Key Takeaways

- Gold remains a popular investment for diversification and as a hedge against inflation, with prices showing strong performance in recent years.

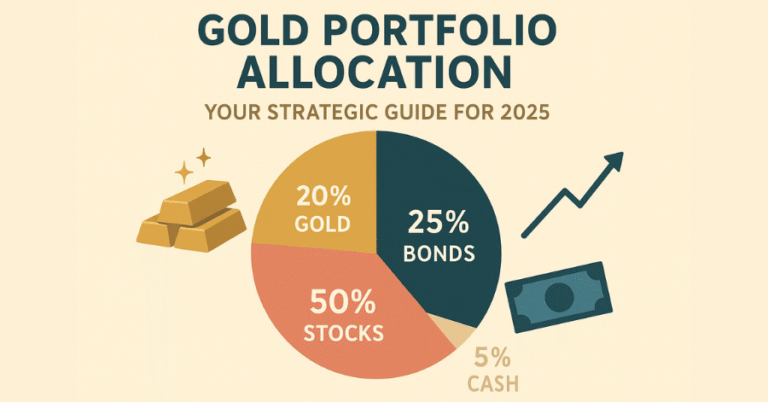

- Financial experts recommend limiting gold investments to 5-10% of your total portfolio to maintain balance.

- Investment options range from physical gold (bars and coins) to financial instruments like ETFs, mining stocks, and Gold IRAs.

- Understanding the purity, weight, and types of gold is crucial before making a purchase.

- Gold IRAs offer a tax-advantaged way to include precious metals in your retirement planning.

- Beginners should approach high-risk options like gold futures with extreme caution.

Read our Main Article: How to Invest in Gold:

Introduction How To Buy Your First Gold Investment

Are you considering how to buy your first gold investment as a way to secure your financial future? Precious metals investing, particularly in gold, is increasingly popular as investors seek to diversify their portfolios and hedge against inflation. With gold prices reaching new highs in recent years, it’s no surprise that beginners are taking a keen interest.

Gold bullion and coins are traditionally seen as safe-haven assets during economic turbulence. Now, with major retailers like Costco making gold bullion more accessible, it’s essential for new investors to understand their options before diving in.

Read Our Article About Bullion Premiums

A 2025 Investor’s Guide to Value!

A 2025 Investor’s Guide to Value!

Gold investing comes in many forms, from owning physical metal to investing in gold-backed ETFs, mining stocks, and specialized IRAs. As of June 2025, an ounce of gold trades for approximately $2,650. While the allure is strong, financial experts typically advise that gold should comprise a modest 5% to 10% of a well-balanced investment portfolio.

Ready to make your first gold investment? This guide will walk you through how to do so wisely and safely.

Understanding Gold as an Investment Asset

Gold’s value has been recognized for millennia, serving as both a currency and a universal store of wealth. Its enduring appeal as an investment is rooted in its unique history and financial qualities.

Historical Significance of Gold

The modern era of gold investing began in 1971 when the U.S. dollar was decoupled from gold. At the time, an ounce was valued at $35. Today, its price has soared, demonstrating its capacity to preserve wealth across generations. It has consistently been sought after during times of economic or geopolitical uncertainty.

Gold’s Role in Modern Portfolios

In contemporary finance, gold is primarily used as a defensive asset. It acts as a hedge against inflation and a safe haven during market volatility. Because its price often moves independently of stocks and bonds, adding gold to a portfolio can reduce overall risk and provide stability.

Current Market Trends and Valuations

The gold market has experienced significant growth. Historically, its long-term performance has been robust. While past performance is not indicative of future results, understanding these trends can help investors make informed decisions.

Gold Performance vs. Stocks (Illustrative)

Gold vs S&P 500: Historical Performance Comparison

Interactive analysis of annualized returns across different market periods

📊 Key Insights

Over the long term (1971-2024), the S&P 500 has outperformed gold with an annualized return of ~10.7% compared to gold’s ~7.9%. However, gold has served as an important portfolio diversifier and hedge during periods of market stress.

Knowing these trends helps investors appreciate gold's potential role in a diversified financial strategy.

Types of Gold Investments Available

Gold investments are available in multiple forms, each with unique benefits and considerations. This allows investors to choose an approach that aligns with their financial goals and risk tolerance.

Physical Gold Options

Gold bars and coins are the preferred choice for investors who want to hold a tangible asset. These are typically purchased at a small premium (1% to 5%) over the spot price of gold. While large gold bars, such as the 400-troy-ounce bars used by central banks, are less practical for individual investors, smaller bars and coins offer greater liquidity.

Read Our Article: Invest in Precious Metals | Secure Wealth with Birch Gold

Read Our Article: Invest in Precious Metals | Secure Wealth with Birch Gold

Gold ETFs and Mutual Funds

Gold ETFs (Exchange-Traded Funds), such as the SPDR Gold Shares ETF (GLD), track the price of gold. They trade like stocks, offering high liquidity and convenience, but come with an annual expense ratio. Other funds, like the VanEck Vectors Gold Miners ETF (GDX), invest in the stocks of gold mining companies, providing exposure to the industry's performance rather than the commodity itself.

Read Our Comprehensive Article About: Gold ETFs: An A+ Approach to Precious Metal Investing

Read Our Comprehensive Article About: Gold ETFs: An A+ Approach to Precious Metal Investing

Gold Mining Stocks

Investing directly in gold mining companies, like Newmont Corporation (NEM) or Barrick Gold Corp. (GOLD), can be profitable. The success of these stocks depends on both the price of gold and the company's operational efficiency, offering a different risk-reward profile than holding bullion.

Get Top Tier Information About Gold Mining Stock Here

Get Top Tier Information About Gold Mining Stock Here

Gold IRA Accounts

A Gold IRA is a self-directed retirement account that allows investors to hold physical precious metals while enjoying tax advantages. These accounts require specialized custodians and approved storage facilities, making them a more complex, long-term investment strategy.

Get Informed. Read Our Intro To Gold-Back IRAs

Get Informed. Read Our Intro To Gold-Back IRAs

Gold Investment Options Comparison

Choose the right approach for your investment goals and risk tolerance

Gold Bars and Coins

Key Feature

Tangible, direct ownership

Important Considerations

Requires secure storage and insurance; higher premiums over spot price.

Gold ETFs

Key Feature

High liquidity, easy to trade

Important Considerations

Annual management fees; no physical ownership of the underlying gold.

Gold Mining Stocks

Key Feature

Potential for dividends and growth

Important Considerations

Subject to company-specific and market risks beyond gold price movements.

Gold IRA Accounts

Key Feature

Tax-deferred or tax-free growth

Important Considerations

Higher fees; requires specialized custodian and approved storage facilities.

How to Buy Your First Gold Investment

Making your first gold investment can be an empowering step toward financial security. With gold prices remaining strong, it's an attractive option for beginners seeking to diversify.

1. Determine Your Investment Goals

First, clarify your objective. Are you seeking long-term wealth preservation, a hedge against inflation, or short-term gains? Understanding your goals and risk tolerance is crucial, as gold may not always outperform other asset classes like stocks over the long term.

2. Set Your Investment Budget

You don't need a large amount of capital to start. It's possible to begin by purchasing fractional shares of gold ETFs or smaller gold coins. Decide on a budget that aligns with the recommended 5-10% portfolio allocation.

3. Choose the Right Investment Vehicle

Based on your goals, select the appropriate investment type. Physical gold offers ultimate security but requires storage. Precious Metals ETFs provide liquidity and ease of access. Gold stocks offer growth potential tied to business performance.

Gold Investment Pros & Cons

Weighing the advantages and disadvantages of each investment approach

Physical Gold

Low RiskPros

Tangible asset; no counterparty risk.

Cons

Storage costs; less liquid; insurance needed.

Gold ETFs

Low RiskPros

Easy to buy/sell; low transaction costs.

Cons

Management fees; not a tangible asset.

Gold Stocks

Medium RiskPros

Potential for dividends; leveraged to gold price.

Cons

Company and market risks.

Gold Futures

High RiskPros

High leverage and liquidity.

Cons

Extremely high risk; not for beginners.

Choose the option that best fits your investment strategy and comfort level with risk.

Physical Gold Investment Essentials

Investing in physical gold is a direct way to own this precious metal. Gold bars, coins, and bullion are top choices for investors seeking stability and a tangible asset.

Investment-grade gold bars are typically at least 0.999 fine (99.9% pure) and come in sizes ranging from 1 gram to 400 troy ounces. Gold coins, such as the American Gold Eagle or Canadian Gold Maple Leaf, are popular for their beauty, recognizability, and smaller, more divisible units.

"Gold is a refuge for investors during market volatility and economic uncertainties."

A critical consideration is storage and insurance. Options include a high-quality home safe, a bank safety deposit box, or a professional third-party depository. Each choice involves a trade-off between security, accessibility, and cost.

Understanding Gold ETFs and Mutual Funds

Read Our Comprehensive Article About Gold ETFs

Gold exchange-traded funds and gold mutual funds provide a simple way to invest in gold without holding the physical metal. These accessible and affordable options are suitable for both new and experienced investors.

Gold exchange-traded funds and gold mutual funds provide a simple way to invest in gold without holding the physical metal. These accessible and affordable options are suitable for both new and experienced investors.

Benefits of Gold ETFs

Gold ETFs are designed to mirror the price performance of gold. Because they trade on major stock exchanges, they offer excellent liquidity. The largest and most well-known is the SPDR Gold Shares (GLD), which holds billions of dollars' worth of physical gold in trust.

How to Purchase Gold ETFs

Using a Gold IRA for Your First Gold Investment

Read Our Article About Gold IRAs and Retirement Planning

Gold Individual Retirement Accounts (IRAs) offer a powerful strategy for diversifying a retirement portfolio. They allow you to hold physical, IRA-approved precious metals while benefiting from the same tax advantages as traditional IRAs.

Gold Individual Retirement Accounts (IRAs) offer a powerful strategy for diversifying a retirement portfolio. They allow you to hold physical, IRA-approved precious metals while benefiting from the same tax advantages as traditional IRAs.

Traditional vs. Roth Gold IRAs

Beyond selecting your gold and silver, the most critical decision for your precious metals IRA is its tax structure: Traditional or Roth. This choice determines whether you receive an upfront tax deduction now or secure completely tax-free withdrawals during retirement. Each path comes with its own set of rules regarding income eligibility, contribution limits, and required distributions that will significantly shape your financial future. Making the right choice is essential for maximizing your long-term wealth.

To see a detailed comparison and determine the best strategy for your goals, read our complete guide: Gold IRA vs. Traditional IRA: Which Is Right for You

Setting Up Your Gold IRA

To begin with tax-advantaged gold investing, you must select a reputable Gold IRA company. They will help you establish an account with an IRS-approved custodian and select eligible precious metals. The IRS requires that gold held in an IRA meet specific purity standards and be stored in an approved depository, not at home. For more information, read our  step-by-step guide to setting up a Gold IRA.

step-by-step guide to setting up a Gold IRA.

Conclusion: Investing in Gold for Beginners

Investing in gold can be an excellent way to preserve wealth and diversify your investments. As a tangible asset with a long history of holding its value, it provides a unique hedge against the economic uncertainties of our time.

Whether you choose to hold physical coins and bars, invest in liquid ETFs, or plan for the long term with a Gold IRA, the key is to start with a clear strategy. Remember the expert advice to keep your gold allocation between 5% and 10% of your overall portfolio to maintain a healthy balance of risk and reward. Before making any investment decisions, consider consulting with a qualified financial advisor to ensure your choices align with your personal financial goals.

FAQ

What are the main types of gold investments available for beginners?

Beginners can invest in physical gold (bars and coins), Gold ETFs, stocks of gold mining companies, or Gold IRAs. Each option has unique benefits, risks, and costs. It's important to research each one to determine the best fit for your investment goals.

How much of my portfolio should I invest in gold?

Most financial advisors suggest allocating 5-10% of your investment portfolio to gold. This amount is generally considered sufficient to provide diversification benefits without overexposing your portfolio to the volatility of a single asset class.

What are the advantages of Gold ETFs over physical gold?

Gold ETFs offer high liquidity (they are easy to buy and sell on stock exchanges) and eliminate the costs and security concerns associated with storing physical gold. However, with an ETF, you own shares in a trust, not the tangible metal itself.

How do I safely store physical gold investments?

When you buy your first gold investment, you can store it in a high-quality home safe, a bank safety deposit box, or a professional, insured depository. Professional storage offers the highest level of security but comes with annual fees. Always ensure your investment is properly insured.

What is a Gold IRA?

A Gold IRA is a self-directed Individual Retirement Account that allows you to hold physical gold and other approved precious metals. It offers tax advantages similar to a standard IRA but requires working with a specialized custodian and storing the metal in an IRS-approved vault.

What factors influence the price of gold?

Gold prices are influenced by supply and demand, central bank buying, geopolitical instability, the value of the U.S. dollar, and inflation rates. As a global commodity, its price can be volatile in the short term but has historically served as a reliable store of value over the long term.

One Comment

Comments are closed.