Ever wondered if your retirement portfolio could use a touch of gold? As market volatility continues to challenge traditional retirement strategies, Gold IRAs are gaining attention among investors seeking diversification. But is the glitter of gold really worth the regulatory hoops you’ll need to jump through? Let’s unravel the complex web of Gold IRA rules and regulations to help you make an informed decision.

Key Takeaways: Gold IRA Rules at a Glance

- It’s a Self-Directed IRA: A Gold IRA allows you to hold physical, IRS-approved precious metals, but it must be managed by a specialized custodian and the assets must be stored in a secure, approved depository—not at home.

- Contribution Limits Apply: For 2025, you can contribute up to $7,000 (or $8,000 if you’re age 50 or older) across all your IRA accounts.

- Rollovers are Common: A popular way to fund a Gold IRA is by rolling over or transferring funds from an existing retirement account, like a 401(k) or traditional IRA.

- Rules Are Strict: Prohibited actions include storing metals at home, buying unapproved collectible coins, or any form of self-dealing. Breaking these rules can lead to significant tax penalties.

- Taxes Depend on the Type: A Traditional Gold IRA offers tax-deductible contributions and taxable withdrawals. A Roth Gold IRA uses after-tax money, allowing for tax-free withdrawals in retirement.

- It’s About Diversification: Gold IRAs are primarily used to diversify a portfolio and as a potential hedge against inflation. They come with unique fees (storage, insurance) and do not pay dividends like stocks.

Read our Gold IRAs and Retirement Planning

Navigating Gold IRA Rules and Regulations (2025 Update)

Is your retirement portfolio truly prepared for an unpredictable market? As economic uncertainties prompt investors to seek stable alternatives, Gold IRAs are increasingly in the spotlight. But what about the complex web of Gold IRA rules and regulations you need to navigate? This comprehensive guide will demystify everything from setup and contributions to IRS stipulations and tax implications, empowering you to make an informed decision about adding the enduring value of gold to your retirement strategy.

What Exactly is a Gold IRA? Understanding the Basics

Think of a Gold IRA as a specialized type of self-directed Individual Retirement Account (SDIRA) that allows you to hold physical precious metals, such as gold, silver, platinum, and palladium, instead of more conventional paper assets. Unlike traditional IRAs focusing on stocks, bonds, and mutual funds, a Gold IRA offers the unique advantage of owning tangible assets while retaining the same tax benefits associated with standard IRA accounts.

Why are savvy investors turning to gold for their retirement? Historically, precious metals, particularly gold, have been viewed as a reliable hedge against inflation, currency devaluation, and broader economic instability. They offer a tangible store of value that can provide stability when other markets are volatile.

Now that  we’ve defined what a Gold IRA is, let’s explore the intricate dance of the gold IRA rules and regulations.

we’ve defined what a Gold IRA is, let’s explore the intricate dance of the gold IRA rules and regulations.

Setting Up Your Gold IRA: Adhering to Key Gold IRA Rules and Regulations

You can’t just stash gold bars under your mattress and call it an IRA! Setting up a Gold IRA requires following specific steps and working with authorized professionals.  How does the setup process differ from a traditional IRA, and why are these differences crucial?

How does the setup process differ from a traditional IRA, and why are these differences crucial?

Finding the Right Custodian

Your first step is selecting a qualified custodian who specializes in precious metals IRAs. These financial institutions must be approved by the IRS to handle self-directed IRAs and have experience with precious metals investments.

Choosing an IRS-Approved Depository

All IRA-held precious metals must be stored in an IRS-approved depository. These facilities provide secure storage and insurance for your investments, ensuring compliance with federal regulations.

Funding Your Account: Options and Pitfalls

You have several ways to fund your Gold IRA, each with specific rules:

- A direct contribution

- A rollover from an existing retirement account

- A transfer from another IRA

Direct Contribution: Make annual contributions subject to IRS limits (see below).

Rollover: You can roll over funds from an existing retirement account like a 401(k), 403(b), or TSP. This must typically be completed within 60 days to avoid tax penalties if done indirectly. A direct rollover, where funds move from custodian to custodian, is often preferred.

Transfer: Transfer funds from one IRA to another (e.g., Traditional IRA to a Gold IRA). This is generally a non-taxable event.

Learn the difference between a Traditional IRA vs a Gold-backed IRA.

Learn the difference between a Traditional IRA vs a Gold-backed IRA.

Be careful to follow IRS guidelines during transfers and  rollovers to avoid unnecessary taxes and penalties.

rollovers to avoid unnecessary taxes and penalties.

With the basics of setup covered, let’s dive into the nitty-gritty of IRS regulations – the real meat and potatoes of Gold IRA compliance.

IRS Regulations: Staying on Uncle Sam’s Good Side

Think of these regulations as the recipe for a tax-advantaged golden retirement – miss an ingredient, and the whole dish could fall flat. How do these regulations protect investors, and what potential pitfalls do they help avoid?

Contribution Limits: How Much Can You Invest?

Gold IRA contribution limits mirror those of traditional IRAs:

- For 2025, the IRS has set the contribution limits to mirror those of 2024:

- Individuals under age 50 can contribute up to $7,000 annually.

- Those age 50 and older can make an additional catch-up contribution of $1,000, for a total of $8,000.

Required Minimum Distributions (RMDs)

Unless you have a Roth Gold IRA, you must begin taking RMDs by age 73. These distributions can be taken in either physical metals or cash equivalents.

Prohibited Transactions

The IRS strictly prohibits:

- Storing IRA gold at home

- Purchasing collectible coins

- Using IRA funds to buy precious metals for personal use

- Engaging in self-dealing transactions

It’s important to note that to be held in an IRA, gold must meet a minimum fineness of .995, and silver must be .999 or purer. This rule ensured you are investing in bullion for its metal content, not its rarity as a collectible.

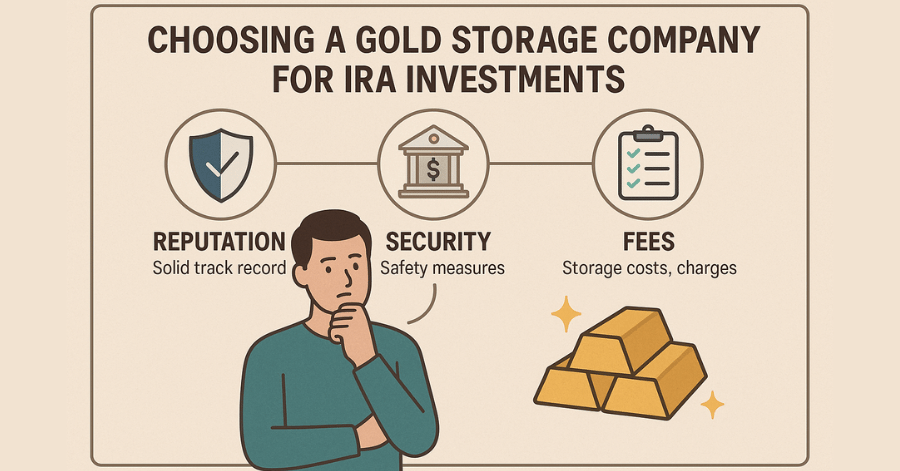

Storage Requirements

All IRA-held precious metals must be stored in an IRS-approved depository. Personal possession of the metals immediately disqualifies them from being included in an IRA. Read our article about Choosing a Storage Company for your Precious Metals IRA.

The Tax Implications of Your Midas Touch

How might your current tax situation influence your choice between a traditional and Roth Gold IRA? Let’s explore the options.

Traditional vs. Roth Gold IRAs

- Traditional Gold IRAs offer tax-deductible contributions but taxable distributions

- Roth Gold IRAs provide tax-free distributions but no immediate tax benefits

- Both types shield your investments from annual capital gains taxes

Now that we’ve covered the tax landscape, let’s weigh the pros and cons of adding gold to your retirement menu.

Weighing the Scales: Pros and Cons of Gold IRAs

Remember, gold in your IRA isn’t about becoming King Midas – it’s about strategic diversification and potential protection against economic uncertainty.

Potential Benefits

- Portfolio diversification

- Protection against inflation

- Tangible asset ownership

- Potential hedge against economic uncertainty

Possible Drawbacks

- Higher fees than traditional IRAs

- Storage and insurance costs

- No rental income or dividends

- Price volatility

Best Practices for Gold IRA Investors

How can you ensure your Gold IRA remains a valuable asset rather than a regulatory headache?

- Work only with reputable custodians and dealers

- Maintain detailed records of all transactions

- Stay informed about market conditions

- Review your allocation strategy regularly

- Consider professional guidance for major decisions

Looking Ahead: Your Golden Future

As you plan for retirement, remember that Gold IRAs can be a valuable component of a diversified portfolio. While the gold IRA rules and regulations may seem complex, they exist to protect your investment and ensure its long-term viability.

Consider consulting with a financial advisor to determine if a Gold IRA aligns with your retirement goals and risk tolerance. They can help you navigate the regulations while maximizing the potential benefits of precious metals in your retirement strategy.

As you consider your retirement strategy, ask yourself: How might a Gold IRA complement your existing plans and help secure your financial future?

Remember: The key to successful Gold IRA investing isn’t just understanding the rules—it’s following them consistently while maintaining a balanced approach to retirement planning.

Gold IRA FAQ: Additional Questions

How much does a Gold IRA actually cost in fees?

Gold IRAs typically involve multiple fee types beyond traditional IRA costs:

- Setup fees: $50-$300 (one-time)

- Annual custodian fees: $75-$300 per year

- Storage fees: $100-$300 annually (segregated storage costs more)

- Insurance fees: Usually included in storage costs

- Transaction fees: $25-$50 per precious metals purchase/sale

- Wire transfer fees: $25-$50 per transaction

Total annual costs typically range from $200-$600, making Gold IRAs significantly more expensive than traditional IRAs.

What specific gold coins and bars are IRA-approved?

IRS-approved precious metals must meet strict purity requirements:

Gold (99.5% minimum purity):

- American Gold Eagles (only gold coin that doesn’t need to meet the 99.5% requirement)

- American Gold Buffalo coins

- Canadian Gold Maple Leaf coins

- Austrian Gold Philharmonic coins

- PAMP Suisse gold bars

- Credit Suisse gold bars

Not allowed: Collectible coins, numismatic coins, most foreign coins, and jewelry.

How long does the Gold IRA setup process typically take?

The complete setup process usually takes 7-14 business days:

- Days 1-3: Account application and approval

- Days 4-7: Funding transfer completion

- Days 8-14: Precious metals purchase and delivery to depository

Direct rollovers may take longer (2-4 weeks) due to coordination between custodians.

Can I have multiple IRAs, including both traditional and Gold IRAs?

Yes, you can maintain multiple IRA accounts simultaneously. However:

- Combined annual contribution limits apply across ALL your IRAs ($7,000 or $8,000 if 50+)

- You can allocate contributions between different IRA types as desired

- Each account may have different custodians and fee structures

- RMD requirements apply to all traditional IRAs combined

What happens to my Gold IRA when I die?

Gold IRAs follow standard IRA inheritance rules:

- Spouse beneficiaries can roll the account into their own IRA or treat it as inherited

- Non-spouse beneficiaries must typically withdraw all assets within 10 years (SECURE Act rules)

- Physical metals can be distributed in-kind to beneficiaries or sold for cash

- Estate planning should specify how precious metals should be handled

How do I actually sell gold from my Gold IRA?

The selling process involves your custodian:

- Contact your custodian to initiate a sale

- Custodian coordinates with the depository and approved dealers

- Metals are sold at current market prices

- Proceeds are deposited into your IRA cash account

- You can then take distributions or reinvest in other IRA-eligible assets

You cannot personally sell the metals or receive them directly for sale.

What happens if my chosen depository goes out of business?

Your precious metals remain protected through multiple safeguards:

- Segregated storage keeps your metals separately identified

- Insurance coverage protects against loss or theft

- FDIC or SIPC protection doesn’t apply, but specialized precious metals insurance does

- Asset transfer to another approved depository is arranged by your custodian

- Ownership records ensure your metals can be identified and recovered

Choose depositories with strong financial backing and comprehensive insurance policies.

Are there any early withdrawal penalties specific to Gold IRAs?

Gold IRAs follow standard IRA penalty rules, but with unique considerations:

- 10% penalty applies to withdrawals before age 59½ (same as traditional IRAs)

- Physical distribution of metals counts as a taxable withdrawal at fair market value

- Storage costs continue until metals are formally distributed

- Liquidation time may delay access to funds compared to selling stocks/bonds

- Market timing becomes crucial since you can’t control when metals are sold during the distribution process

2 Comments