In today’s uncertain economic climate, more investors are looking to diversify their retirement portfolios with precious metals. Setting up a Gold IRA has become an increasingly popular choice for those seeking to protect their retirement savings against inflation and market volatility. This comprehensive guide will walk you through the process of the set-up, helping you understand each step along the way.

Understanding the Basics: What is a Gold IRA?

A Gold IRA is a self-directed Individual Retirement Account that allows you to invest in physical precious metals like gold, silver, platinum, and palladium. Unlike traditional IRAs that typically hold stocks, bonds, and mutual funds, a Gold IRA gives you the ability to own physical AU while maintaining the tax advantages of a retirement account.

The main benefits of investing in a Gold-backed IRA include:

- Protection against inflation

- Portfolio diversification

- Potential hedge against economic uncertainty

- Tax advantages similar to traditional IRAs

Before diving into the setup process, it’s important to note that while Gold IRAs offer unique advantages, they also come with their own set of rules and considerations. Let’s explore the different types of Gold IRAs to help you make an informed decision.

Understanding Gold IRAs: Types and Benefits

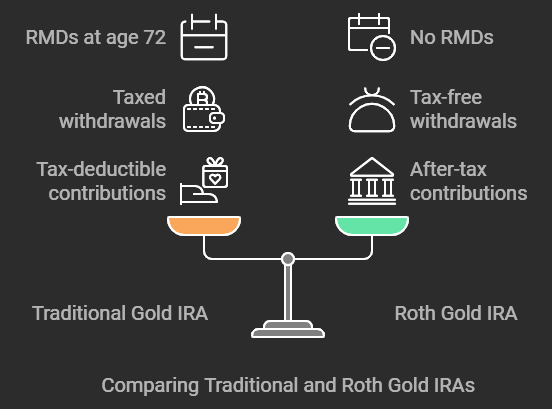

Types of Gold IRAs

- Traditional Gold IRA

- Contributions are tax-deductible

- Withdrawals are taxed as ordinary income

- Required Minimum Distributions (RMDs) start at age 72

- Roth Gold IRA

- Contributions are made with after-tax dollars

- Qualified withdrawals are tax-free

- No Required Minimum Distributions

Advantages of Gold IRAs

- Physical ownership of precious metals

- Protection against currency devaluation

- Potential for long-term appreciation

- Security through regulated storage facilities

While Gold IRAs offer numerous benefits, they also come with considerations such as storage fees, setup costs, and specific IRS regulations. Understanding these factors is crucial before moving forward with selecting a custodian, which is your next important step.

The 7-Step Process of Setting Up Your Gold IRA

Step 1: Choosing a gold-centric retirement savings account Custodian

Selecting the right custodian is crucial when configuring an Au-inclusive IRA. A custodian is a financial institution approved by the IRS to hold and protect your precious metals investments.

Key Criteria for Selecting a Custodian:

- Years of experience in handling self-directed IRAs

- Industry reputation and customer reviews

- Transparent fee structure

- Quality of customer service

- Security measures and insurance coverage

Note: These are example figures. Actual fees and minimums vary by custodian.

With your custodian selected, the next step is opening your account and completing the necessary paperwork.

Step 2: Opening Your Gold IRA Account

The account opening process typically involves several key steps and documentation requirements.

Required Documentation:

- Government-issued photo ID

- Social Security number

- Proof of address

- Beneficiary information

- Previous IRA or 401(k) statements (if transferring funds)

Take time to carefully review all agreements and terms, paying special attention to:

- Fee schedules

- Storage arrangements

- Buy/sell procedures

- Account maintenance requirements

Once your account is established, you’ll need to fund it before making any gold purchases.

Step 3: Funding Your Gold IRA

Funding Methods Available:

- Direct Contributions

- Annual contribution limits apply ($6,500 for 2023, $7,500 if age 50 or older)

- Must have earned income

- IRA Transfers

- Direct transfer from existing IRA

- No tax implications

- No annual limits

- 401(k) Rollovers

- From previous employer plans

- 60-day window to complete

- One rollover per 12-month period

Understanding these funding options helps you plan your next step: selecting the right gold products for your IRA.

Step 4: Selecting Gold for Your IRA

The IRS has strict requirements for AU products eligible for IRA investment.

IRS-Approved Gold Requirements:

- Minimum fineness of .995 for gold

- Must be produced by approved mints/refiners

- Certain coins and bullion only

Popular IRA-Approved Gold Products:

- American Gold Eagle coins

- Canadian Gold Maple Leaf coins

- Austrian Gold Philharmonic coins

- Gold bars from approved refiners

Consider factors like premium over spot price, liquidity, and recognition when selecting specific products.

Step 5: Making the Purchase

Working with approved dealers through your custodian ensures compliance with IRS regulations.

Purchase Process:

- Select approved dealer

- Place order through custodian

- Verify pricing and fees

- Complete purchase documentation

- Arrange secure transport to depository

Your custodian will handle most of these steps, but understanding the process helps you make informed decisions.

Step 6: Storage and Security

IRS regulations require that your gold-centric retirement savings account assets be stored in an approved depository.

Storage Options:

- Segregated Storage: Your metals are stored separately

- Non-segregated Storage: Your metals are stored with others

- Allocated Storage: Specific bars/coins are assigned to you

Security Features to Look For:

- 24/7 monitoring

- Multiple security layers

- Complete insurance coverage

- Regular audits

- Climate control

Step 7: Monitoring and Managing Your Gold IRA

Regular oversight of your Gold IRA ensures it continues meeting your retirement goals.

Management Tasks:

- Annual portfolio reviews

- Market trend analysis

- Rebalancing as needed

- RMD planning (for traditional IRAs)

- Documentation maintenance

Keep detailed records of all transactions and regularly review your statement.

Tax Implications

Understanding tax implications helps avoid costly mistakes.

Key Tax Considerations:

- Traditional Gold IRA withdrawals taxed as ordinary income

- Roth Gold IRA qualified withdrawals are tax-free

- Early withdrawal penalties before age 59½

- RMD requirements for traditional IRAs

Common Questions and Concerns

Frequently Asked Questions:

Q: Can I store my IRA precious metals at home? A: No, IRS regulations require storage at approved depositories.

Q: What happens if I need to take distributions? A: You can take distributions in metal or cash value.

Q: Can I add more gold to my IRA each year? A: Yes, within annual contribution limits or through rollovers.

Best Practices for Configuring a Gold-inclusive IRA

While every investor’s situation is unique, successful Gold IRA investors typically:

- Maintain diversified portfolios

- Stay informed about market conditions

- Work with reputable custodians

- Keep detailed records

- Plan for long-term holding

Conclusion

Setting up a Gold IRA requires careful consideration and planning, but the process becomes manageable when broken down into steps. Remember these key points:

- Choose a reputable custodian

- Understand IRS requirements

- Select appropriate gold products

- Maintain proper documentation

- Monitor your investment

Important Notice: This guide is for informational purposes only. Please consult with financial and tax professionals before making any investment decisions. Investment in precious metals involves risks, and past performance does not guarantee future results.

Frequently Asked Questions About Gold IRAs

General Eligibility and Setup

Q: Who is eligible to open a Gold IRA? A: Anyone with earned income can open a Gold IRA. The same eligibility rules that apply to traditional IRAs apply to Gold IRAs. You must be under 70½ years old for traditional Gold IRAs, but there’s no age limit for Roth Gold IRAs.

Q: How much money do I need to start a Gold IRA? A: Minimum investment requirements vary by custodian, typically ranging from $5,000 to $25,000. However, some custodians may have lower minimums for new accounts.

Q: Can I use my existing IRA to buy gold? A: Yes, you can transfer or roll over funds from an existing IRA or 401(k) into a Gold IRA without tax penalties if done correctly.

Investment Rules and Restrictions

Q: What types of gold can I hold in my IRA? A: The IRS only allows certain gold products meeting minimum purity requirements (.995 fine). Approved items include:

- American Gold Eagle coins

- Canadian Gold Maple Leaf coins

- Austrian Philharmonic coins

- Gold bars and rounds from approved refiners

Q: Can I store my IRA gold at home? A: No, IRS regulations require that Gold IRA assets be stored in an approved depository. Home storage of IRA gold is prohibited and can result in tax penalties.

Q: Can I add gold I already own to my Gold IRA? A: No, you cannot add physical gold you already own to your IRA. All precious metals must be purchased directly through your IRA custodian using IRA funds.

Costs and Fees

Q: What fees should I expect with a Gold IRA? A: Common fees include:

- Setup fees ($50-$150)

- Annual custodian fees ($75-$300)

- Storage fees ($100-$300 annually)

- Transaction fees when buying/selling

- Insurance costs

Q: Are storage fees based on the amount of gold I own? A: Some depositories charge a flat rate, while others base fees on the value or volume of metals stored. Ask potential custodians for their specific fee structures.

Distributions and Withdrawals

Q: When can I take distributions from my Gold IRA? A: For traditional Gold IRAs, you can take penalty-free distributions starting at age 59½. Required Minimum Distributions (RMDs) begin at age 72. Roth Gold IRAs have no RMDs, and qualified distributions can begin after the account has been open for 5 years and you’re 59½.

Q: How do I take distributions from my Gold IRA? A: You can take distributions in either:

- Physical gold (shipped to you)

- Cash value of your gold Note that taking physical possession may have tax implications.

Market and Investment Concerns

Q: What happens if gold prices drop after I invest? A: Like any investment, gold prices can fluctuate. Most investors view gold as a long-term hedge against inflation and currency devaluation rather than a short-term investment.

Q: Can I lose money in a Gold IRA? A: Yes, like any investment, Gold IRAs carry risk. Factors affecting potential losses include:

- Market price fluctuations

- Storage and maintenance fees

- Buying gold at premium prices

- Early withdrawal penalties

Account Management

Q: How often should I check my Gold IRA’s performance? A: While daily monitoring isn’t necessary, review your account quarterly and rebalance annually if needed. Stay informed about major market events that could affect gold prices.

Q: Can I have both a regular IRA and a Gold IRA? A: Yes, you can maintain multiple IRAs. However, your total annual contributions across all IRAs cannot exceed IRS limits ($6,500 for 2023, or $7,500 if you’re 50 or older).

Security and Insurance

Q: How is my gold protected in storage? A: Approved depositories provide:

- 24/7 surveillance

- Armed security

- Advanced alarm systems

- Insurance coverage

- Regular audits

- Disaster protection

Q: What happens if the depository goes bankrupt? A: Your gold is held in segregated storage under your name and is not part of the depository’s assets. It remains your property and is fully insured against theft, damage, or loss.

Remember: This information is for educational purposes only. Consult with financial and tax professionals before making investment decisions.

4 Comments