Key Takeaways: Junior Gold Mining Investments

- High Risk/Reward: Similar to tech startups, junior miners offer potential for significant returns.

- Gold Leverage: Typically provide 2-3x exposure to gold price movements.

- Portfolio Diversification: Low correlation with traditional markets enhances risk management.

Unlocking Portfolio Growth Potential

Junior gold mining investments offer high-reward opportunities. Some stocks have outpaced tech startups with 300%+ returns. Ready to tap into this gold rush? While many investors focus solely on blue-chip stocks and bonds, a select group of savvy investors has been quietly capitalizing on one of the market’s most explosive sectors. In 2023 alone, several junior mining stocks delivered returns exceeding 200%, yet most portfolios remain unexposed to this dynamic market segment.

Smart Investment Strategy

Start Small:

- Allocate 2-5% of your portfolio.

- Use ETFs (like GDXJ) for initial exposure.

- Diversify across 5-10 stocks for risk management.

Focus on Quality:

- Strong management and healthy financials.

- Projects in politically stable regions.

- Clear timelines for exploration and development.

Watch for Red Flags:

- High cash burn or funding needs.

- Over-reliance on a single project.

- Operations in politically unstable regions.

Action Steps

- Research thoroughly before investing.

- Start with ETFs for broad market exposure.

- Gradually build stock positions.

- Monitor gold prices and company updates.

- Regularly review financials and project milestones.

Remember: Success requires patience, diversification, and continuous learning.

Understanding the Basics: What Makes Junior Miners Different?

Junior gold mining companies represent the entrepreneurial backbone of the mining industry. Unlike industry giants such as Barrick Gold Corporation (market cap: $30+ billion) or Newmont Corporation (market cap: $40+ billion), these smaller companies focus on the crucial task of discovering tomorrow’s gold deposits. Think of them as the Silicon Valley startups of the mining world—high-risk ventures that could either strike it big or fade into obscurity.

Key Performance Metrics That Matter

Recent market data reveals compelling statistics about junior mining investments:

- Historical volatility averaging 1.5-2x that of senior producers

- The correlation coefficient of just 0.3 with the S&P 500, providing genuine diversification benefits

- Average leverage of 2-3x to gold price movements during bull markets

- Return potential of 500%+ for successful explorers that advance to production

The Growth Potential: From Junior Explorer to Mining Giant

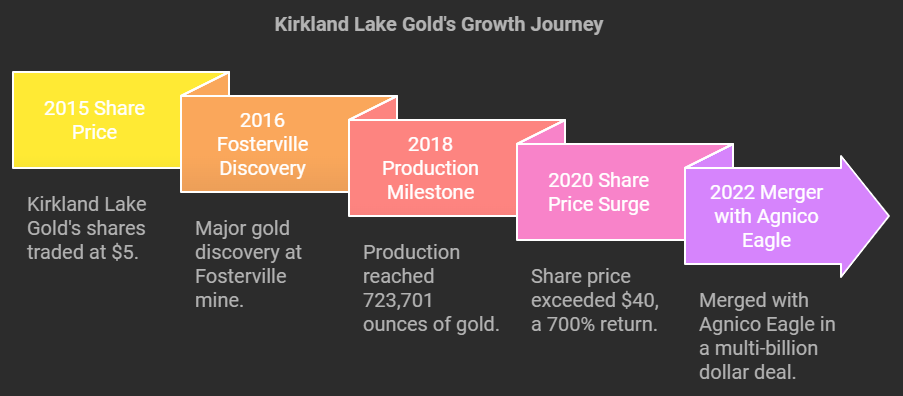

The Kirkland Lake Gold Success Story

Perhaps no company better illustrates the potential of junior mining investments than Kirkland Lake Gold. This case study reveals the remarkable journey from small explorer to industry powerhouse:

- 2015: Trading at approximately $5 per share

- 2016: Major discovery at Fosterville mine in Australia

- 2018: Production reaches 723,701 ounces of gold

- 2020: Share price exceeds $40, representing a 700% return

- 2022: Merged with Agnico Eagle in a multi-billion dollar deal

Current Market Dynamics Driving Opportunity

Today’s market presents a unique confluence of factors favoring junior miners:

- Gold prices maintaining strength above $1,800 per ounce

- Major producers facing depleting reserves

- Increased M&A activity as senior miners seek to replenish resources

- Rising exploration budgets across the sector

- Growing institutional interest in the junior mining space

Technology Revolution: How Innovation is Reducing Risk

AI-Driven Exploration: The New Gold Rush

Modern junior miners are leveraging artificial intelligence to revolutionize exploration:

- Machine learning algorithms analyzing vast geological datasets

- Satellite imagery processing for target identification

- Drill hole optimization reducing exploration costs by 25-35%

- Real-time data analysis improving decision-making accuracy

Environmental Innovation Leading the Way

Leading junior miners are setting new standards in sustainable practices:

- Water recycling systems achieving 80% reduction in consumption

- Solar-powered exploration camps cutting diesel usage by 60%

- Drone technology for minimal-impact surveying

- Advanced rehabilitation techniques for post-exploration restoration

Understanding and Managing Investment Risks

Risk Analysis: By the Numbers

The junior mining sector presents specific challenges that investors must understand:

- Exploration Success Rate: Approximately 1 in 1,000 prospects becomes a producing mine

- Financing Risk: 60% of juniors require additional funding within 12 months

- Technical Risk: 40% of projects face geological or metallurgical challenges

- Political Risk: 30% of projects affected by jurisdictional issues annually

Practical Risk Mitigation Strategies

- Portfolio Diversification

- Invest across 5-10 different junior miners

- Spread investments across different jurisdictions

- Mix early-stage explorers with more advanced developers

- Due Diligence Focus Areas

- Management team track record

- Cash position and burn rate

- Project quality and location

- Upcoming catalysts and news flow

Investment Strategies for Success

Direct Investment Approach

For investors choosing individual stocks, essential research tools include:

- SEDAR+ for Canadian company filings

- Company presentations and technical reports

- Quarterly financial statements

- Management discussion and analysis (MD&A)

- Site visit reports and third-party analysis

ETF and Fund Options

Popular investment vehicles include:

- VanEck Junior Gold Miners ETF (GDXJ)

- Assets: $4.5+ billion

- Holdings: 100+ junior miners

- Average daily volume: 6+ million shares

- Management fee: 0.52%

- Sprott Junior Gold Miners ETF (SGDJ)

- Factor-based weighting methodology

- Focus on growth and momentum

- Smaller, more focused portfolio

- Management fee: 0.35%

Geographic Considerations: Where to Look for Opportunity

Top Mining Jurisdictions

Canada

- Flow-through share tax incentives

- Clear permitting process

- Strong technical expertise

- Established mining infrastructure

Australia

- Streamlined approval process

- World-class geological database

- Supportive mining culture

- Advanced technical capabilities

Emerging Opportunities

The West African Gold Belt has emerged as a significant growth region:

- Ghana: Over 100 million ounces of gold discovered

- Burkina Faso: Fastest-growing gold producer in Africa

- Mali: Third-largest gold producer in Africa

- Côte d’Ivoire: Rapidly expanding exploration activity

Economic and Community Impact

Creating Sustainable Value

Junior mining projects generate significant local benefits:

- Average of 150 direct jobs during exploration phase

- $5-10 million annual local spending during active exploration

- Infrastructure improvements (roads, power, water)

- Skills training and technology transfer

- Local business development opportunities

ESG Focus on Junior Gold Mining Investments

Environmental Stewardship

Junior miners are adopting eco-friendly practices:

- Carbon Reduction: Using solar power and cutting emissions by 30%.

- Water Recycling: Reducing water usage by up to 80%.

- Land Rehabilitation: Restoring mining sites to natural states post-extraction.

Key Metric: Carbon emissions reduction targets.

Social Responsibility

Supporting local communities through:

- Job Creation: 150+ jobs during exploration phases.

- Community Investment: Funding schools, healthcare, and infrastructure.

- Local Hiring: Training programs to develop local talent.

Certification: Fairmined for ethical mining practices.

Governance and Transparency

Ensuring accountability with:

- ESG Reporting: Regular updates on environmental and social metrics.

- Stakeholder Engagement: Open communication with communities and investors.

- Independent Audits: Third-party verification of ESG efforts.

Key Metric: Biodiversity monitoring programs.

Why ESG Matters:

Investing in ESG-focused junior miners reduces risks, attracts institutional interest, and supports sustainable growth.

Building Your Investment Strategy

Portfolio Integration Guide

- Initial Allocation (2-5% of portfolio)

- Prioritize companies in safe jurisdictions

- Focus on established explorers with strong balance sheets

- Look for near-term catalysts

- Growth Phase (5-10% of portfolio)

- Add earlier-stage explorers

- Consider emerging jurisdictions

- Include developers nearing production

Essential Due Diligence Checklist

Management Assessment

- Track record of previous successes

- Technical expertise in geology and mining

- Capital markets experience

- Alignment with shareholders

Project Evaluation

- Grade and size potential

- Infrastructure access

- Metallurgical characteristics

- Exploration upside

- Development timeline

Financial Health

- Current cash position

- Monthly burn rate

- Funding requirements

- Major shareholders

- Warrant overhang

Jurisdiction Analysis

- Mining code stability

- Permitting timeline

- Tax regime

- Infrastructure quality

- Political risk assessment

FAQs

Frequently Asked Questions

💡Expert Answers to Your Junior Mining Investment Questions

Ready to Start Your Junior Mining Journey?

🚀These FAQs cover the fundamentals, but successful investing requires continuous education and careful research.

Conclusion: Your Action Plan for Junior Mining Investment

Junior gold mining investments offer a unique combination of growth potential and portfolio diversification. While the risks are significant, careful selection and proper portfolio allocation can help investors capture the extraordinary potential of this dynamic sector.

Key Steps to Get Started

Start with research

- Study successful case studies

- Understand the risk factors

- Learn about different jurisdictions

Build gradually

- Begin with ETFs for broad exposure

- Add individual stocks as knowledge grows

- Maintain proper position sizing

Stay informed

- Follow industry news

- Monitor gold price trends

- Track company milestones

- Attend mining conferences

Review regularly

- Rebalance positions as needed

- Update company assessments

- Monitor risk factors

- Adjust strategy based on market conditions

Remember, successful junior mining investment requires patience, discipline, and continuous learning. By following these guidelines and maintaining a long-term perspective, investors can potentially capture significant returns while managing risks effectively.

Whether you’re looking to add growth potential or reduce correlation with traditional assets, junior gold mining stocks deserve consideration in a modern investment portfolio. The key is to start small, stay diversified, and never stop learning about this fascinating sector.

One Comment

Comments are closed.