Currency Shifts & Geopolitical Impact: New World Order Post-Rio

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Your blog category

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

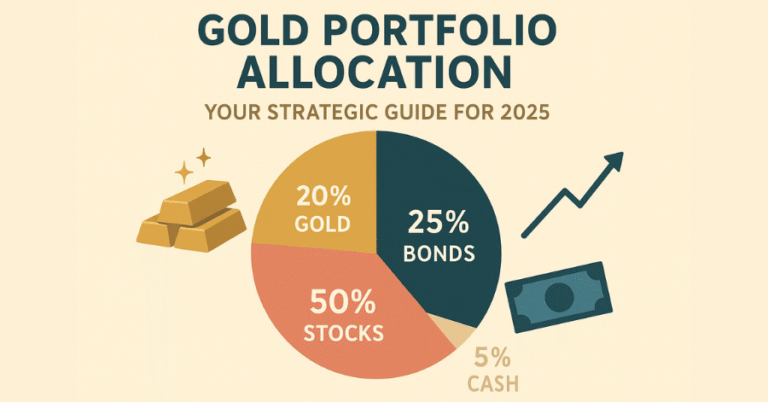

Key Takaways: Gold Allocation Percentage Why Gold Allocation Matters in 2025: The ‘Rio Reset’ and Your Retirement The global economic order…

Key Takeaways: A Signal for Retirement Savers: The reasons central banks buy gold (safety, diversification, inflation protection) are the same reasons…

Key Takeaways Read Our Comprehensive Article About Investing In Gold The Definitive Guide for 2025 Why Gold ETFs Matter in 2025’s…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Key Takeaways A 2025 Guide to Assets, Fees, and Your Retirement Are you confident your retirement savings can weather the coming…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Key Takeaways Read our Main Article: How to Invest in Gold: The Definitive Guide for 2025 Introduction How To Buy Your…

Key Takeaways: Affiliate Disclosure: To support our mission of providing valuable financial analysis, this page may contain affiliate links. If you…

Key Takeaways IRS-Approved Depository is Mandatory: IRS regulations strictly prohibit storing Gold IRA metals at home. To maintain your IRA’s tax-advantaged…