from a dealer.

What are the storage and maintenance requirements for a Gold IRA?

Gold IRAs need metals stored in an approved place. This costs an annual fee. Your custodian will handle the storage and safety of your metals.

Can I hold both a Gold IRA and a Traditional IRA?

Yes, you can have both a Gold IRA and a Traditional IRA. This diversifies your portfolio and can benefit from each IRA’s unique features.

2 Comments