Gold Silver Ratio Investing isn’t just a buzzphrase—it’s your secret weapon for spotting undervalued opportunities in precious metals. This simple yet powerful system helps you maximize profits and hedge against market uncertainty. Whether you’re a seasoned investor or just starting, mastering this ratio could transform your strategy. Ready to unlock its potential? Let’s dive in!

Key Takeaways

- The gold-silver ratio compares the value of an ounce of silver to an ounce of gold, helping investors diversify their portfolios.

- Historical ratios have ranged widely, from 12:1 in ancient times to nearly 100:1 in modern markets.

- Investors can use the ratio to anticipate price movements and profit even when gold and silver prices fluctuate.

- Various strategies, such as futures investing, ETFs, and options, can be used to trade the gold-silver ratio.

- Understanding the gold-silver ratio is crucial for making informed decisions in precious metals investing.

What is the Gold-to-Silver Ratio?

The gold-to-silver ratio is important for investors and traders. It shows how much silver it takes to buy one ounce of gold. To find the current ratio, just divide the gold price by the silver price.

For example, if gold is $1,800 and silver is $24, the ratio is 75:1. This means 75 ounces of silver equals one ounce of gold. On July 26, 2024, the ratio was about 85:1. This shows gold was more valuable than silver at that time.

| Date | Gold Price (per oz) | Silver Price (per oz) | Gold-Silver Ratio |

|---|---|---|---|

| July 26, 2024 | $1,950 | $23 | 84.78:1 |

| January 1, 2023 | $1,825 | $24 | 76.04:1 |

| April 1, 2020 | $1,590 | $14 | 113.57:1 |

Knowing the gold-silver ratio is key for investors. It helps them balance their precious metals portfolio. By watching the ratio and comparing it to past values, you can spot good times to buy or sell.

The gold/silver ratio varies between 20 and 100. The average over 30 years is about 68. This shows gold is usually 68 times more valuable than silver.

Investing in precious metals? Keep an eye on the gold-silver ratio. It helps you make smart choices and improve your portfolio’s performance.

Historical Perspective on the Gold-Silver Ratio

The gold-silver ratio has a long history, dating back to ancient times. It offers insights into the precious metals’ dynamics and their role in different economies.

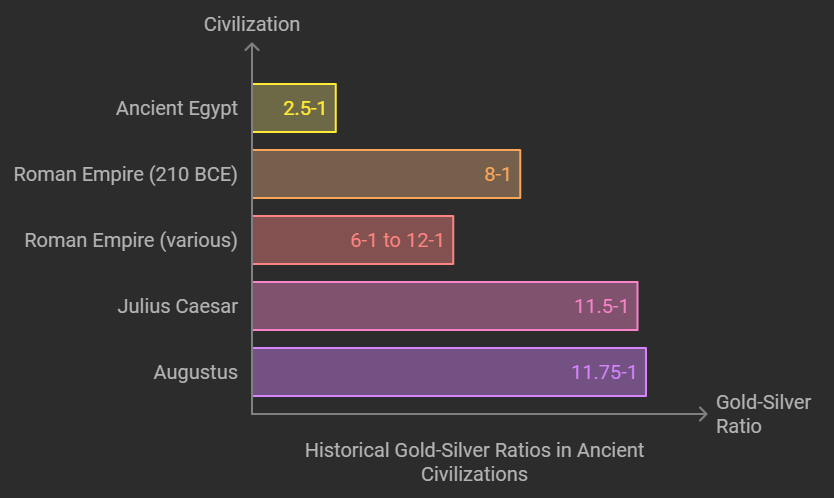

Ancient Civilizations and the Ratio

In ancient times, the gold-silver ratio varied across civilizations. For example:

- In ancient Egypt, King Menes set the gold-silver ratio at a low of 2.5-1.

- The Roman Empire initially set the ratio at 8-1 in 210 BCE, later changing between 6-1 and 12-1.

- Julius Caesar set a ratio of 11.5-1, and Augustus raised it to 11.75-1.

Since ancient Rome, the annual silver production has been about 8 times that of gold.

The Ratio During the Gold Standard Era

In the 19th century, many countries used a bimetallic monetary system. The gold-silver ratio was key. Here are some important events:

- In 1792, the U.S. Congress fixed the gold-silver ratio at 15-1 under the first Coinage Act, contrasting with France’s 15.5-1 ratio set in 1803.

- After the 1834 adjustment, the U.S. gold-silver ratio increased to 16-1, with the gold price set at $20.67.

- Post-1873, the gold standard led to a gradual increase in the gold-silver ratio, influenced by the Comstock Lode discovery.

The table below summarizes the historical fluctuations of the gold-silver ratio:

| Time Period | Gold-Silver Ratio Range |

|---|---|

| Ancient Civilizations | 2.5-1 to 12-1 |

| 19th Century (Gold Standard Era) | 15-1 to 16-1 |

| World War II | Up to 40-1 |

| Modern Era (post-1972) | 40-1 to 60-1 |

| 2020 (Covid-19 Crisis) | Peaked at 123-1 |

By studying the gold-silver ratio’s history and trends, investors can better understand these metals. This knowledge helps them make informed decisions when balancing their portfolios.

Calculating the Gold-Silver Ratio

The gold-silver ratio is crucial for investors balancing their precious metals portfolio. It shows how many ounces of silver it takes to buy one ounce of gold. Knowing how to calculate and understand this ratio helps investors make better choices when buying gold and silver.

Current Gold and Silver Prices

To figure out the current gold-silver ratio, you need to know the spot prices of both metals. At the start of 2020, the average price ratio was about 55:1. But, this ratio changes a lot over time, as shown by past data:

| Year | Gold-Silver Ratio | Significance |

|---|---|---|

| 1990 | Highest recorded | Silver undervalued relative to gold |

| 1979 | Lowest recorded | Silver overvalued relative to gold |

| 2020 | 125:1 | All-time high, coinciding with COVID-19 pandemic |

| Historical average | 15:1 | 100-year average around 40:1 |

Interpreting the Ratio Values

If the gold-silver ratio is higher than usual, silver is seen as cheaper than gold. This might make investors put more money into silver. On the other hand, if the ratio is lower than usual, silver is seen as more expensive than gold. This could mean it’s a good time to invest in gold.

Investors can use live ratio trackers and calculators to keep an eye on the gold-silver ratio. This helps them make smart choices based on the data. By understanding the gold-silver ratio, investors can improve their precious metals portfolio and find good buying chances.

Relevance of the Gold Silver Ratio Investing in Modern Markets

The importance of the gold-silver ratio today is huge. It’s a key investment tool for understanding the economy and making smart choices in precious metals. By watching the gold-silver ratio, investors can spot market changes and make money.

The gold-silver ratio is also key for gold portfolio allocation. It helps investors balance their holdings in gold and silver, optimizing their exposure to protect against market ups and downs. Knowing the historical averages allows investors to identify when values are too high or too low, guiding them to adjust their portfolios strategically.

| Ratio Range | Investor Action |

|---|---|

| Approaching 80:1 | Buy more silver |

| Closer to 40:1 | Sell silver and buy gold |

Over the last 100 years, the gold-silver ratio has mostly been around 47:1. It usually stays between 40:1 and 80:1. But, there have been some big changes:

- The highest recorded ratio was 125:1 during the COVID-19 pandemic in April 2020.

- In the 1940s-50s, the ratio was in the 90s.

- The lowest historical ratio was 2.5:1 in Ancient Egypt.

“The gold-silver ratio is a powerful tool for investors seeking to optimize their precious metals portfolios and capitalize on market inefficiencies.”

By using the gold-silver ratio, investors can make smart choices. Both long-term and short-term traders can benefit from it. The ratio’s lasting importance shows its value in the world of precious metals investing.

Strategies for Trading the Gold-Silver Ratio

The gold-silver ratio is a key tool for investors looking to improve their precious metals portfolio. It helps you decide when to buy gold or silver. Let’s look at some effective ways to trade the gold-silver ratio.

Accumulating Silver When the Ratio is High

One strategy is to buy silver when the ratio is above its average. For instance, if the ratio is over 65, silver might be cheaper than gold. This could be a good time to buy more silver, hoping its price will go up as the ratio returns to normal.

Accumulating Gold When the Ratio is Low

On the other hand, if the ratio is below average, gold might be cheaper than silver. Investors might then choose to buy more gold, expecting its price to rise as the ratio gets back to normal. Buying gold when it’s cheap can help you grow your holdings more efficiently.

Long and Short Positions Based on the Ratio

For more experienced traders, using long and short positions can be profitable. When the ratio is high, you might bet on silver going up and gold going down. When the ratio is low, you might bet on gold going up and silver going down. This method needs careful watching of the market and a good grasp of risk management.

| Ratio Range | Trading Strategy |

|---|---|

| Above 65 | Accumulate silver |

| Below 50 | Accumulate gold |

| High ratio | Long silver, short gold |

| Low ratio | Long gold, short silver |

While these strategies can work, they come with risks. Gold and silver prices can change due to many factors, and prices might drop after you buy. Always do your homework, know your risk level, and match your trading plans with your financial goals.

By understanding and using these strategies for the gold-silver ratio, you can make better choices about buying gold or silver. Whether you’re looking at long-term or short-term strategies, the gold-silver ratio offers valuable insights. It helps you make the most of your investments in the ever-changing world of gold and silver trading.

Using the Gold-Silver Ratio to Identify Buying Opportunities

The gold-silver ratio is a powerful tool for finding buying chances in precious metals. It helps you spot when gold or silver is cheaper than usual. This can lead to good investment opportunities.

The ratio has changed a lot over time. In 1991, it hit 100:1, and in 2011, it fell to 32:1. In 2020, during the COVID-19 pandemic, it reached 125:1.

| Year | Gold-Silver Ratio | Market Conditions |

|---|---|---|

| 1991 | 100:1 | High ratio, silver undervalued |

| 2011 | 32:1 | Low ratio, gold undervalued |

| 2020 | 125:1 | Record high ratio, silver significantly undervalued |

| 2024 | 88.93:1 | Moderately high ratio, silver potentially undervalued |

When the ratio is high, silver looks cheap compared to gold. For instance, at 100:1, 100 ounces of silver are worth as much as 1 ounce of gold. This makes silver a good buy, as the ratio will likely even out, leading to gains.

On the other hand, a low ratio means gold is cheap. At 30:1, 30 ounces of silver are needed for 1 ounce of gold. Investing in gold seems smart here, as it’s relatively cheap.

Investors can use the gold-silver ratio as a tool for identifying undervalued precious metals and making informed buying decisions based on historical trends and current market conditions.

Remember, the gold-silver ratio is just one factor to think about when investing. Market mood, economic state, and supply and demand are also key. By watching the ratio and adjusting your investments, you can meet your financial goals and risk level.

Economic Factors Influencing the Gold-Silver Ratio

The gold-silver ratio is important for investors and traders. It shows the value of gold and silver compared to each other. Understanding what affects this ratio helps you manage your investments better.

Supply and Demand Dynamics

The amount of gold and silver available affects their prices and the ratio. Mining changes can shift the prices of gold and silver. For example, more silver mining can make silver cheaper compared to gold, raising the ratio.

Gold and silver demand also plays a big role. Gold is often chosen as a safe investment during economic worries. Silver, on the other hand, is used a lot in industries. In 2018, 60% of silver demand was for industrial use, while gold’s was just 7%.

Industrial Uses of Silver

Silver’s wide use in industries affects the gold-silver ratio. When silver demand goes up, its price rises, making the ratio fall. In 2023, silver demand for industries was 632 million ounces. It’s expected to grow by 9% to 711 million ounces in 2024.

| Year | Industrial Silver Demand (million ounces) | Percent Change |

|---|---|---|

| 2023 | 632 | – |

| 2024 (projected) | 711 | 9% |

Geopolitical Events and Market Uncertainty

When there’s global turmoil or economic worries, gold becomes more popular. This drives up gold’s price, making the ratio go up. The ratio has risen during market crises and recessions.

The gold-silver ratio hit an all-time high above 120:1 during the COVID-19 pandemic. This shows how global economic uncertainty affects gold and silver prices.

Inflation and Deflation

Economic conditions like inflation and deflation also affect the ratio. Inflation makes investors choose gold, increasing the ratio. Deflation, however, might make silver more attractive, lowering the ratio.

By watching these economic factors, you can make better choices for your precious metals investments.

Investment Options for Gold Silver Ratio Investing

Investing in the gold silver ratio offers several choices. Each option has its benefits and things to consider. This lets you pick what fits your financial goals and how much risk you’re willing to take. Let’s look at the main ways to invest in the gold silver ratio.

Physical Gold and Silver

Buying physical gold and silver is a simple way to invest. You get to hold real assets in your hands. But, remember, there are costs for storage and insurance. Also, gold and silver coins often cost more than their metal value because of manufacturing and distribution.

Futures and Options

Futures and options are more complex ways to invest in the gold silver ratio. They let you use your money to make more money from price changes without owning the metals. But, trading futures and options is riskier and more complicated than other options. It’s important to understand these well before you start trading.

Exchange-Traded Funds (ETFs)

Precious metals ETFs are a convenient way to invest in gold and silver. They follow the price of the metals, so you can invest in the gold silver ratio easily. ETFs are liquid and easy to get into, making them popular. Some well-known ETFs include:

- SPDR Gold Shares (GLD)

- iShares Silver Trust (SLV)

- Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR)

When picking an investment for the gold silver ratio, think about what you prefer, how much risk you can handle, and your investment goals. Each option has its own good and bad points. It’s key to do your homework and talk to a financial advisor before deciding.

“The key to successful gold silver ratio investing lies in understanding the unique characteristics of each investment option and aligning them with your financial objectives.”

By spreading your investments across different options, you can lower risk and find chances in the precious metals market.

Market Analysis and Indicators for Ratio Trading

To trade the gold-silver ratio well, you need to analyze the market and use important indicators. Looking at past data and current trends helps you spot chances and plan your trades.

Watching how the gold-silver ratio has changed over time is key. It has swung from over 90:1 to about 50:1. These shifts are due to many things, like the economy, world events, and how much silver is needed for industry.

| Historical Event | Gold-Silver Ratio |

|---|---|

| Roman Empire | 12:1 |

| 20th Century Average | 47:1 |

| 2008 Financial Crisis Peak | 80:1 |

| 2020 COVID-19 Pandemic Peak | 126:1 |

To find the current ratio, divide gold’s price by silver’s. For example, if gold is $1,800 and silver is $25, the ratio is 72:1. This means you need 72 ounces of silver for one ounce of gold.

Tools like technical indicators and charts are very helpful for ratio trading. They help you see important levels, trends, and when things might change. Indicators like moving averages and the RSI are often used.

Using the gold-silver ratio with other indicators gives a clearer view of the market. This helps you make better trading choices.

It’s also important to watch economic signs like inflation and interest rates. These can affect the ratio and offer chances to profit from price differences between gold and silver.

By doing deep market analysis, using technical tools, and keeping up with the economy, you can do well in gold-silver ratio trading. This way, you can make smart choices to improve your investment portfolio.

Risk Management in Gold-Silver Ratio Trading

Gold-silver ratio trading comes with risks. It’s important to manage these risks well. This way, you can handle the ups and downs of the precious metals market and improve your portfolio’s performance.

Portfolio Diversification

Managing risks starts with diversifying your portfolio. Don’t put all your eggs in one basket. Spread your investments across different areas like stocks, bonds, and real estate. This helps protect your money from big losses.

The gold-silver ratio has changed a lot over time. It has swung from 10:1 to 100:1, averaging around 60:1. By diversifying, you can better handle market changes.

Market Volatility Considerations

The gold-silver ratio is affected by market ups and downs. Economic and geopolitical events can change the ratio. It’s key to keep up with market trends and adjust your plans as needed.

To deal with ratio volatility, try these:

- Set clear entry and exit points for your trades

- Use stop-loss orders to control losses

- Keep an eye on market changes and adjust your positions

- Look at the ratio’s past highs and lows to find support and resistance

| Date | Gold Price (per ounce) | Silver Price (per ounce) | Gold-Silver Ratio |

|---|---|---|---|

| May 30, 2023 | $1,975 | $23.40 | 84.4:1 |

| 2013 | $1,600 | $28.50 | 55:1 |

| 2021-2023 | – | – | 65.5:1 to 83.5:1 |

Knowing the past and current market helps you make smart choices in gold-silver ratio trading. Success comes from adapting your strategies to the ever-changing market landscape.

Case Studies: Successful Gold-Silver Ratio Trades

Real-world examples of gold-silver ratio trading show its potential benefits. By looking at successful stories, you can learn how to use this strategy in your portfolio.

In the 1980s, the gold-silver ratio hit a high of 125. A smart investor saw this chance and sold gold to buy 125 times more silver. When the ratio fell to 60, they sold the silver for a big profit. This doubled their gold.

| Year | Gold-Silver Ratio | Trading Strategy | Outcome |

|---|---|---|---|

| 1980 | 16 | Sell gold, buy silver | Profit as ratio normalizes |

| 2011 | 31 | Sell gold, buy silver | Profit as ratio normalizes |

| 2020 | 125 | Sell gold, buy silver | Potential for significant gains |

In 2011, the ratio fell to 31. An investor then sold silver to buy gold. As the ratio rose to over 60, their gold’s value went up a lot.

The key to success in gold-silver ratio trading is patience and a long-term perspective. By waiting for extreme ratio levels and then capitalizing on the inevitable reversion to the mean, investors can accumulate greater quantities of metal over time.

While these examples show the benefits of ratio trading, remember that past results don’t predict the future. Always do your research and manage risks. By learning from successful stories, you can increase your chances of success in your own trades.

Conclusion

Knowing the gold-silver ratio is key for investors. It helps them make smart choices in the precious metals market. By understanding the ratio’s history, how it’s calculated, and what affects it, you can move through the gold and silver market with ease.

The ratio has changed a lot over time. It has gone from around 15:1 to over 100:1 recently. This shows how important it is to keep an eye on these changes.

For those trading the ratio, it’s important to know when silver or gold might be cheaper than the other. If the ratio is over 80:1, silver might be a good buy. But if it’s under 60:1, gold might be a better choice. Using these tips and thinking about demand, market mood, and central bank actions can help you make better choices for your investments.

It’s also vital to diversify and manage risks when investing in the gold-silver ratio. By putting money into physical metals, futures, options, and ETFs, you can reduce risk and take advantage of different market situations. Keeping up with market swings and global events is also crucial. By using the gold-silver ratio wisely, you can make your investment portfolio more balanced and possibly earn more over time.

FAQ

What is the gold-to-silver ratio?

The gold-to-silver ratio shows how many ounces of silver it takes to buy one ounce of gold. It’s found by dividing the gold price by the silver price.

Why is the gold-to-silver ratio important for investors?

It helps investors see the value of gold and silver. By watching the ratio, they can decide when to buy or sell. This can help them make more money and avoid losses.

How can I calculate the current gold-to-silver ratio?

To find the current ratio, divide the gold price by the silver price. For example, if gold is $2,000 and silver is $25, the ratio is 80 (2,000 ÷ 25 = 80).

What are some historical trends of the gold-to-silver ratio?

The ratio has changed over time. In the past, it was often 12:1 or 15:1. In the 20th century, it averaged around 50:1, changing with economic and world events. Today, it’s usually between 50:1 and 80:1.

How can I use the gold-to-silver ratio in my investment strategy?

Use the ratio to guide your buying and selling. When the ratio is high (above 80), silver might be cheap. This could be a good time to buy. When it’s low (below 50), gold might be cheap, so it’s a good time to buy gold.

What are some common strategies for trading the gold-to-silver ratio?

Strategies include buying silver when the ratio is high and gold when it’s low. You can also take long or short positions based on the ratio. Or, use it to diversify your precious metals portfolio. But, each strategy has risks, so think carefully about your goals and how much risk you can take.

How can I invest in gold and silver based on the ratio?

You can invest in gold and silver through physical bullion, futures, options, or ETFs. Each has its own benefits and drawbacks. Your choice depends on your investment goals, how much risk you can handle, and where you want to store your investments.

What tools and resources are available for tracking the gold-to-silver ratio?

You can track the ratio with live trackers, charts, and data from financial websites and precious metals dealers. Many platforms offer real-time calculations and charts to show trends over time.

What risks should I be aware of when trading based on the gold-to-silver ratio?

Trading based on the ratio comes with risks like price changes and potential losses. Economic and world events can also affect the ratio in unexpected ways. Always consider the ratio as part of a bigger strategy and manage risks with careful planning and stop-loss orders.

Are there any limitations to using the gold-to-silver ratio in investing?

While the ratio is useful, it shouldn’t be the only thing you look at. Market conditions, supply and demand, and investor feelings can also change prices. Remember, past results don’t mean future success. Always do your research and talk to financial experts before investing.