As a passionate gold enthusiast, I’ve always been fascinated by the intricacies of gold bullion purity. Today, I want to share my knowledge and experience with you, fellow precious metal lovers. But before we dive in, I want to emphasize that while I’m excited to explore this topic with you, I’m not a professional. You must always do your research and seek professional advice when making investment decisions related to gold bullion purity or any other aspect of precious metals.

The Basics of Gold Bullion Purity

When we talk about gold bullion purity, we’re essentially discussing the amount of pure gold content in a piece of bullion. This measurement is fundamental to understanding the value and quality of gold products. Whether you’re a seasoned investor or a curious newcomer, grasping the concept of gold purity is crucial for making informed decisions in the precious metals market.

Karat vs. Fineness: Two Sides of the Same Coin

In the world of gold, we use two primary systems to measure purity: karats and fineness. Let’s break these down:

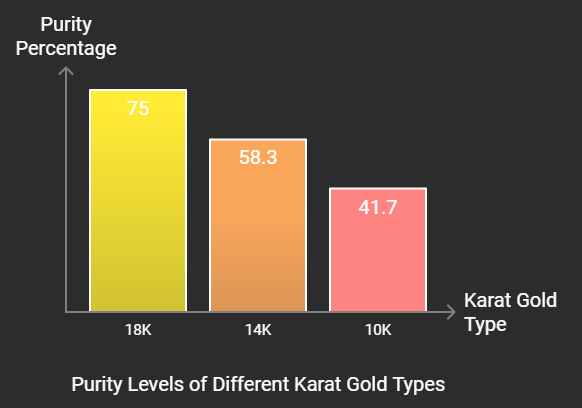

Karat System: This is the more commonly known method, especially in jewelry. Pure gold is 24 karat, while lower purities are expressed as fractions of 24. For example:

- 18 karat gold is 75% pure (18/24)

- 14 karat gold is 58.3% pure (14/24)

- 10 karat gold is 41.7% pure (10/24)

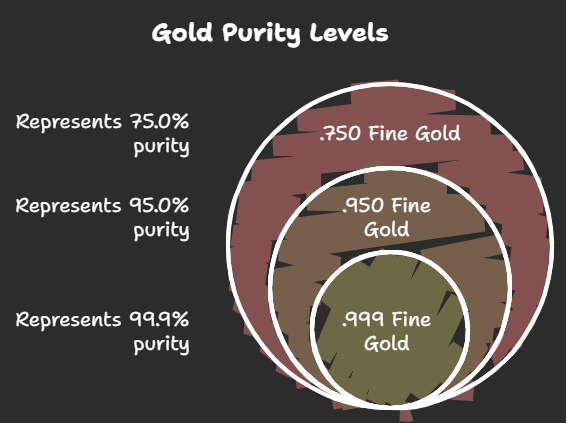

Fineness System: This is typically used for bullion and is expressed in parts per thousand. For instance:

- .999 fine gold is 99.9% pure

- .9999 fine gold is 99.99% pure (often called “four nines fine”)

It’s worth noting that most investment-grade gold bullion is 99.5% pure or higher, with many products reaching 99.99% purity. This high level of purity ensures the gold’s value and makes it easier to trade in international markets.

Historical Context: The Evolution of Gold Purity Measurements

The concept of measuring gold purity isn’t new – it’s been around for millennia. Ancient civilizations like the Egyptians and Greeks had their methods of assessing gold content. The karat system, for instance, has its roots in ancient times when carob seeds were used as a unit of measurement due to their consistent weight.

As trade expanded and economies grew more complex, the need for standardized purity measurements became evident. This led to the development of more precise methods and eventually to the international standards we use today.

International Standards: Ensuring Global Consistency

In today’s interconnected world, having uniform standards for gold purity is crucial. One of the most recognized standards is the London Good Delivery, set by the London Bullion Market Association (LBMA). This standard requires gold bars to have a minimum fineness of .995 (99.5% pure), although many exceed this, reaching a .9999 fine.

These international standards play a vital role in maintaining consistency and trust in the global gold market. They ensure that when we talk about “investment-grade gold,” we’re all on the same page, regardless of whether we’re in New York, London, China, or Singapore.

Common Gold Alloys: Strength in Diversity

While pure gold is prized for its value, it’s often too soft for practical use, especially in jewelry. This is where gold alloys come into play. By mixing gold with other metals, we can create stronger, more durable materials while still maintaining a significant gold content. Some common gold alloys include:

- Yellow Gold: Typically a mix of gold, silver, and copper

- White Gold: Gold alloyed with nickel, palladium, or platinum

- Rose Gold: A combination of gold and copper, sometimes with a touch of silver

Each of these alloys has its own unique properties, affecting not just the durability but also the color and even the potential for allergic reactions (as is sometimes the case with nickel in white gold).

The Golden Hue: How Purity Affects Color and Malleability

One of the fascinating aspects of gold purity is its impact on the metal’s physical properties. Pure gold has that rich, warm yellow color we all associate with the precious metal. As we add other metals to create alloys, the color can change dramatically.

Moreover, the purity of gold directly affects its malleability. Pure gold is incredibly soft – so soft that you can bend it with your bare hands! This malleability decreases as we add other metals, which is why jewelry often uses lower karat gold for increased durability.

Testing for Gold Purity: From Ancient Techniques to Modern Technology

Over the years, various methods have been developed to test gold purity. Some of these include:

- The Touchstone Method: An ancient technique still used today, involving rubbing the gold on a touchstone and comparing the streak to known purity samples.

- Acid Test: Different strengths of nitric acid are used to test gold of various purities.

- XRF Analysis: X-ray fluorescence technology provides a non-destructive way to analyze gold content quickly and accurately.

- Fire Assay: Considered the most accurate method, it involves melting a sample of gold and chemically separating the pure gold from other metals.

As technology advances, these testing methods become more precise, allowing for incredibly accurate purity measurements.

The Investor’s Perspective: Purity, Premiums, and Market Dynamics

For those of us interested in gold as an investment, understanding purity is crucial. Here’s why:

- Premiums: Generally, higher purity gold commands higher premiums over the spot price. For example, a 1 oz coin of .9999 fine gold might cost more than its .999 fine counterpart, even though the pure gold content is nearly identical.

- Liquidity: Higher purity gold tends to be more liquid in the market. The closer to pure gold a product is, the easier it is to trade internationally.

- Market Preferences: Interestingly, different markets around the world have varying preferences for gold purity. In India, for instance, 22 karat gold is highly popular, while in China, 24 karat gold is preferred.

Understanding these nuances can help investors make more informed decisions about what type of gold to purchase and where to sell it.

The Technical Side: Composition and Trace Elements

When we delve into the technical aspects of gold purity, we find that even the purest gold bullion contains trace amounts of other elements. For .9999 fine gold, that 0.01% could consist of elements like silver, copper, or platinum.

These trace elements, while minuscule, can affect the overall properties of the gold and are part of what refineries consider when processing and purifying gold.

Conclusion: The Ongoing Fascination with Gold Bullion Purity

As we’ve explored, gold bullion purity is a fascinating and complex topic that goes far beyond simple numbers. From its historical significance to its impact on modern investments, understanding gold purity is key for anyone interested in precious metals.

Remember, while this information can serve as a starting point, it’s always crucial to conduct your research and consult with professionals before making any investment decisions. The world of gold is vast and ever-changing, and staying informed is the best way to navigate it successfully.

Whether you’re a collector, investor, or simply a gold enthusiast like me, I hope this deep dive into gold bullion purity has been informative and engaging. Keep exploring, keep learning, and may your interest in precious metals continue to shine as brightly as the gold itself!

6 Comments