Hey there, fellow gold enthusiasts! Today, we’re diving deep into the glittering world of gold futures. Now, before we start, remember: we’re not professionals, just passionate gold bugs sharing our knowledge. Always do your due diligence and seek professional advice when it comes to investing. That said, let’s embark on this golden journey together!

What Are Gold Futures?

Gold futures are like a crystal ball for gold prices, but with a twist. They’re contracts that let you buy or sell gold at a set price on a future date. It’s as if you’re making a bet on what gold will be worth down the road. Cool, right?

But here’s the kicker: you don’t actually have to handle any real gold. It’s all about the promise of gold. This makes gold futures a fascinating way to play the gold market without needing a Fort Knox in your basement.

Why People Love Gold Futures: A1 Guide to the Golden Attraction

Leverage: Big Moves with Less Money

One of the biggest reasons traders flock to gold futures is leverage. It’s like having a golden superpower. With gold futures, you can control a large amount of gold without putting down a ton of cash upfront. Small price changes can lead to big profits – but watch out, because they can also mean big losses.

Let’s break it down with an example:

Imagine a gold futures contract for 100 ounces of gold. The current price is $1,800 per ounce, making the contract worth $180,000. But here’s the magic: you might only need to put down 10% as margin, which is $18,000.

If gold prices rise by just 1% to $1,818 per ounce, your contract is now worth $181,800. That’s a $1,800 profit on your $18,000 investment – a 10% return! But remember, if prices fall by 1%, you’d lose $1,800, which is also 10% of your initial margin.

Different brokers have different margin requirements, usually ranging from 5% to 15%. Always check with your broker for the exact details.

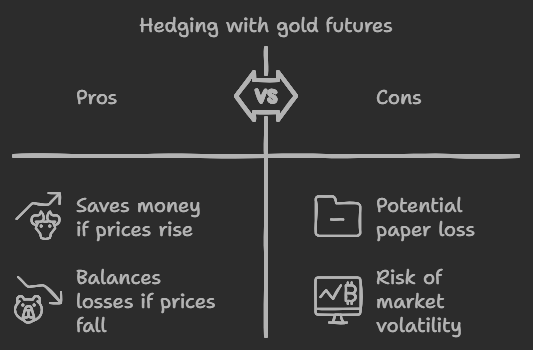

Hedging: Playing It Safe

Gold miners and jewelry makers use futures to lock in prices. It’s like buying insurance for gold prices. This way, they know exactly what they’ll pay or receive for gold in the future.

Here’s how it might work:

- A jewelry maker expects to need 1,000 ounces of gold in six months. They’re worried prices might rise.

- They buy gold futures contracts for 1,000 ounces at the current price of $1,800 per ounce.

- If gold prices rise to $2,000 per ounce in six months, they’ve saved $200,000!

- If prices fall to $1,600, they’ve lost $200,000 on paper, but their actual gold costs less, balancing it out.

Speculation: Betting on Gold’s Future

Think gold prices are going up? Buy futures! Think they’re going down? Sell futures! It’s a way for traders to make money based on what they think will happen to gold prices. It’s like being a gold price psychic, but with real money on the line.

No Storage Needed

Unlike buying physical gold, you don’t need a safe or vault to store futures contracts. All you need is a trading account and some courage. No need to worry about gold thieves or finding space for your treasure hoard!

The Nitty-Gritty: How Gold Futures Work: An Enthusiast’s Guide

Look, I’ve been fascinated by gold trading for over a decade now, and I keep seeing the same questions pop up in forums and social media: “What exactly are gold futures?” and “Should I trade futures or stick to physical gold?” After years of experience (and yes, some hard-learned lessons), I want to break this down for you in plain English.

The Basics: What You’re Actually Trading

Let me tell you something that blew my mind when I first started: when you’re trading gold futures, you’re dealing with contracts for 100 troy ounces of gold. That’s a lot of gold! Each contract is standardized, which means everyone’s playing with the same building blocks. The prices you’ll see are always in U.S. dollars and cents per troy ounce, making it easier to track what’s happening.

Here’s what really matters: prices move in $0.10 increments, which we call “ticks.” Each tick means a $10 change in your contract value. Trust me, those ticks can add up fast, for better or worse!

The Nitty-Gritty Details You Need to Know

Let me break down the specifications that took me way too long to figure out when I started:

Trading Hours

The market runs almost 24/7, which was a game-changer for me. You can trade from Sunday to Friday, 6:00 PM to 5:00 PM Eastern Time. There’s a one-hour break daily starting at 5:00 PM ET, which I’ve learned to use for quick strategy adjustments.

Contract Months

Here’s something crucial: futures contracts expire. You’ll typically see contracts available for:

- February

- April

- June

- August

- December

Most traders (myself included) close positions before expiration. Taking actual delivery of gold? That’s rare and usually not what you want unless you’re running a jewelry business!

The Real Talk: Futures vs. Physical Gold

After years of handling both, here’s my honest take on the pros and cons:

Gold Futures Advantages

- You can control a lot of gold with less money (that’s leverage)

- No need to worry about storage or security

- Easy to short if you think prices are heading down

- Super liquid – you can get in and out quickly

Gold Futures Challenges

- The complexity can be overwhelming at first

- Contracts expire (I learned this the hard way)

- Leverage can work against you – losses can pile up fast

Physical Gold Benefits

- You actually own it (I love being able to hold my gold)

- No expiration dates to worry about

- Simple to understand

- Great for long-term holding

Physical Gold Drawbacks

- Storage can be a pain (and expensive)

- Insurance costs add up

- Harder to sell quickly when you need to

- No leverage options

Smart Money Moves: What I’ve Learned

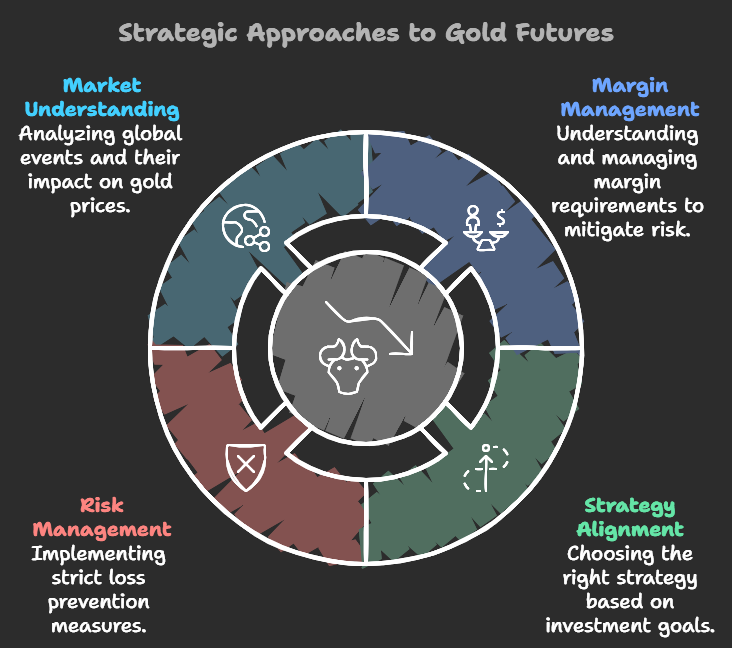

After years in this space, here are some crucial insights:

- Margin Matters: With futures, you only need to put up a fraction of the contract’s value. This is powerful but dangerous – make sure you understand your margin requirements.

- Strategy Alignment: Ask yourself why you want gold exposure. If it’s for long-term wealth preservation, physical gold might be your best bet. If you’re more interested in trading price movements, futures could be your game.

- Risk Management: Never trade futures without a solid plan for managing losses. I set strict stop-losses and position sizes based on my total trading capital.

- Market Understanding: Keep an eye on global events, currency movements, and central bank actions. Gold futures react quickly to these factors.

Bottom Line

Here’s what it comes down to: gold futures are a powerful tool, but they’re not for everyone. If you’re new to this space, start small and maybe even paper trade first. I’ve seen too many people jump in with both feet and get burned.

Remember, whether you choose futures or physical gold, the key is understanding what you’re getting into. Don’t be afraid to ask questions in forums or seek out mentorship – the gold trading community is generally pretty helpful.

Disclaimer: This comes from my personal experience as a gold enthusiast. Always do your own research and consider consulting with financial professionals before making investment decisions.

Who’s Who in the Gold Futures World

Speculators: The Risk-Takers

These are the traders looking to make quick profits from price movements. They’re in it for the thrill and the potential gains. They’re the adrenaline junkies of the gold world!

Hedgers: The Cautious Ones

Miners, jewelers, and manufacturers use futures to protect themselves from price changes. It’s all about managing risk. They’re the ones wearing golden seatbelts!

Big Players: ETFs and Funds

Many gold ETFs use futures to track gold prices. So even if you’re not trading futures directly, you might be involved through your investments. It’s like being part of a gold futures club without even knowing it!

Factors That Make Gold Futures Prices Shimmer and Shake

Economic Indicators

Things like inflation, GDP, and employment numbers can all impact gold prices. When the economy is uncertain, gold often becomes more valuable. It’s like gold is the popular kid during economic recess!

Geopolitical Events

Wars, elections, and trade disputes can all make gold prices move. When the world gets crazy, gold often shines. It’s the calm in the storm of global events.

Currency Movements

The value of the U.S. dollar has a big impact on gold prices. When the dollar is weak, gold often gets stronger. It’s like they’re on a financial seesaw!

The Risks: When Gold Futures Lose Their Shine

Leverage: A Double-Edged Sword

Remember how leverage can lead to big profits? Well, it can also lead to big losses. A small move against you can hurt your wallet in a big way. It’s like riding a golden roller coaster – thrilling, but potentially nauseating!

Liquidity Risk: Getting Stuck

Some contracts are easier to buy and sell than others. If you can’t find someone to take the other side of your trade, you might get stuck in a position you don’t want. It’s like being at a gold-themed dance where no one wants to be your partner!

Execution Risk: Slipping Up

In fast-moving markets, you might not get the exact price you want. This difference is called slippage, and it can eat into your profits. It’s like trying to catch a golden fish with your bare hands – slippery!

Getting Started with Gold Futures Trading: Your A1 Guide

- Choose a Broker: Look for a reputable broker with good customer service and a user-friendly platform. Some popular choices include Interactive Brokers, TD Ameritrade, and E*TRADE.

- Open an Account: You’ll need to provide personal information and proof of identity. Some brokers may require a minimum deposit.

- Fund Your Account: Transfer money into your trading account. Remember, you’ll need enough to cover initial margin requirements.

- Learn the Platform: Most brokers offer demo accounts. Use these to practice without risking real money.

- Start Small: When you’re ready for real trading, start with just one contract. You can always scale up later.

Gold Futures Trading Strategies: Your A1 Toolbox

- Scalping: Making many small trades throughout the day, aiming for small profits each time.

- Day Trading: Opening and closing positions within the same trading day.

- Swing Trading: Holding positions for several days or weeks to catch larger price movements.

- Spread Trading: Simultaneously buying and selling related futures contracts to profit from price differences.

Remember, each strategy has its own risks and rewards. It’s like choosing between different types of golden shovels for your treasure hunt!

Risk Management: Keeping Your Gold Safe

- Stop-Loss Orders: Automatically close your position if prices move against you by a certain amount.

- Position Sizing: Never risk more than a small percentage of your account on any single trade.

- Diversification: Don’t put all your eggs in one golden basket. Trade other markets or invest in different assets too.

- Education: Continuously learn about the market and improve your skills. Knowledge is golden power!

The Future of Gold Futures: What’s Next in Our A1 Guide?

The world of gold futures is always changing. Here’s what might be coming:

- More electronic trading

- Smaller contracts for regular investors

- New rules and regulations

- New types of products

- More connections between global markets

It’s an exciting time to be in gold futures!

Wrapping It Up: Is Gold Futures Trading Right for You?

Trading gold futures can be thrilling and potentially profitable. It’s a great way to bet on where you think gold prices are heading. But it’s not for everyone. It’s complex, risky, and can lead to big losses if you’re not careful.

If you decide to give it a try, make sure you’re well-educated, start small, and always manage your risk. Remember, in the world of gold futures, what glitters isn’t always gold – sometimes it’s the red in your trading account!

Whether you decide to trade gold futures or not, understanding how they work can help you better understand the global economy and financial markets. So even if you never place a trade, the knowledge you’ve gained is valuable.

Now that you’re armed with this golden knowledge from our A1 Guide to Trading Tomorrow’s Gold, you can decide if gold futures trading is right for you. Just remember to trade wisely and never risk more than you can afford to lose. Happy trading, and may your future be as bright as gold!t for you. Just remember to trade wisely and never risk more than you can afford to lose. Happy trading!

One Comment