Key Takeaways

IRS-Approved Depository is Mandatory: IRS regulations strictly prohibit storing Gold IRA metals at home. To maintain your IRA’s tax-advantaged status, you must use a secure, third-party depository.

Vet for Security and Insurance: The most critical factors when evaluating a depository are its security protocols (like 24/7 monitoring and vault class) and its insurance policy. Look for comprehensive, “all-risk” coverage that protects the full value of your assets.

Reputable Providers Simplify the Process: Trusted Gold IRA companies like Birch Gold streamline this decision by partnering with a pre-vetted selection of top-tier, fully insured depositories, such as the Delaware Depository and Brink’s Global Services.

Read our Gold IRAs and Retirement Planning

Introduction: Where You Store Your Gold Matters as Much as Owning It

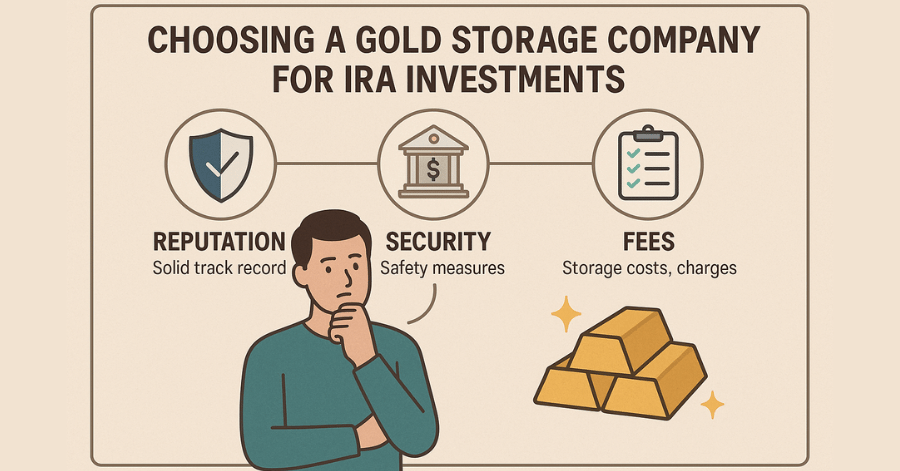

In an economic landscape increasingly shaped by the  ‘Rio Reset’ and de-dollarization trends, investors are turning to physical gold as a primary shield for their retirement savings. However, owning gold within an IRA is only half the battle. Choosing a Gold Storage Company for IRA Investments, a critical, often overlooked question follows: Where is my physical gold actually stored? In an unstable world, the physical security and regulatory compliance of your tangible assets are paramount.

‘Rio Reset’ and de-dollarization trends, investors are turning to physical gold as a primary shield for their retirement savings. However, owning gold within an IRA is only half the battle. Choosing a Gold Storage Company for IRA Investments, a critical, often overlooked question follows: Where is my physical gold actually stored? In an unstable world, the physical security and regulatory compliance of your tangible assets are paramount.

Choosing a Gold Storage Company for IRA Investments is not an administrative detail; it is a crucial decision that safeguards your investment’s value and its tax-advantaged status. This guide provides a definitive checklist to help you vet and select an IRS-approved depository, ensuring your path to wealth preservation is built on a foundation of solid steel.

Your 7-Point Depository Due Diligence Checklist

Choosing the right depository isn’t just about finding a vault; it’s about verifying its security, insurance, and integrity. Use this checklist to vet any potential storage partner for your Gold IRA.

7-Point Depository Due Diligence Checklist

Essential checkpoints for securing your Gold IRA storage

IRS Approval & Compliance

Mandatory third-party storage at IRS-approved depositories. Home storage is a prohibited transaction with severe tax penalties.

Security Protocols

Multi-layered protection with 24/7 monitoring, armed security, Class 3 vaults, and biometric access controls.

Comprehensive Insurance

Substantial “all-risk” coverage through specialized underwriters like Lloyd’s of London for theft, damage, and loss protection.

Reputation & Track Record

Established institutions with decades of precious metals industry experience and positive reputation among professionals.

Transparent Fee Structure

Clear, easy-to-understand annual fee schedule. Either flat rate or percentage-based pricing with no hidden costs.

Storage Options

Segregated: Private vault space for your specific items

Commingled: Cost-effective shared storage with precise tracking

Logistics & Accessibility

Clear procedures for metal receipt, auditing, visitation appointments, and in-kind distributions with proper security protocols.

Birch Gold’s Trusted Depository Partners

Birch Gold Group simplifies the storage decision by partnering with a select group of the most reputable and secure IRS-approved depositories in the nation. This ensures that clients’ assets are protected by industry-leading security and insurance. Key partners include:

- Delaware Depository: With over 200 years of combined experience, Delaware Depository is a cornerstone of the precious metals industry. It offers exceptional security, segregated and commingled storage options, and a comprehensive $1 billion all-risk insurance policy. With locations in Wilmington, Delaware, and Boulder City, Nevada, it provides geographic diversification.

- Brink’s Global Services: As a world leader in secure logistics, Brink’s has unparalleled brand recognition and trust. Their high-security vaults, located in Los Angeles, Salt Lake City, and New York City, are equipped with state-of-the-art protection and are backed by their global security network.

- Texas Precious Metals Depository: Located in Shiner, Texas, this facility offers highly secure, fully segregated storage at competitive rates. They provide detailed auditing and are insured by Lloyd’s of London, making them a favorite among investors seeking private, individualized storage.

- International Depository Services (IDS): With locations in Texas and Delaware, IDS provides another top-tier option for secure, compliant storage. They are known for their security-first approach, utilizing Class 3 vaults and 24/7 monitoring.

Working with a company like Birch Gold ensures your precious metals are stored at a facility that has already been thoroughly vetted for security, insurance, and IRS compliance.

“Get a Free Info Kit from Birch Gold That Includes a Full List of Approved Depositories”

Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you follow a link and make a purchase, we may earn a commission at no additional cost to you. We only recommend partners we thoroughly research and trust.

Conclusion: The Final Step in Securing Your Assets

In the quest of choosing a Gold Storage Company for IRA Investments against the backdrop of the ‘Rio Reset,’ owning physical gold is a powerful first step. However, ensuring that gold is stored in a secure, insured, and IRS-compliant depository is the crucial final step that makes the strategy viable. By performing thorough due diligence and selecting a trusted depository partner, you can have complete confidence that your tangible wealth is truly safe for the years to come.

Frequently Asked Questions (FAQ)

Q1: What is the difference between a custodian and a depository?

A: The  custodian is the IRS-approved financial institution that manages the IRA paperwork, handles transactions, and ensures tax compliance (e.g., Equity Trust). The depository is the physical, high-security vault where the actual gold bars and coins are stored (e.g., Delaware Depository). They are separate entities that work together.

custodian is the IRS-approved financial institution that manages the IRA paperwork, handles transactions, and ensures tax compliance (e.g., Equity Trust). The depository is the physical, high-security vault where the actual gold bars and coins are stored (e.g., Delaware Depository). They are separate entities that work together.

Q2: Is my gold insured when stored in a depository?

A: Yes. A key service provided by IRS-approved depositories is comprehensive insurance that covers the full market value of your holdings against theft, damage, and other losses. Top depositories carry policies for up to $1 billion.

Q3: Can I visit my precious metals in the depository?

A: Yes, most depositories partnered with Birch Gold Group offer visitation privileges. You must schedule an appointment through your custodian, and you will be escorted by staff at all times for security reasons.

Q4: What is the typical annual cost for gold storage?

A: Annual storage fees typically range from $100 to $300, depending on the depository and whether you choose commingled or segregated storage. For a detailed breakdown, please see our guide to fees.

Q5: Why is home storage of IRA gold not allowed?

A: The IRS considers taking personal possession of your IRA assets a “prohibited transaction.” Doing so is treated as a full taxable distribution of your IRA, which would trigger income taxes and a potential 10% early withdrawal penalty.

One Comment

Comments are closed.