For more information about reading gold charts: Click Here

For more information about reading gold charts: Click Here

Why Gold Candlestick Charts Analysis Rules Gold Trading

Introduction To Gold Candlestick Charts

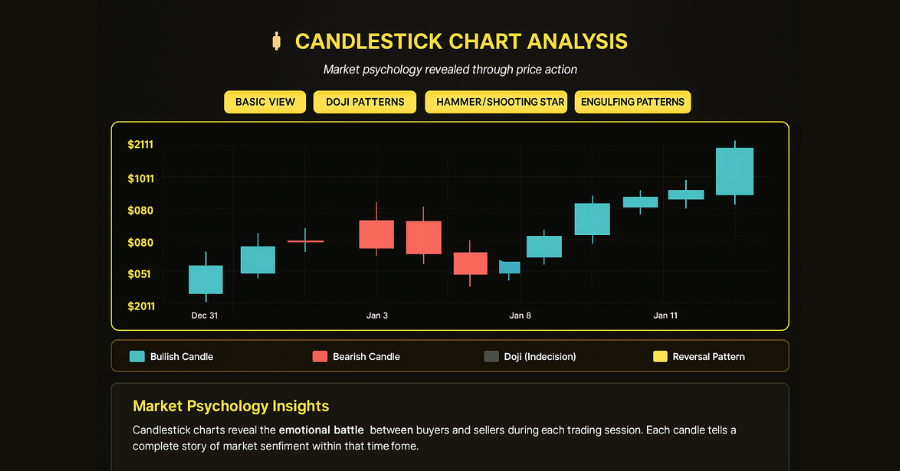

To begin with, Gold Candlestick Charts reveal the emotional battle between gold buyers and sellers during each trading session.

The Reveal

Every candle tells a complete story of market sentiment, making them essential for tactical gold trading decisions.

Candlestick charts are one of the most powerful tools in technical analysis. Each “candle” represents a complete trading period (day, hour, etc.) and shows four crucial pieces of information:

🔵 Open: The starting price when trading began

🔴 Close: The final price when trading ended

⬆️ High: The highest price reached during the period

⬇️ Low: The lowest price reached during the period

The body of the candle shows the difference between open and close, while the wicks (thin lines) show the high and low extremes.

🟢 Bullish Candles (Green/Blue):

• Close price is HIGHER than open price

• Shows buyers were in control

• Indicates upward pressure

• Often colored green or blue

🔴 Bearish Candles (Red):

• Close price is LOWER than open price

• Shows sellers were in control

• Indicates downward pressure

• Usually colored red

The longer the body, the stronger the sentiment!

🕯️ Doji Pattern:

• Open and close prices are nearly equal

• Shows market indecision

• Often signals potential reversals

🔨 Hammer Pattern:

• Small body with long lower wick

• Shows rejection of lower prices

• Bullish reversal signal

⚡ Engulfing Pattern:

• One candle completely “engulfs” the previous

• Shows strong momentum shift

• Powerful reversal signal

Every candlestick tells a story about the battle between buyers and sellers:

🧠 Long Wicks: Show extreme emotions (fear/greed) that pushed prices to extremes but couldn’t be sustained

📏 Body Size: Indicates the strength of conviction. Large bodies show strong sentiment, small bodies show uncertainty

🔄 Pattern Context: The same pattern can have different meanings depending on where it appears in a trend

Remember: Candlesticks reveal not just what happened to prices, but WHY it happened psychologically!

📈 Interactive Chart Analysis

Explore different patterns and timeframes

Next Steps:

Complete all tutorial steps, score 80% or higher on the quiz, and finish 3 exercises to unlock the Expert Trader badge!

Master These Essential Gold Candlestick Charts Patterns

Doji Patterns – Market Indecision

What it shows: Opening and closing prices nearly equal

Psychology: Bulls and bears in perfect balance

Trading signal: Potential reversal after strong trends

Gold context: Often appears at major support/resistance levels

Hammer Patterns – Reversal Signals

Formation: Long lower wick, small body at top

Psychology: Sellers pushed the price down, but buyers regained control

Trading signal: Bullish reversal at support levels

Gold application: Common at key psychological price levels ($2000, $1900)

Engulfing Patterns – Momentum Shifts

Bullish engulfing: Large green candle engulfs previous red candle

Psychology: Complete sentiment reversal

Trading signal: Strong trend continuation or reversal

Volume: Must be confirmed with above-average volume

Interactive Learning Features

Pattern Recognition: Automatic pattern detection

Psychology Insights: Understand trader emotions

Success Rates: Historical pattern performance

Volume Analysis: Confirmation indicators

Gold Candlestick Charts: Reading Gold Market Psychology

Bullish Signals

Long green bodies: Strong buying conviction

Small wicks: Limited selling pressure

Increasing volume: Institutional participation

Bearish Warnings

Long red bodies: Heavy selling pressure

Upper wicks: Rejection of higher prices

Volume spikes: Distribution activity

Bearish Warnings

Long red bodies: Heavy selling pressure

Upper wicks: Rejection of higher prices

Volume spikes: Distribution activity

Advanced Candlestick Strategies

Multiple Timeframe Analysis

– Use daily candles for trend direction

– Apply hourly candles for precise entries

– Weekly candles for portfolio allocation

Pattern Combinations

– Look for multiple patterns confirming signals

– Combine with support/resistance levels

– Wait for volume confirmation

Risk Management

– Place stops below hammer lows

– Exit positions on bearish engulfing patterns

– Use position sizing based on pattern reliability

Gold-Specific Candlestick Insights

Asian Session: Often shows range-bound candlesticks with small bodies

London/NY Overlap: Higher volatility creates longer wicks

News Events: Doji patterns are common before major economic announcements

Start exploring the interactive candlestick chart above to see how these patterns play out in real gold price action. Notice how volume often validates or invalidates pattern signals.