Central Bank Gold Buying: The Modern Surge, New Rules of Money

Key Takeaway A surge in gold buying by central banks marks a major shift in the global financial system. This is…

Gold Markets and Prices

Welcome to our Gold Markets and Prices category, your essential guide to understanding the complex and dynamic world of gold trading and valuation. This section explores the key factors driving gold prices and how they influence global markets, from economic trends to geopolitical events. Our goal is to equip you with the insights you need to make informed decisions in the gold market.

Gold prices are affected by numerous factors, including economic indicators, inflation, interest rates, and supply and demand. Additionally, political events and global tensions can play a significant role in price fluctuations. Understanding these elements is crucial for anyone looking to invest in or trade gold.

For those new to gold investing, interpreting price charts is a valuable skill. Our beginner’s guide explains essential chart patterns, indicators, and analytical tools that can help you recognize trends and make educated predictions about future price movements.

Decisions made by the Federal Reserve have a substantial impact on gold prices. When the Fed adjusts interest rates or implements quantitative easing, it often creates ripple effects in the gold market. Here, we delve into why these policies matter and how investors can respond.

Understanding the difference between gold’s spot and futures prices is essential for traders and investors alike. Each price has unique implications for trading strategies, and this section clarifies how they impact the overall market.

Did you know that certain times of the year are more favorable for buying gold? Gold price seasonality is a fascinating trend that can help you make more strategic purchases. This section discusses seasonal patterns, highlighting times when gold may be more affordable.

Gold has long been a “haven” asset during political instability. From trade tensions to military conflicts, global events can drive significant changes in the gold market. Here, we examine recent geopolitical events and their effects on gold prices.

The Gold Markets and Prices category is designed to be a comprehensive resource for anyone interested in understanding gold’s role in the economy. By exploring each topic in detail, we provide a clear path to help you navigate the complexities of the gold market, whether you’re a beginner or an experienced investor.

Key Takeaway A surge in gold buying by central banks marks a major shift in the global financial system. This is…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

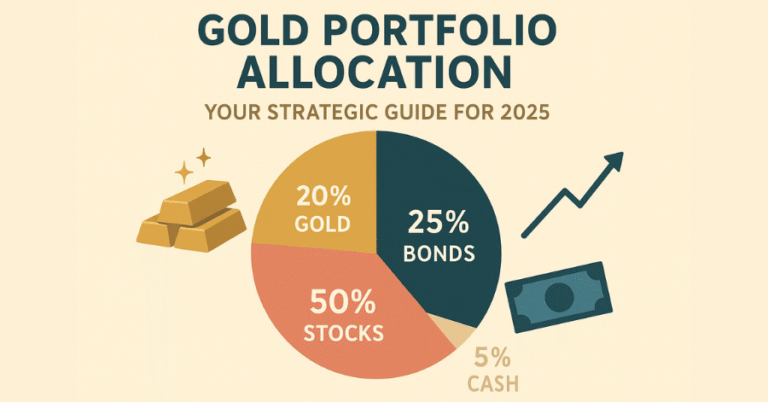

Key Takaways: Gold Allocation Percentage Why Gold Allocation Matters in 2025: The ‘Rio Reset’ and Your Retirement The global economic order…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Introduction: The Science Behind a Resilient Portfolio To build a truly resilient portfolio for 2025, you must understand a fundamental concept:…

Key Takeaways Read our Main Article: How to Invest in Gold: The Definitive Guide for 2025 Introduction How To Buy Your…

Key Takeaways 🏅 Physical Gold 📊 Gold ETFs ⛏️ Gold Mining Stocks 🎯 Bottom Line 💡 Decision Framework Introduction: Physical Gold…

Key Takeaways: You don’t own gold in unallocated accounts—you’re an unsecured creditor holding only a paper promise. Rehypothecation risks mean institutions…

Key Takeaways: Finding Your Strategic Gold Portfolio Percentage • The 5-10% rule is outdated for 2025 – Traditional advice of 5-10%…